First-home buyer numbers are up but affordability worse: REIA / Adelaide Bank report

Contact

First-home buyer numbers are up but affordability worse: REIA / Adelaide Bank report

New Research from the REIA and Adelaide Bank shows the number of first-home buyers in the market increased during the December quarter, even though housing affordability declined.

Housing affordability worsened in every state and territory in Australia during the December quarter, according to new research from the Real Estate Institute of Australia and Adelaide Bank.

Rental affordability improved in New South Wales and Queensland, but was weaker in other states.

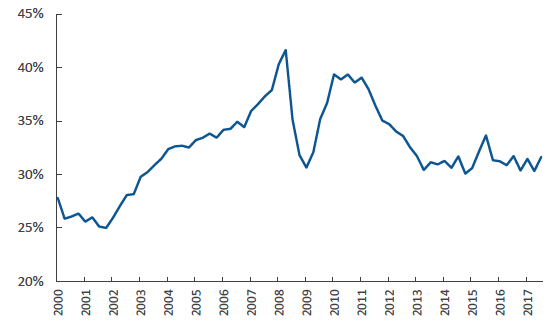

The Adelaide Bank/REIA Housing Affordability Report for the December quarter showed that the proportion of median family income required to meet average loan repayments increased by 1.3 percentage points to 31.6 per cent over the quarter.

But compared with the same period in 2016, the index is actually 0.1 percentage point lower, meaning that housing affordability is virtually unchanged over the year.

Source: Adelaide Bank/REIA Housing Affordability Report.

Source: Adelaide Bank/REIA Housing Affordability Report.

REIA president Malcolm Gunning said the number of loans increased across the country by 1.5 per cent, with increases in each state and territory except New South Wales and Western Australia.

Proportion of family income required to meet average loan repayments

Source: Adelaide Bank/REIA Housing Affordability Report.

Rental affordability varied from state to state

Gunning said affordability for renters varied among the states and territories.

“Over the quarter, the proportion of median family income required to meet rent payments increased by 0.1 percentage points to 25.8 per cent, with rental affordability declining in Melbourne, Adelaide, Hobart, Darwin and Canberra, and stabilizing in Western Australia,” Gunning said.

Darren Kasehagen, Head of Distribution, Third Party Banking, Adelaide Bank, said, “Tasmania and the Northern Territory were notable in that for the December 2017 quarter, the proportion of family income needed to meet loan repayments was actually less than the proportion of income needed to meet rental payments, which may well see more people decide to take the step towards home ownership in these jurisdictions. "

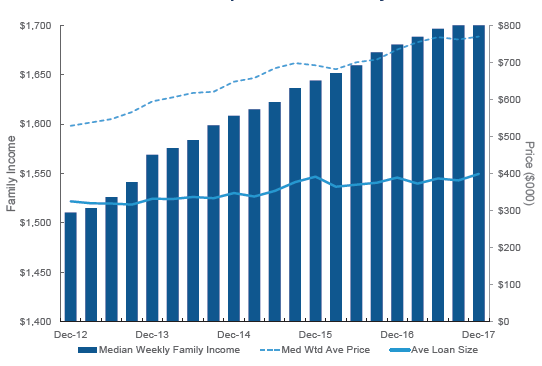

Median house price and family income

Source: Adelaide Bank/REIA Housing Affordability Report.

The number of first-home buyers the highest since 2009

The numbers of loans to first-home buyers continues to improve, with 30,894 new loans issued during the quarter, the highest number since December 2009.

“First home buyers now make up 25.8 per cent of the total owner occupied housing market (excluding refinancing). This is the highest rate since December 2012 after dropping steadily over the past five years,” said Gunning.

Kasehagen said, "The continued increase in the number of first-home buyers - with the exception of Western Australia - is a particularly welcome finding. Almost 31,000 first home buyers entered the market in the December quarter, an increase of 6.8 per cent or 32.6 per cent year on year.

New housing supply is crucial to improving affordability

While the December quarter showed a marginal decline in housing affordability after a relatively stable year in 2017, any major improvement is going to come from a considerable increase in supply, says the REIA. The recent Grattan Institute report 'Housing Affordability: Re-Imagining The Australian Dream' says Australia needs 50,000 new homes every year for a decade to bring house prices 5 to 20 per cent lower than they would be otherwise be.

In line with the Grattan report, Gunning says that unless there is a coordinated and aligned approach by all three levels of government, this moderation of house prices will not occur.

“We need to address this with some urgency and reform the planning and approval process," said Gunning, calling on the government to appoint a Minister of Property Services, in recognition of the fact that housing is a crucial driver of economic growth and employment.

Rental affordability improved in New South Wales and Queensland, remained steady in Western Australia, but declined in Victoria, South Australia, Tasmania, the Northern Territory and the ACT.

Fast Facts from the Adelaide Bank/REIA Housing Affordability Report

Victoria

Of the total number of Australian first home buyers that purchased during the December quarter, 9,892 were from Victoria. The number of loans to first home buyers increased by 12.6 for the quarter or 39.7 per cent year on year. In Victoria, first home buyers now make up 28.2 per cent of the State's owner-occupier market. Rental affordability declined slightly with 23.6 per cent of income required to meet median rents.

NSW

The proportion of family income required to meet loan repayments increased by 1.7 per cent to 37.8 per cent. New South Wales remains the least affordable State or Territory in which to buy a home. Of the total number of first home buyers that purchased during the December quarter, 24.3 per cent were from New South Wales. First home buyers now comprise 21.3 per cent of the State's owner-occupier market. Rental affordability improved slightly for the quarter with 29.7 per cent of income required to meet median rents, a decrease of 0.1 percentage points for the quarter.

Queensland

The proportion of income required to meet home loan repayments increased to 27.6 per cent, a 0.8 percentage point decrease over the quarter. Of all Australian first home buyers over the quarter, 21.3 per cent or 6,578 were from Queensland while the proportion of first home buyers in the State's owner-occupier market was 27.0 per cent. Rental affordability improved slightly with a decrease of 0.2 per cent to 22.7 per cent of income required to meet median rents.

South Australia

South Australia recorded a decline in housing affordability with the proportion of income required to meet monthly loan repayments increasing to 26.4 per cent- an increase of 1.1 percentage points over the quarter. In the national breakdown, 4.9 per cent of first home buyers were from South Australia while the proportion of first home buyers in the State's owner-occupier market recorded an increase of 0.5 per cent to 19.7 per cent. Rental affordability declined by 0.2 percentage points increasing to 21.9 per cent of income.

Western Australia

The number of first home buyers in Western Australia decreased by 9.8 per cent over the quarter, but actually increased by 4.9 per cent when compared with the same quarter last year. 12.9 per cent of all Australian first home buyers were from Western Australia. Housing affordability declined with the proportion of income required to meet loan repayments increasing to 23.9 per cent. This was an increase of 1.5 per cent over the quarter or a decrease of 0.3 per cent year on year. Rental affordability remained stable at 17.4 per cent of family income.

Tasmania

Housing affordability in Tasmania declined with the proportion of income required to meet home loan repayments increasing to 25.7 per cent, an increase of 2.4 per cent over the quarter or 1.5 per cent year on year. Rental affordability in Tasmania declined with the proportion of income required to meet median rents increasing to 26.8 per cent, a 0.5 percentage point increase or 1.5 per cent year on year. First home buyers in Tasmania increased by 14.5 per cent over the quarter and compared to the same quarter last year, recorded a 4.0 per cent increase.

Australian Capital Territory

Housing affordability in the Australian Capital Territory declined with the proportion of income required to meet home loan repayments increasing to 19.6 per cent, a 1.1 per cent increase over the quarter. This was a decrease of 0.9 percentage points compared to the same quarter last year. Rental affordability also declined. The proportion of income required to meet the median rent is now 18.2 per cent, an increase of 0.1 per cent for the quarter or 0.6 per cent year on year.

Northern Territory

Housing affordability in the Northern Territory declined with the proportion of income required to meet loan repayments increasing to 20.9 per cent for the quarter or 1.5 per cent. This was a decrease of 1.7 per cent year on year. Rental affordability in the Northern Territory also declined with the proportion of income required to meet the median rent increasing to 23.1 per cent or 0.4 percentage points over the quarter. This was a decrease of 1.4 per cent compared to the December 2016 quarter.

REIA subscribers can down load the report here.

Read more about housing affordability:

Government inactivity contributes to affordability problems say HIA and Grattan