Deteriorating housing affordability driving a spike in home renovations

Contact

Deteriorating housing affordability driving a spike in home renovations

The decline in housing affordability is driving a surge in applications for renovation loans, says ME Bank.

The decline in housing affordability is driving a surge in applications for renovation loans, says ME Bank.

Applications for loans for cosmetic renovations grew 48% and applications for loans for structural renovations jumped 25 per cent between January and June 2017.

Loans for large renovations averaged around $400,000, said ME Bank.

Loans for kitchen and bathroom renovations generally came in around the $40,000 mark.

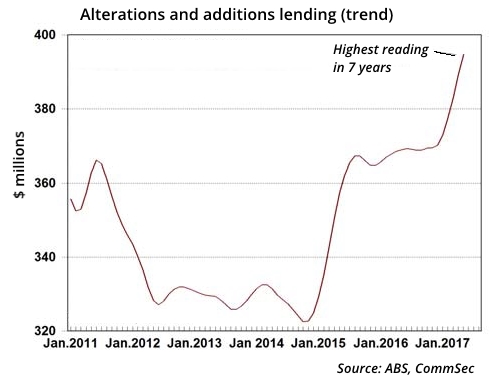

ME's experience is reflected in the latest ABS data, which shows that renovation lending is at a seven-year high:

ME Head of Home Loans, Patrick Nolan said, "Many (homeowners) are choosing to stay put to avoid the high house prices, and expenses such as stamp duty."

Nolan said most ME customers are using equity in their homes to fund their renovations.

With property prices recording extraordinary growth in recent years, particularly in Sydney and Melbourne, owners' equity in their homes has also increased.

Nolan said borrowers who are ahead with their loan repayments can also dip into that equity.

But he warned not to spend more on your renovation than the value it will add to your property.

Read more about home renovations in Australia:

How to get the most 'bang' from your renovations 'buck'