Investors make way for first-home buyers

Contact

Investors make way for first-home buyers

“The cooling of investor activity in the market should be closely monitored,” says Tim Reardon of the HIA.

“In April this year APRA announced restrictions on the housing market which have impeded investor activity in the housing market and they have also had a secondary impact of helping first home buyers back into the market,” stated Tim Reardon, HIA’s Principal Economist.

The ABS released the Housing Finance data for September 2017 today which reports lending activity in the housing market.

“The growth of first home buyers is evident across all markets but is most dramatic in NSW and Victoria (57.7 per cent and 32.2 per cent increase from the previous quarter) where an increase in the FHOGs have boosted sales,” added Mr Reardon.

“First home owners have also been brought back to the market due to the large supply of apartments that are being completed at the moment.

“This is a very positive sign of a healthy market. First home owners have been forced out of the market in recent years due to rising prices.

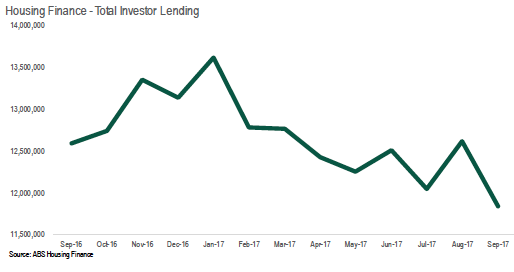

“On the other side of the market, investors have incurred additional borrowing costs from APRA regulatory imposts which have limited the availability of loans to investors and therefore forced up the effective interest rate they incur. This was the intention of these imposts.

“There has been a reduction of investor borrowing activity of 2 per cent in the six months since these punitive measures came into effect.

“This is a concern for the market as investors remain important to the ongoing supply of new homes in the market available for rent.

“The cooling of investor activity in the market should be closely monitored,” concluded Reardon.

Read more about housing finance data:

APRA measures push investors out, let first-home buyers in

Affordability is improving, and first-home buyers are back in the market