First-home buyers are back in the market

Contact

First-home buyers are back in the market

Government policies have caused a "dramatic increase" in the involvement of first-home buyers in the market, says Tim Reardon of the HIA.

First-home buyers are re-entering the market after years spent waiting on the sidelines.

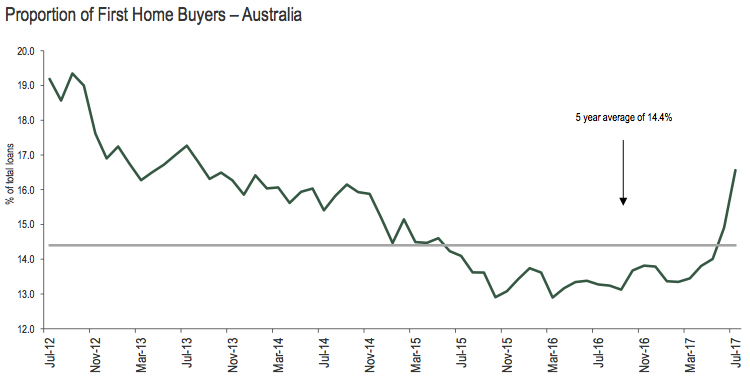

The latest Australian Bureau of Statistics housing finance data shows the proportion of first-time buyers in the home loan market rose from 14.9 per cent to a 47-month high of 16.6 per cent in July.

In total, 56,464 home loans were approved in July, up 2.9 per cent from the previous month and the third consecutive monthly gain.

Related content: Where are Australia's most popular places for first-home buyers?

Related content: First-home buyers: know your market

"More loans are being taken out to buy or build homes and a key reason is the incentives being offered by various state governments to first-home buyers," said CommSec chief economist, Craig James.

Tim Reardon, principal economist HIA, said, “First-home buyers are returning to the market in NSW and Victoria off the back of enhanced stamp duty concessions in these markets."

“In July 2017 - the first month that these concessions took effect - the volume of first-home buyers in NSW jumped to its highest level since 2012," said Reardon.

Source: HIA.

The first-home buyer data is backed up by recent lending stats from ME Bank, the not-for profit bank owned by industry super funds.

In July and August 2017, first-home buyers represented 24 per cent of all ME home loan applications, an increase of 17 percentage points on the same time last year.

The largest increase in first home buyer applications was in Western Australia (up 28 points to 37 per cent), Queensland (up 24 points to 33 per cent) and Victoria (up 15 points to 24 per cent).

ME's head of home loans, Patrick Nolan, said first home buyers are clearly taking advantage of grant and stamp duty changes, and dampening demand from investors.

“Since 1 July 2017, the First Home Owner Grant and stamp duty discounts have been ramped up, providing a helping hand for eligible first home buyers," he said.

“This means eligible first home buyers can assemble a larger deposit, reduce their loan-to-value ratio and potentially cut out mortgage insurance”.

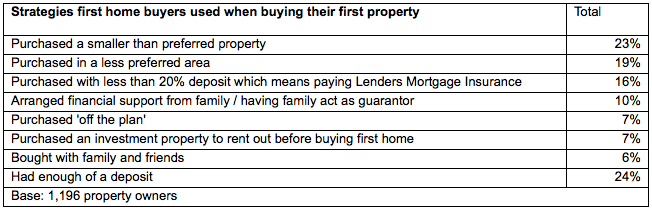

Nolan said first-home buyers are also using innovative strategies to get a foot on the foothold in the market. ME's research of 1,000 property owners in June 2017 found the following strategies were being used.

Review the ABS home lending data here.

Lending to investors is down...

While the number of home loan approvals rose, the value of dwelling commitments fell 0.9% to $33.03 billion in July.

“This can be attributed to the drop in the value of investment loans approved," said John Flavell, CEO of Mortgage Choice.

In July, $12.06 billion in investment loans were approved, a 3.9 per cent decrease from the previous month.

“Unfortunately, an increase in regulatory restrictions and punitive taxes have resulted in a 3.9 per cent reduction in investor lending, which remains an aspect of the market for monitoring,” said Reardon.

“I am not surprised to see a downwards shift in investment demand. Over the past few months, we have seen a number of Australia’s lenders tweak their pricing and policy in this area. These changes have made it hard for some investors to qualify for finance," said Flavell.

...but loans to owner-occupiers are up

The total value of owner-occupied housing loans rose 0.9 per cent to $20.96 billion in July.

“This is not surprising as the banks have recently been reducing the rates on their owner-occupied principal and interest home loan products and there are some competitive deals to be found," said Flavell.

Look at the latest ABS lending data here.

Read more about first-home buyers:

Where are Australia's most popular places for first-home buyers?

Weekend auctions litmus test of new first-home-buyer benefits