Debt soars to new high against income

Contact

Debt soars to new high against income

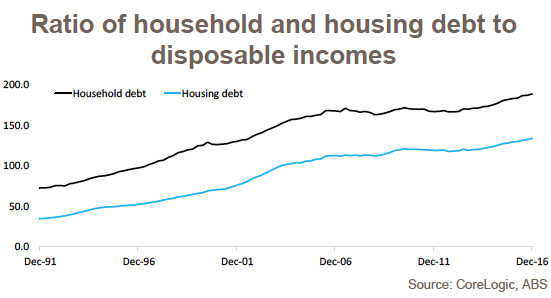

The ratio of household debt to disposable income was at a record high of 188.7 per cent at the end of 2016, according to recent statistics from the RBA.

The ratio of household debt to disposable income reached a record high of 188.7 per cent at the end of 2016, according to recent statistics from the Reserve Bank based on new Australian Bureau of Statistics data.

The rise marked a gain of 1.6 percentage points for the quarter, and 3.1 percentage points for the year.

The data should be viewed with caution, according to CoreLogic's Property Pulse report, because it doesn't take into account geographic variation, but rather takes the view of the nation overall.

The Property Pulse report says high levels of private debt are compounding fears about recent buyers being left in a position of negative equity if housing prices decline.

The report warns that investors might be more readily prepared to sell property at a loss than owner occupiers because investor's losses can be offset against future gains. An increase in the number of investors selling could put downward pressure on the overall market. Owner-occupiers don't have the same ability to offset losses, and therefore "are potentially much more financially vulnerable in the event of a housing market downturn", according to the report.

See also:

RBA governor says supply key to improving housing woes