Affordability is improving, and first-home buyers are back in the market

Contact

Affordability is improving, and first-home buyers are back in the market

New data from the HIA shows that housing affordability improved during the September quarter, while Mortgage Choice says loan approvals for first-home buyers are at four-year highs.

New data shows that housing affordability improved during the September quarter, while the proportion of first-home buyers was also on the rise.

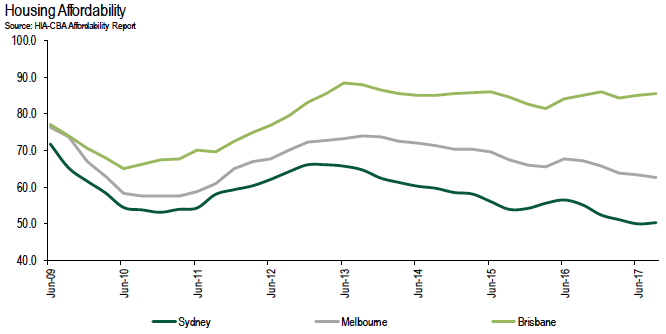

The HIA Housing Affordability index improved by 0.5 per cent in the September 2017 quarter but still remains 4.4 per cent below the level recorded a year ago, said Tim Reardon, HIA's principal economist.

Higher mortgage rates for investors have eased the pressure for owner-occupiers, said Reardon.

Related content: First-home buyers at highest levels since 2013: REIA

Related content: First-home buyers are back in the market

“Despite the poor levels of housing affordability, there are signs of improvement for home-buyers," said Reardon.

“Housing Affordability has been deteriorating in Australia for decades, particularly in capital cities, as demand for new housing greatly exceeded the supply.

“Recent interventions by the government, through APRA, to curb growth in investor activity may have improved affordability for owner-occupiers," he said.

The HIA Affordability Index has been produced for more than 17 years and uses data including wages, house prices, and borrowing costs to provide an indication of housing affordability.

A higher result on the index indicates a more favourable affordability environment.

The report demonstrates there are different markets around the country, said Reardon.

“Sydney retains the mantle as the nation’s least affordable housing market despite the affordability index showing a modest improvement in affordability during the quarter," he said.

Brisbane, Adelaide, Perth and Darwin recorded modest improvements in affordability in the September quarter.

Housing affordability deteriorated in Melbourne, Hobart and Canberra.

Source: HIA.

The HIA research dovetails with September data from Mortgage Choice, which shows that the proportion of first-home buyers in the market is rising.

Low interest rates and new first-home buyer incentives are helping more buyers get a foot on the property ladder, the Mortgage Choice research shows.

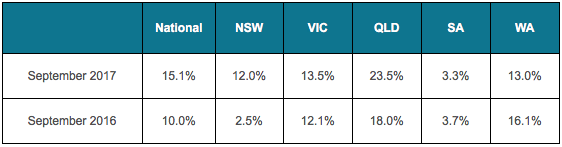

Mortgage Choice’s home loan approval data for the month of September shows that first-home buyers accounted for approximately 15 per cent of all loans written during the month, up from 10 per cent in 2016.

Source: Mortgage Choice.

“We haven’t seen this many first home buyers in the market since July 2013,” said Mortgage Choice chief executive officer, John Flavell.

“The latest data from the Australian Bureau of Statistics’ Housing Finance report also revealed a recent uplift in home loan approvals for first home buyers. In August, first home buyers made up approximately 17.2% of the market, which is the highest level recorded since July 2013,” he said.

“In NSW, the state government scrapped stamp duty on all homes worth up to $650,000 from 1 July 2017. In addition, the government said it would provide stamp duty concessions to those first home buyers purchasing properties worth between $650,000 and $800,000.

“Similarly, in Victoria, stamp duty was abolished for first home buyers purchasing properties worth up to $600,000, with concessions on homes worth up to $750,000. The first home owner’s grant was also doubled to $20,000 in regional Victoria," explained Flavell.

Again the data varied from state to state.

“In NSW, the proportion of loans written by Mortgage Choice brokers for first-home buyers rose from 2.5% in September 2016 to 12% in September 2017.

“Meanwhile, in Victoria, the proportion of loans written for first-home buyers rose from 12.1% to 13.5% over the same time period.”

However, in the last year Western Australia and South Australia experienced a decline in first-home buyer activity, said Flavell.

“Of course, this doesn’t come as much of a shock when you consider that the Western Australia state government cut the first-home buyer grant from $15,000 to $10,000 in May," he said.

Read more about housing affordability in Australia:

First-home buyers at highest levels since 2013: REIA

Weekend auctions litmus test of new first-home-buyer benefits

Where are Australia's most popular places for first-home buyers?