Foreign investors in Sydney paying almost four times as much stamp duty as locals

Contact

Foreign investors in Sydney paying almost four times as much stamp duty as locals

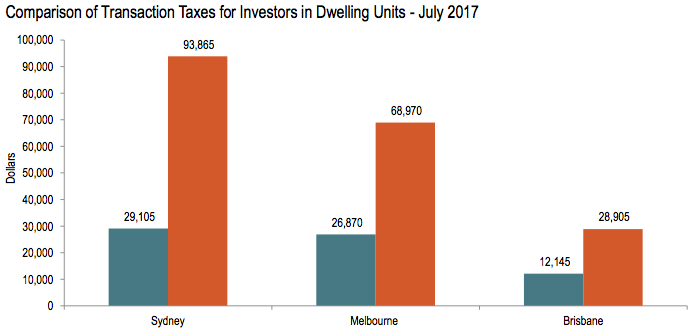

Recent changes to stamp duty in NSW mean that foreign investors now pay almost $100,000 in transaction taxes to acquire a standard apartment in Sydney.

“Recent changes to stamp duty in NSW mean that foreign investors now pay almost $100,000 in transaction taxes to acquire a standard apartment in Sydney – almost four times as much as local buyers,” commented HIA Senior Economist, Shane Garrett.

This remarkable finding is contained in the latest Stamp Duty Watch report which has just been released by the Housing Industry Association.

“The average stamp duty bill in Australia paid by resident owner occupiers is also up by 16.4 per over the year to $20,725, even though dwelling prices increased by just 10.5 per cent,” added Mr Garrett.

“On the owner occupier side, stamp duty drains family coffers of $107 each and every month over a 30- year mortgage term.

“For owner occupiers, the typical stamp duty bill now amounts to $20,725 – an increase of some 16.4 per cent on a year ago.

“Shelling out so much in stamp duty drains the household piggy bank of vital funds for their home deposit. Families are then forced to take out larger mortgages and incur heavier mortgage insurance premiums.

“Foreign investors are a vital component of rental supply in cities like Sydney and Melbourne. With rental market conditions now so tight in Australia’s two biggest cities, should we really be placing more and more barriers in the way of new supply?” concluded Garrett.

Download the HIA Stamp Duty Watch report here.

Read more about charges of foreign buyers:

How will the 50% foreign ownership limit affect developers?

Housing measures in the 2017 Budget

Capital gains withholding tax too low for foreign residents says REIA