Auction volumes up, clearance rates hold steady

Contact

Auction volumes up, clearance rates hold steady

Auction clearance rates are stabilising, which is good news for the market, says John Cunningham, president of the REINSW.

CoreLogic's preliminary auction clearance rate for last week shows another strong result, and auction volumes ticked higher.

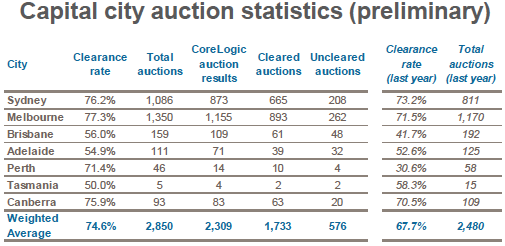

A total of 2,850 properties went to auction last week, up from 2,824 the previous week. At the same time last year, auction volumes were lower, with 2,480 homes taken to auction across the country.

Last week’s preliminary clearance rate across the capital cities was 74.6 per cent, up from a final result of 73.1 per cent for the previous week. By comparison, the auction clearance rate at this time last year was only 67.7 per cent

Clearance rates increased week-on week across all the major cities except Adelaide and Hobart.

Source: CoreLogic.

REIV President Joseph Walton told SCHWARTZWILLIAMS more than 1,000 homes went under the hammer in Melbourne last week, and he said "more than 1,000 homes will go to auction next weekend as vendors look to sell their homes before the Queen’s Birthday long weekend."

“Sales under the hammer this weekend remain higher than the same period last year," said Walton. Melbourne's preliminary clearance rate was 77.3 per cent, compared with 71.5 per cent for the same time the previous year.

Glen Iris recorded the city’s highest number of auction sales this weekend with 12 homes selling under the hammer – and achieving a 100 per cent clearance rate.

Hawthorn, Kew and Reservoir were the most popular auction locations with 15 auctions held in each suburb. “High auction activity was experienced in a number of premium suburbs this weekend," said Walton.

The City of Boroondara was the top performing municipality, with 75 auctions being held and 56 selling. The City of Knox recorded the city’s highest clearance rate, at 94 per cent from 18 auctions.

Norlane was the best performing regional suburb on the weekend, recording a 100 per cent clearance rate from five auctions.

REINSW president John Cunningham told SCHWARTZWILLIAMS, "the market is sitting in a very comfortable place".

Sydney's preliminary clearance rate was 76.2 per cent, compared with 73.2 per cent for the same time last year.

With stock levels increasing across Sydney in May, auction clearance rates have been consistent said Cunningham.

"Demand is staying strong albeit not at peak boom rates and with increased supply it is making for a very strong yet more stable market," he said.

"Buyers and sellers should be feeling very confident that these conditions are ideal for transacting real estate as the post boom plateauing of the market provides far more surety of decision making."

Read more about auction markets:

Pent-up demand means more auctions and more sales

Strong auction clearances hose down cooling theory

Auction clearances indicate real estate market could be drifting lower