South East Queensland increasingly attractive to investors: Knight Frank

Contact

South East Queensland increasingly attractive to investors: Knight Frank

Brisbane is currently experiencing the highest level of interest from offshore investors ever witnessed, and it’s only expected to strengthen, according to Knight Frank.

Attention has turned to Queensland's capital city, largely because opportunities in the city’s southern counterparts of Sydney and Melbourne were limited due to previous strong growth.

“Every offshore investor, whether institutional or private, is now including Brisbane on their mandate,” he said. “It’s now well and truly on the list for most investors of global cities to target," said Knight Frank Queensland Managing Director and Senior Director of Institutional Sales, Ben McGrath.

“This is largely due to the fact that Sydney and Melbourne are expensive, with Brisbane providing a much more attractive value proposition, but it’s also due to the fact that the Brisbane market has now reached a level of maturity that’s putting it on par with its southern counterparts.

"Right across the economy there will be benefits for tourism and education, the government and private sector has invested heavily into the student accommodation market. I think the benefits from further investment into Brisbane from offshore make us a more mature market, and for that reason it makes us more recognised in the international market in terms of tourism and education, and more broadly, the investment into our economy," he told WILLIAMS MEDIA.

Related reading: Howard Smith Wharves development to breathe new life into Brisbane river

Source: Knight Frank Research

“There is now sufficient interest from buyers in Brisbane that investors are no longer concerned about the market being illiquid. That's always been a concern for investors putting large amounts of capital into our city’s assets, but since the investor pool has grown, it’s no longer an issue.”

Brisbane

More than 80 per cent of global investors want to buy into the Brisbane CBD, according to Justin Bond, Knight Frank Senior Director, Institutional Sales, who told WILLIAMS MEDIA the amount of interest from overseas investors is the highest level it has ever been.

“The amount of offshore capital that's focused on Brisbane is at the highest we've ever seen it, as is the amount of interest we're getting from overseas investors," he said.

Source: Knight Frank Research

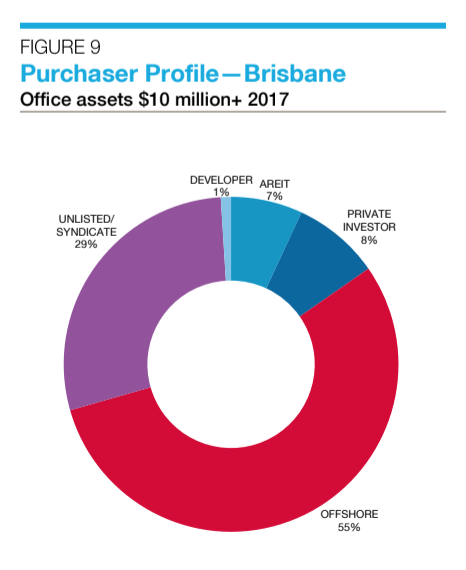

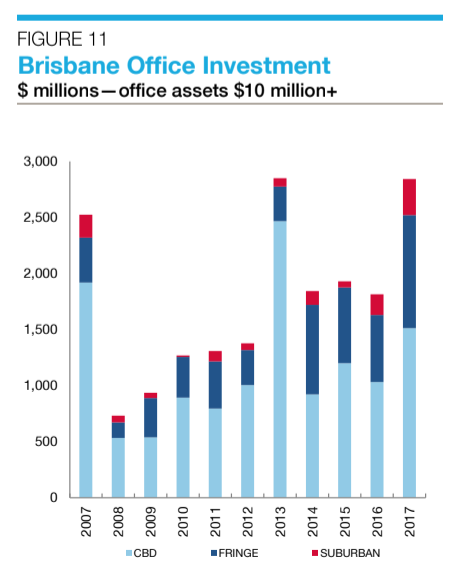

The recent Knight Frank Brisbane Investment Environment research report found that offshore investors remained the biggest purchasers of office assets in 2017, accounting for 43 per cent of all sales.

In the Brisbane CBD, international purchasers accounted for 70 per cent of turnover in 2017. The continued penetration of offshore owners into the Brisbane CBD market was largely responsible for the high level of transaction activity in 2017, with total transactions 47 per cent higher than 2016, according to the report.

“We’ve seen interest in Brisbane really pick up this year, and this will continue to grow throughout the rest of 2018,” he said. “Now is the time to be investing, before more attention turns to our city and there is greater buyer competition.

“Infrastructure projects in the pipeline totalling $134 billion, such as the Brisbane Airport Second Runway, the Cross River Rail, Brisbane Metro, Brisbane Live, Howard Smith Wharves, and Queen’s Wharf will sustain the interest we’re already seeing.

“These projects will heighten Brisbane's reputation and the Queen's Wharf, for example, will boost tourism into the area, putting our city on the radar as a must-see destination," he told WILLIAMS MEDIA.

Read the Brisbane Investment Environment research report in full here.

Related reading:

Sydney, Melbourne make top 20 for Knight Frank Prime Residential Index

Knight Frank expands Global Prime Team

Knight Frank Australia evolves leadership team by announcing new partnership structure