It's not all about capital cities

Contact

It's not all about capital cities

If someone had some capital to invest in property at the start of 2004, the biggest return on their investment would have been in Mount Isa, writes Simon Pressley.

Over the last decade, the better performing property markets have been in regional locations, not capital cities. The majority of property investors who didn’t even contemplate investing in a regional location could have achieved a significantly better return on investment and with a smaller capital (and cash flow) outlay.

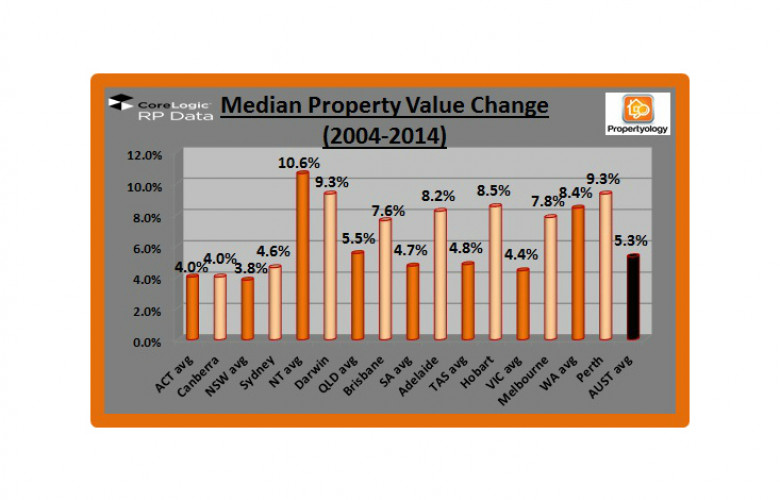

With the exception of Darwin, each of the eight capital cities did perform better than their respective state average between 2004 and 2014. The capital city average annual change in median property value was 5.7% and the average across Australia as a whole was 5.3%. Investors are too easily influenced by media, well-meaning colleagues, poor advisors, and perception. Many confuse ‘reading’ with ‘research’.

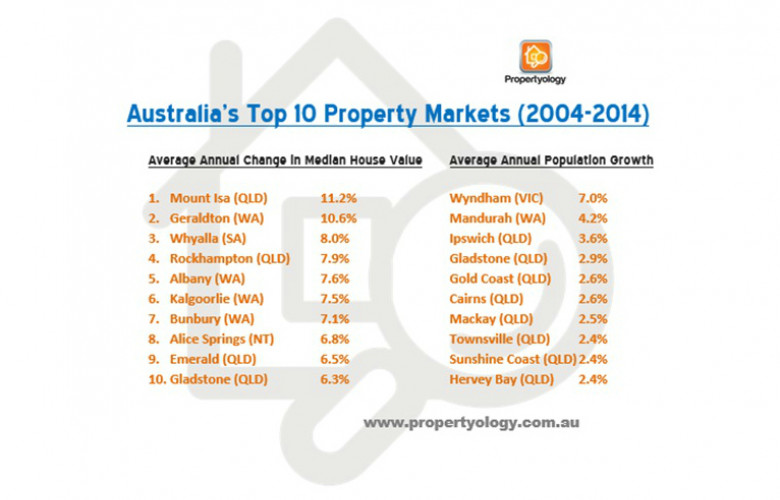

I have reviewed the historical property market performance of Australia’s fifty largest regional towns, all with a population of greater than 20,000 people. If someone had some capital to invest in property at the start of 2004 and were capable of blocking out all of that noise the biggest return on their investment would have been in Mount Isa. One could have purchased a typical 3-bedroom house in Mount Isa for $115,000 in 2004; it would have grown by an average of 11.3% per annum over the last ten years and today be worth $360,000. How long would it take you to save $245,000?

Geraldton (10.6%), Whyalla (8.0%), Rockhampton (7.9%), and Albany (7.6%) rounded out the top 5. Queensland and Western Australia both had four cities in the top 10. When rental yields are factored in along with capital growth rates there’s a long list of regions that have performed better than capital cities. Most property investors can’t see beyond investing in the same city that they live – they are creatures of habit.

Given that 67% of Australians live in a capital city it is not surprising that few consider regional locations. There is also a perception that population growth is higher in capital cities. For the record, Australia’s average annual population growth rate over the last decade is 1.7%.

Propertyology’s research revealed numerous examples of regional locations which have experienced higher population growth rates than capital cities and the national average. Wyndham in Victoria is streaks ahead of the rest of the country with a population growth rate of 7.0% per annum, although its annual change in median house value over the last decade (5.1%) was slightly below the national average. Historical data kills the myth that the higher the population growth the higher the property price growth.

There’s much more to the science of property markets than population stats. I like to educate clients on what we call ‘the sum of all factors’. I’m not for one second implying that all regional locations are good investments. For the record, I personally own investments in (both) regional cities and capital cities. The main reason that certain regional cities have performed so strongly is that the entry price for property is much more affordable. Resident salaries in regions are often comparable to capital cities. Owner-occupiers, investors, first home buyers, empty-nesters… the more people who can afford accommodation the higher the demand.

The investment properties that Propertyology has purchased in regional locations across Australia over the years range from $200,000 to $450,000. At that price, there is high demand and therefore more scope for growth. Historical data from this research exercise supports this methodology.

Australia’s biggest regional cities are over 100 years old and have all of the essential infrastructure that one would expect of a sustainable community. These locations are spread right across the country and include the likes of Albany, Armidale, Ballarat, Bendigo, Bunbury, Bundaberg, Cairns, Dubbo, Emerald, Geelong, Geraldton, Gladstone, Gosford, Ipswich, Mackay, Mandurah, Mount Gambier, Newcastle, Orange, Rockhampton, Shepparton, Townsville, Whyalla, and Wollongong.

As at June 2014, 7,863,000 Australians elect to live in regional locations. That equates to demand for over 3 million properties. People are attracted to living in regional cities because of better quality lifestyle, employment opportunities, lower cost of living, more affordable housing, and connections with family.

With an aging population and an unhealthy reliance on government-funded pensions, it is quite likely that more and more baby boomers will benefits in relocating to more affordable regional locations.

This article was written by Simon Pressley, Managing Director of Propertyology, a REIA Hall Of fame Inductee, property market analyst, accredited property investment adviser, and Buyer’s Agent. Propertyology works exclusively with property investors to purchase properties in strategically chosen locations all over Australia.