HIA stamp duty report fuels calls for national review of property taxes

Contact

HIA stamp duty report fuels calls for national review of property taxes

The HIA and the Real Estate Institutes of Australia, Victoria and New South Wales are calling for a review of stamp duty.

The HIA’s Stamp Duty Watch report reveals that stamp duty bills have increased almost three times faster than house prices since the 1980s.

The analysis shows the trend will continue unless stamp duty is reformed, says HIA senior economist, Shane Garrett.

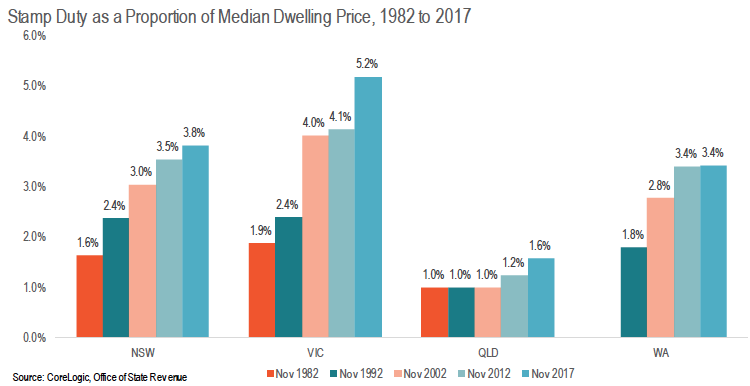

“In Victoria, the typical stamp duty bill increased from 1.9 per cent to 5.2 per cent of the median dwelling price between 1982 and 2017 – equivalent to a surge of 4,000 per cent in the cash value of stamp duty," said Garrett.

In NSW, the stamp duty burden rose from 1.6 per cent to 3.8 per cent of the median dwelling price over the same period.

Source: HIA Stamp Duty Watch.

“Increases in home prices cause stamp duty bills to accelerate because stamp duty rate brackets are rarely updated," explained Garrett.

In NSW, stamp duty rates have not been reformed since 1985 when the average house price was $70,000.

State governments' total stamp duty revenues almost doubled over the past four years: from $11.7 billion in 2011-12 to $20.6 billion in 2015-16.

“State governments are increasingly reliant on rising stamp duty revenues. This situation is not sustainable," said Garrett.

“By draining the pockets of homebuyers to the tune of over $20 billion each year, stamp duty is a central pillar of the affordability crisis," said Garrett, saying that a long-term plan to "do away with the scourge of stamp duty" would go a long way towards improving housing affordability in Australia.

Malcolm Gunning, president of the REIA, told SCHWARTZWILLIAMS the institute also supports the abolition of stamp duty, but the process would need to be managed so that existing homeowners are not penalised.

Gunning said the REIV and the REINSW have "lobbied ferociously" for a review of stamp duty because of bracket creep.

Gunning said the matter of a review of stamp duty feeds into the REIA's calls for a federal minister for property, so that a whole-country review of property taxes can be undertaken.

"The federal government should be taking a leadership role and looking at property taxes at a federal level," he said.

"It's time," said Gunning.

HIA subscribers can download a copy of the HIA Stamp Duty Watch report here.

Read more about property taxes:

How to transition from stamp duty to property tax