Budget to leave negative gearing, capital gains alone

Contact

Budget to leave negative gearing, capital gains alone

With the budget looming only months before an election, controversial measures are off the table.

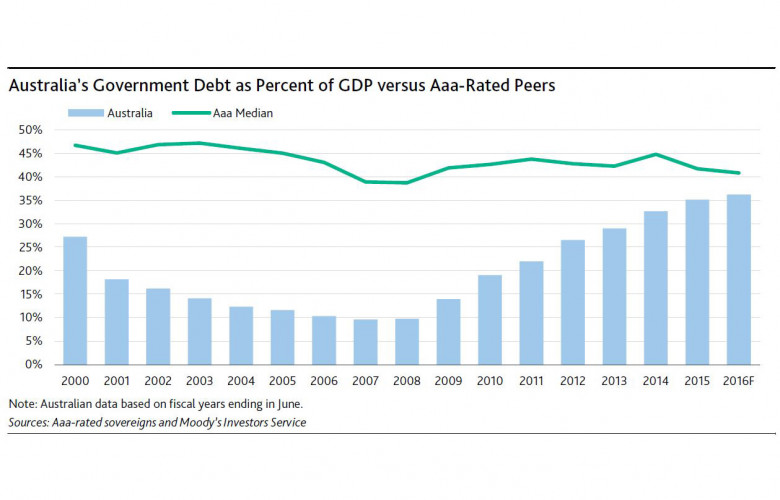

Moody’s released a bombshell on the federal government last week, calling for revenue gains as well as spending cuts to avoid risking the nation’s AAA rating.

"Limited spending cuts are unlikely to meaningfully advance the government’s aim of balanced finances by 2021," Moody’s said.

The ratings agency said efforts to curb spending would be constrained by "significant commitments on welfare, education and health."

Moody’s noted the government’s tendency to "shelve" reform, such as its opposition to Labor’s negative gearing and capital gains tax proposals, which were forecast to improve the budget position by $32 billion over a decade.

With the Moody’s warning coming only weeks before the May 3 budget, Treasurer Scott Morrison was quick to respond, saying revenue changes would be offset by tax measures in an effort to rein in the ballooning budget.

"Our plan is to consolidate the budget by being disciplined. We will apply revenue measures to reduce the tax burden in other parts of the economy, and wherever possible to continue to drive down the deficit," said Morrison.

Christopher Pyne made the government’s position clear on Sky News. "The gravest threat to our credit rating is a Labor government that abolishes negative gearing, pushes up rents, pushes down the value of house prices and increases the capital gains tax by 50%."

A downgrade to Australia’s credit rating could drive up banking costs, pushing mortgage costs higher and undermining economic growth.