Mortgage demand lifts - CoreLogic

Contact

Mortgage demand lifts - CoreLogic

Overall, the latest housing finance data is mirroring other indicators such as auction clearance rates and the CoreLogic Home Value Index, which highlight early signs of improved housing market conditions.

Earlier today the Australian Bureau of Statistics (ABS) released the June 2019 data for lending to households and businesses. After many other indicators were pointing to improved housing market conditions (and demand), the latest housing finance data also showed a lift.

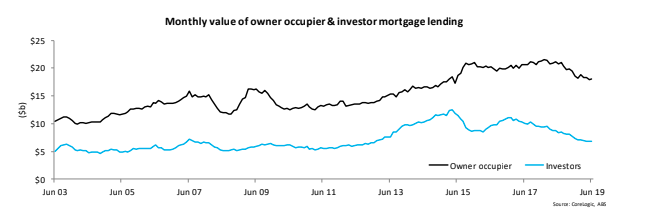

In June 2019, there was $24.9 billion worth of housing finance commitments, which was 0.6% greater than the previous month but -14.6% lower year-on-year. The $24.9 billion worth of finance commitments was split between $18.1 billion to owner-occupiers and $6.8 billion to investors, both of which recorded an increase in the value over the month.

The value of owner-occupier finance commitments rose by 0.7% over the month while investor commitments increased by 0.5%.

The $18.1 billion worth of owner-occupier housing finance commitments was split between: $1.8 billion for construction, $0.9 billion for purchase of new, $9.8 billion for purchase of established stock and $5.6 billion in refinancing.

The value of lending fell over the month for construction, purchase of new and refinancing however, the strong increase in the value for lending for established housing led to the overall increase. Despite the overall monthly increase in owner-occupier lending, all components fell year-on-year with refinancing recording the most moderate decline.

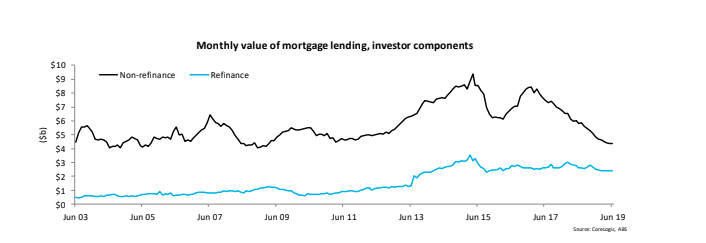

Looking at the investor component of lending, the $6.8 billion worth of commitments was a combination of $4.4 billion for new lending to investors and $2.4 billion worth of commitments for

refinances. Both the value of lending of new and refinance lending to investors was higher over the month while they were also each lower year-on-year.

The owner-occupier and investor charts highlight that refinance commitment values continue to broadly trend lower. At the same time, there is some emerging evidence that the new lending (on non-refinance) space is starting to show some recovery.

It will be interesting to see whether this trend continues over the coming months as housing conditions improved further in July, the rules around serviceability testing were loosened and mortgage rates reduced. Additionally, there is already strong competition for new mortgage customers by lenders. This may encourage an increase in refinance activity.

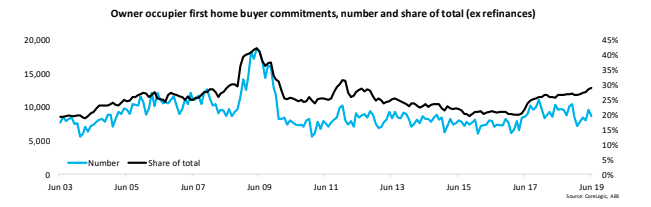

In terms of the number of owner-occupier housing finance commitments to first home buyers, there was a decline in June 2019 with 8,653 commitments. Although the number of commitments was lower over the month, as a share of all new commitments to owner-occupiers, first home buyers increased to a 28.9% share.

The 28.9% share was the highest since January 2012. In terms of volume, first home buyers remain much lower than they were in 2009 and the recent lift in the number of commitments seems to have stalled.

With lower mortgage rates, increased borrowing capacities and reduced serviceability floors there may be a further reduction in first home buyer activity over the coming months.

Should this occur it would likely be due to increased competition from both investors and existing owner-occupies that are choosing to upgrade.

Overall, the latest housing finance data is mirroring other indicators such as auction clearance rates and the CoreLogic Home Value Index, which highlight early signs of improved housing market conditions. With stronger clearance rates and value growth in July 2019, we wouldn’t be surprised to see a further improvement in demand for mortgages over the coming months.

Similar to this:

Real dwelling values continue their falls over the June 2019 quarter

What APRA (potentially) giveth does comprehensive credit reporting take-away?

The rate of value decline across the most expensive properties is starting to slow