First-home buyers concession a 'boon' in regional Melbourne

Contact

First-home buyers concession a 'boon' in regional Melbourne

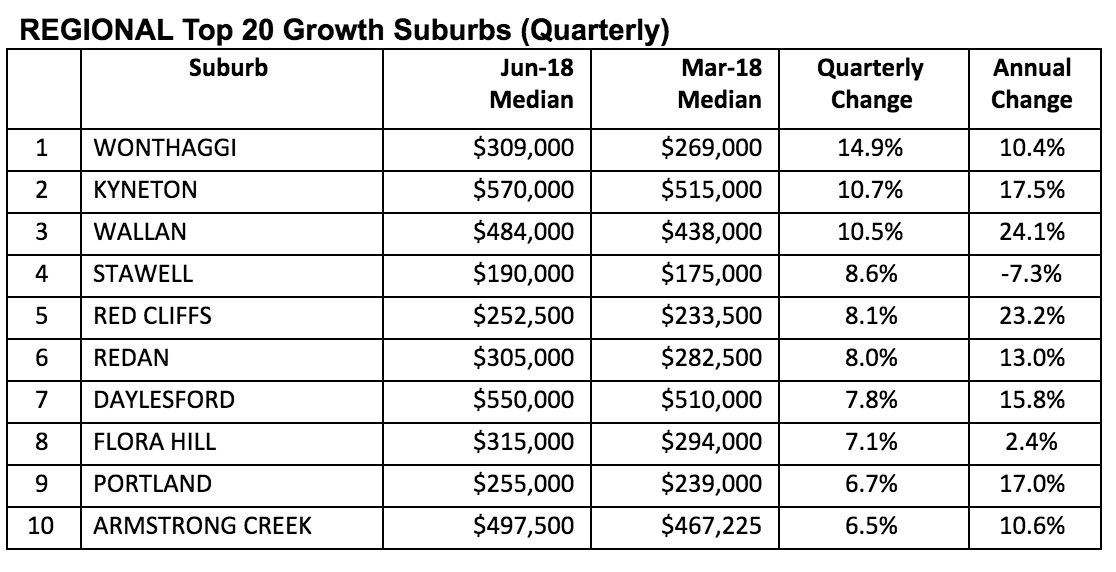

New data from the Real Estate Institute of Victoria (REIV) shows regional Melbourne is outstripping the inner city suburbs, partly thanks to the first-home buyers concession.

Regional Victoria's more affordable property market is powering along while Melbourne's more pricey inner city suburbs continue to cool their heels.

The median house price in regional Victoria rose 4 per cent to $419,000, while apartment and unit prices in regional areas rose 3.7 per cent to $304,000.

REIV President Richard Simpson said the first-home buyer's concession has been a "boon" for regional areas.

"A new entrant to the property market buying a house at the regional median will pay no stamp duty, while a first home buyer of an apartment in Melbourne at the median price would pay stamp duty of nearly $25,000," Simpson said.

“Whether for reasons of housing price or a change in lifestyle, more prospective buyers are willing to look to regional Victoria to purchase. The possibilities of better transport connections with Melbourne make that option even more palatable," Simpson continued.

Source: REIV

Tim Lawless, head of research at CoreLogic, tells WILLIAMS MEDIA regional areas of Melbourne have benefitted from a demand spillover.

"The regional growth is partially thanks to their overall affordability and an increase in first home buyer activity from July 2017, when first home buyer concessions became available.

“Markets such as Geelong, the Capital Region and Ballarat, have each benefitted from a spillover of demand emanating from the more expensive and often more congested metropolitan areas of Melbourne and Canberra," Lawless said.

Simpson says new builds in the outer suburbs are most popular among first-home buyers.

“In the outer suburbs, newer houses have been most popular with first-home buyers, particularly families, while older style units and apartments in middle and inner Melbourne have also seen a growing number of purchases by first-home buyers.

300 Lithia Lane Hepburn, for sale through Lee Milne of Hockingstuart as featured on Luxury List.“The rises in these suburbs are not entirely contributable to first-home buyer activity with the low interest rate environment and Melbourne’s growing population also significant factors.”

Mr Simpson said the exemptions had saved buyers up to $30,000 each.

Currently, first-home buyers in Victoria aren't required to pay stamp duty on property purchases below $600,000, with concessions on a sliding scale up to $750,000, since the state government introduced the changes as part of their Homes for Victorians package last July.

Related reading: Victorian government steps in to help first-home buyers

Managing director of Perry Property Advocates, Adam Perry tells WILLIAMS MEDIA that while the removal of stamp duty has been a boost to outer Melbourne, it presents a danger that it may lock first-home buyers out of key locations, leaving them with little option other than to move further out.

"The removal of stamp duty has delivered a major boost to many outer areas of Melbourne, particularly locations with good road and rail links and strong local infrastructure. This has been a positive outcome for those looking to sell in these key locations.

"However there is a potential danger that first home buyers are increasingly being priced out of key locations – which will leave them with little option other than moving further out, often to regional areas.

"The time to buy is normally “now” – and no more so than for Melbourne’s first home buyers. It is a critical period, especially if they want to take advantage of the significant stamp duty concessions available for homes in outer Melbourne.

"With Melbourne growing as a city - and the increasing demand on real estate city-wide - these key outer locations won’t be relatively affordable for an extended period," Perry warns.

Top growth suburbs in metro Melbourne

While median house prices in regional Victoria rose, they dipped by 0.6 per cent to $840,000 in the Melbourne metro area.

Median apartment and unit prices in metro Melbourne rose by 0.5 per cent to $604,000, indicating a continued interest in smaller properties.

According to the REIV, the result in metro Melbourne was due to a fall of 0.8 per cent in median prices achieved at auction, defying the median lift of 2.3 per cent in private sales of houses.

Source: REIV

This overall correction was most apparent in Inner Melbourne, where the overall median house price dropped 4.9 per cent to $1,459,000 and in Middle Melbourne, which fell 5.4 per cent to $974,500.

The Outer Melbourne house market performed more strongly, with the median edging up by 0.5 per cent to $681,000.

Simpson says Melbourne's outer perimeter is seeing good growth.

"Small increases in the June quarter mean that the median prices for both houses and units have risen over 10.5 per cent from a year ago.

“Auctions continue to be popular all over Melbourne, but clearance rates have fallen from the lofty highs of early 2017.

6 Seymour Grove, Brighton, the top growth suburb in metro Melbourne. For sale through Nick Johnstone and Kris Barker of Nick Johnstone Brighton as featured on Luxury List."Negative chatter about the future of the sector coupled with stronger lending controls by financial institutions has created some uncertainty and vendors need to be realistic with their price expectations,” Simpson said.

Simpson says despite lower auction clearance rates and fewer overall sales, some sectors of the market are still performing well.

“2017 was a bumper year and while the trendline has flattened, despite the fall in median house prices in the June quarter, median prices are still up this calendar year for both houses and units, in Melbourne and in the regions,” Simpson said.

RT Edgar Toorak's Holly Gillham says that while fewer people are attending auctions, the market is still quite strong.

"The market has levelled. We are seeing fewer people at auctions, but auctions are still achieving excellent results. If not on the day, then certainly afterwards," she told WILLIAMS MEDIA.

Related reading:

Victorian first-home buyers' 2018 shared-equity scheme open for registrations

First-home buyers at highest share of market in five years

Weaker investor demand, tax concessions let first-home buyers back in: CoreLogic