Asia Pacific real estate investors looked to home markets in 2016

Contact

Asia Pacific real estate investors looked to home markets in 2016

Asia Pacific real estate investors turned to their home markets in 2016 amid greater political and economic uncertainty, according to JLL's 'Real Estate Investment Flows: An Asia Pacific Perspective' report.

New research from Jones Lang LaSalle shows that most markets in the Asia Pacific region invested more heavily in local real estate during 2016, amid political and economic uncertainty sparked by Brexit and the US election.

The report, titled 'Real Estate Investment Flows: An Asia Pacific Perspective', looks at deals worth more than US$5m in commercial, retail and industrial real estate in the Asia Pacific region.

In China, investment in domestic real estate increased by 50 per cent compared with the previous year. Increased regulatory scrutiny of capital outflows led many domestic investors to bid strongy for local properties, ultimately outbidding foreign investors, according to the report.

Despite stronger local investment, outbound investment from China grew to record levels in 2016 reflecting a desire for trophy assets and to diversify out of China. Key markets were the US, Australia, and Hong Kong.

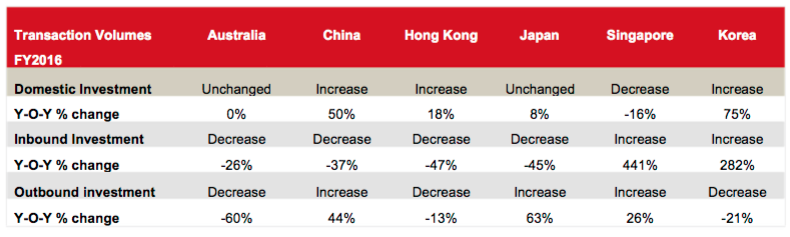

Asia Pacific capital flow trends: domestic, inbound, and outbound

Source: Jones Lang LaSalle.

In Australia, transaction volumes fell 13 per cent from a record high in 2015. Jones Lang LaSalle reports that the decline was due to a lack of "investible stock" available. Record-low yields have also prompted investors to take a more cautious approach.

Inbound real estate investment accounted for 42 per cent of total transaction in 2016, with the key sources the US, China, Singapore and Hong Kong. Sydney and Melbourne remained the key markets.

The weaker Australian dollar and global economic and political uncertainty dragged outbound real estate investment from Australia down 60 per cent.

Read Jones Lang LaSalle's complete report 'Real Estate Investment Flows: An Asia Pacific Perspective' here.

See also:

Chinese New Year tourists combine holidaying with buying property

JLL among world’s most ethical companies

Banks, visas likely to deter foreign buyers more than regulatory changes