Finance tips for first time home buyers

Contact

Finance tips for first time home buyers

What first home buyers should consider from a finance perspective when purchasing their first home.

With the Adelaide Bank/REIA Housing Affordability Report showing first home buyers at historic lows as a proportion of purchasers, average loan sizes increasing and restrictions placed on access to first home owner assistance schemes, times are undoubtedly tough for this demographic. While the political debate continues to rage about the implementation of policies to improve housing affordability, REIA CEO Amanda Lynch talked to Adelaide Bank’s Senior Manager Broker Distribution about what first home buyers should consider from a finance perspective when purchasing their first home.

Amanda Lynch: What’s the first thing that a first time borrower should be thinking about, other than of course finding the right property?

Fons Caminiti: It sounds obvious, but prospective borrowers should take the opportunity to get their finances in order before making an application for their first home loan. As well as saving for a deposit, borrowers may want to assess other items that will impact their borrowing or credit worthiness. For example be sure to close or reduce the balance of any unwanted credit facilities – even with a zero balance they impact a customer’s borrowing capacity. If the borrower has any concerns about their credit history they can get a free copy of their credit report from mycreditfile.com.au; they should also ensure any minor defaults are paid and arrange to have any errors fixed.

AL: Just how much will a first time borrower need to get a foothold in the market?

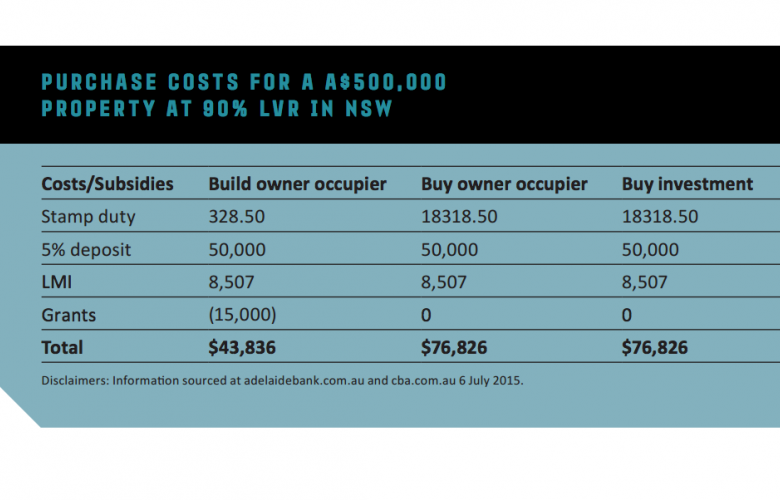

FC: While it varies from state to state and with the type of home being purchased, borrowers should expect to stump up 10-15% of the value of the property in available funds to cover the deposit, government fees and LMI. Banks tend to require 5% of the deposit as genuine savings, so first time borrowers need to be able to demonstrate their capacity to save and an element of discipline. If they are going to rely on a gift as part of the deposit, then the funds normally need to be held for 3 to 6 months prior to application in order to be counted as genuine savings. Borrowers should also research what level of government support is available in their state for first home buyers – while more restrictive than in the past, this could still provide an important boost.

AL: Are there any other alternative finance methods?

FC: There are a range of alternatives that first time borrowers can consider – although anything a bit different might also be worth some extra research to ensure borrowers really understand the risks and benefits. These could include non-mainstream lenders, parental guarantees, government lenders, buying as tenants in common with friends or family, or borrowing to invest first. My colleagues over at www.leveraged.com.au tell me that they are seeing younger people borrowing relatively small amounts to build a blue chip share portfolio and build credit worthiness, then using their investments to get into property further down the track. I can see this strategy growing in popularity, particularly in Sydney and Melbourne.

AL: Any other advice?

FC: A mortgage broker with plenty of experience with first home buyers in your area can guide a borrower through the many decisions that need to be made. If your clients need a recommendation then they can call the Adelaide Bank contact centre on 1300 652 220 and we can put you in touch with a licenced and accredited mortgage broker.

This article was originally published in REIA News July 2015.