Opportunity ripe for developers as demand for uni housing increases

Contact

Opportunity ripe for developers as demand for uni housing increases

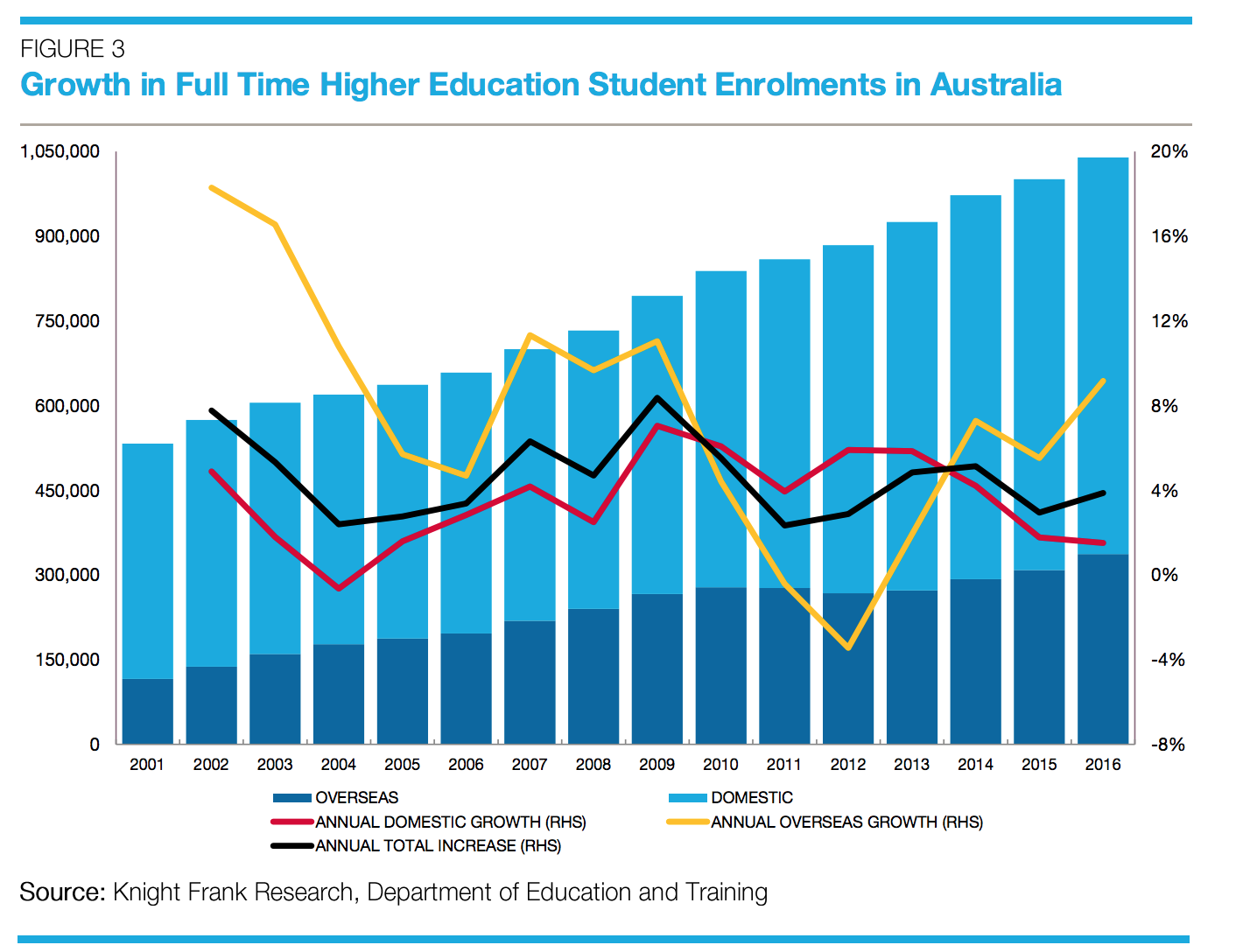

Australia’s student housing sector is predicted to boom in the coming years, due to an increasing number of Australian and international university students, according to a report by Knight Frank.

Australia’s purpose built student accommodation (PBSA) sector is undergoing rapid growth due to an influx of Australian and international university students, according to the Student Housing 2018 report by Knight Frank.

And with demand only set to increase over the coming years, development opportunities abound to build new, freestanding developments, as well as upgrade existing university accommodation.

According to the report, Sydney, Melbourne, Brisbane, and Adelaide will account for around 80 per cent of the new supply.

Key findings from the Student Housing 2018 Knight Frank report:

- There are 337,117 full time Higher Education international students studying in Australia, but only 93,890 PBSA bedspaces as at the end of 2017.

- This equates to a theoretical international student to bed ratio of 3.6:1 - highlighting the demand for quality and affordable student accommodation.

- Key barriers to entry into the Australian market remain the availability of suitable land and the viability of student housing development.

According to the Australian Bureau of Statistics (ABS), the number of 18 to 25-year-olds in Australia is projected to increase by 104,000 between 2016 and 2026, thereby increasing the number of Australian university students.

Australia’s student housing sector is set to boom in the coming years. Image supplied by UniLodgeGrowing demand

That's creating an increasing need for accommodation, as demand continues to outweigh supply, with growing numbers of both local and international students underpinning the current demand.

This year, around 8,290 new PBSA beds will become operational around Australia - 20 per cent more than in 2017.

According to the report, those undertaking the initial development wave to meet this increasing demand are international groups such as Atira, Scape, GSA, Iglu, Wee Hur, Student One, Cedar Pacific and Centurion.

These groups are also beginning to extend their product offering, as Scape is doing with developments on Melbourne's Swanston and Franklin streets, where they are incorporating commercial rental stock, cleverly targeting a market of post-study young professionals.

International students account for whopping influx

Chinese Higher Education enrolments in Australia could more than double by 2027 - rising from the current figure of 124,700 to 294,000 enrolments according to the Knight Frank report.

Knight Frank’s Paul Savitz, Director, Research and Consulting, Australia, says speculation about the negative impact of high-ranking Chinese universities is completely unwarranted.

“There has been speculation of late that because Chinese global university rankings are improving, that this may have negative consequences for Australian universities; given their part reliance on full-fee paying international students.

"However, when students are looking to study abroad, research shows that lifestyle factors are equally as important as the quality of education.

"Because Australia offers international students a fantastic lifestyle with excellent employment opportunities, we have every confidence international student numbers will continue to rise," Mr Savitz said.

In addition to freestanding PBSA developments, further development opportunities await for developers to upgrade existing university accommodation.

As a result, Knight Frank expects some of the biggest investment opportunities will be in partnership with regional or metro universities to redevelop older on-campus stock.

Australia’s student housing sector is set to boom in the coming years. Image supplied by UniLodge.Mr Savitz says establishing long-term partnerships with universities is the key to success in the PBSA sector.

“Whether it is upgrading university accommodation or targeting overseas students in the direct let market, the key is developing long term relationships with universities to help meet their specific needs.

"Investors and developers who are able to match a university’s vision will benefit long term - much more than those who simply target particular cities," Mr Savitz told WILLIAMS MEDIA.

Rental affordability still a major factor

Reflecting other student housing markets, Mr Savitz says affordability will be a key theme for the next few years, as rising construction and land costs make the delivery of affordable accommodation in Sydney and Melbourne extremely challenging.

Image supplied by UniLodge"Going forward, Knight Frank Research foresees comparatively stronger rental growth for en-suite and non en-suite rooms with shared kitchen facilities compared with self-contained studios throughout this current development cycle, until the market absorbs the historically high supply levels of new product," Mr Savitz told WILLIAMS MEDIA.

However, due to the speed of new development coming onto the market, with 2018 anticipated to deliver a similar number of beds as 2016 and 2017 combined, occupancy levels and rental growth across-the-board will remain subdued.

"We anticipate there to be higher levels of demand at the more affordable end of the market and will see that trend towards affordability, among both occupiers and developers, emerge," Mr Savitz concluded.

Read the Student Housing 2018 report on the Knight Frank website.

Related reading:

More student accommodation needed

International students drive demand for Brisbane student digs