Savvy homeowners cash in on high capital growth suburbs in Brisbane

Contact

Savvy homeowners cash in on high capital growth suburbs in Brisbane

Savvy property owners have made huge cash gains after investing in a number of Brisbane suburbs which have recorded high capital growth, new research from Place Advisory reveals.

Despite lingering reports of a sluggish real estate market in the South East, Place Advisory research has found certain areas in Brisbane, Ipswich and Logan have performed incredibly well, and homeowners are cashing in.

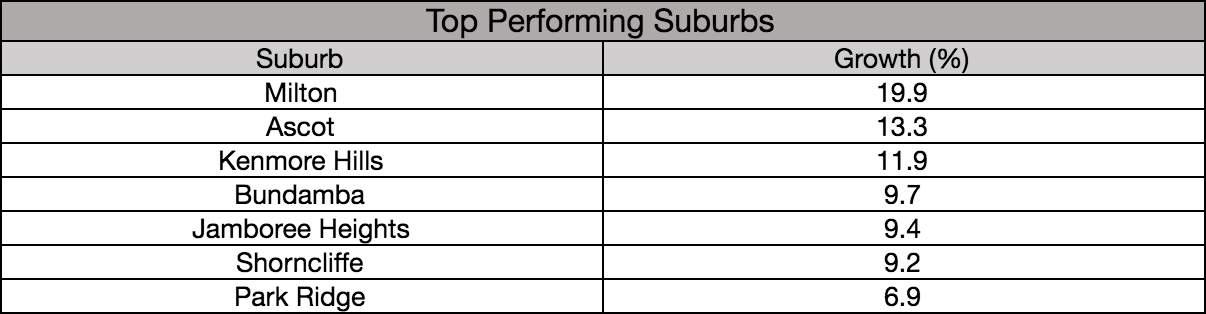

Brisbane recorded an average capital gain of 6.2 per cent, with the inner suburb of Milton landing the highest capital growth – a whopping 19.9 per cent. The suburb now boasts a median price tag of $892,500.

Place Advisory’s Lachlan Walker said the strong growth has resulted in significant gains for property owners who have sold in the current market.

“These gains are however the result of long term strategies. Sellers today are crystallising capital growth if their initial investment was made based on the underlying drivers of population growth and the delivery of planned strategic local infrastructure," Walker said.

34 Comus Avenue, Ascot for sale through Alex Jordan and Frazer Watson of Mcgrath, as featured on Luxury List.

Drew Davies, an agent with McGrath New Farm, previously told WILLIAMS MEDIA that Sydney buyers in particular are looking to buy in the Hamilton and Ascot areas.

"Sydney buyers are searching for properties in Hamilton and Ascot in the $1.5m to $2.5m range, and these same vendors are looking at eventually downsizing to easily maintainable apartments for their next move," he said.

Place Bulimba's James Curtain told WILLIAMS MEDIA he has seen several clients clearly invest in suburbs like Hamilton, Ascot and Milton with the potential for high capital growth years ago, who are now reaping the rewards.

"I've had clients invest in suburbs like Coorparoo, Ascot and New Farm, five or six years ago, and they've made significant gains in that time," Curtain said.

"Buyers are clearly targeting these suburbs and reaping the results.

10 Morgan Street in Ascot, for sale through Matt Lancashire of Ray White New Farm as featured on Luxury List.

"The market in Brisbane is holding firm at the moment. It is interesting to read that Sydney and Melbourne have stagnated, and from what I understand, their prices are retracting to a certain extent.

"I think our prices are holding up, certainly in the city fringe, but I certainly don't expect to see a great deal of growth over the next twelve months," Curtain said.

Meanwhile, Ipswich is currently leading the market in terms of a general rise in demand and pricing.

“The Ipswich corridor has undergone significant change over the past few years. Low entry-level prices have allowed for strong growth to be achieved and value to be recognised by purchasers as this area continues to develop," Walker said.

Source: Place Advisory

“The suburb of Bundamba recorded the highest capital growth in the Ipswich area – a significant 9.7 per cent.”

In Logan, the top performing suburb was Park Ridge – with 6.9 per cent capital growth.

“The wider Logan area is a long term investment opportunity” Mr Walker said.

Related reading:

Which Brisbane suburbs will benefit from the planned metro?

Demand from downsizers for prestige property pushes Brisbane onto international stage