Sydney, Perth and the Gold Coast top ranked cities in Australia for luxury residential price growth says Knight Frank

Contact

Sydney, Perth and the Gold Coast top ranked cities in Australia for luxury residential price growth says Knight Frank

Knight Frank's Prime Global Cities Index Q3 2020 tracks the movement in prime residential prices in local currency across 45 cities worldwide using data from Knight Frank’s global research network. Five Australian cities were ranked in the top 26 cities around the world for luxury residential market performance over the past year.

Luxury property prices are still rising around the world despite the global pandemic, with Australia among the top-ranked cities seeing growth, according to the results of the Knight Frank Prime Global Cities Index Q3 2020.

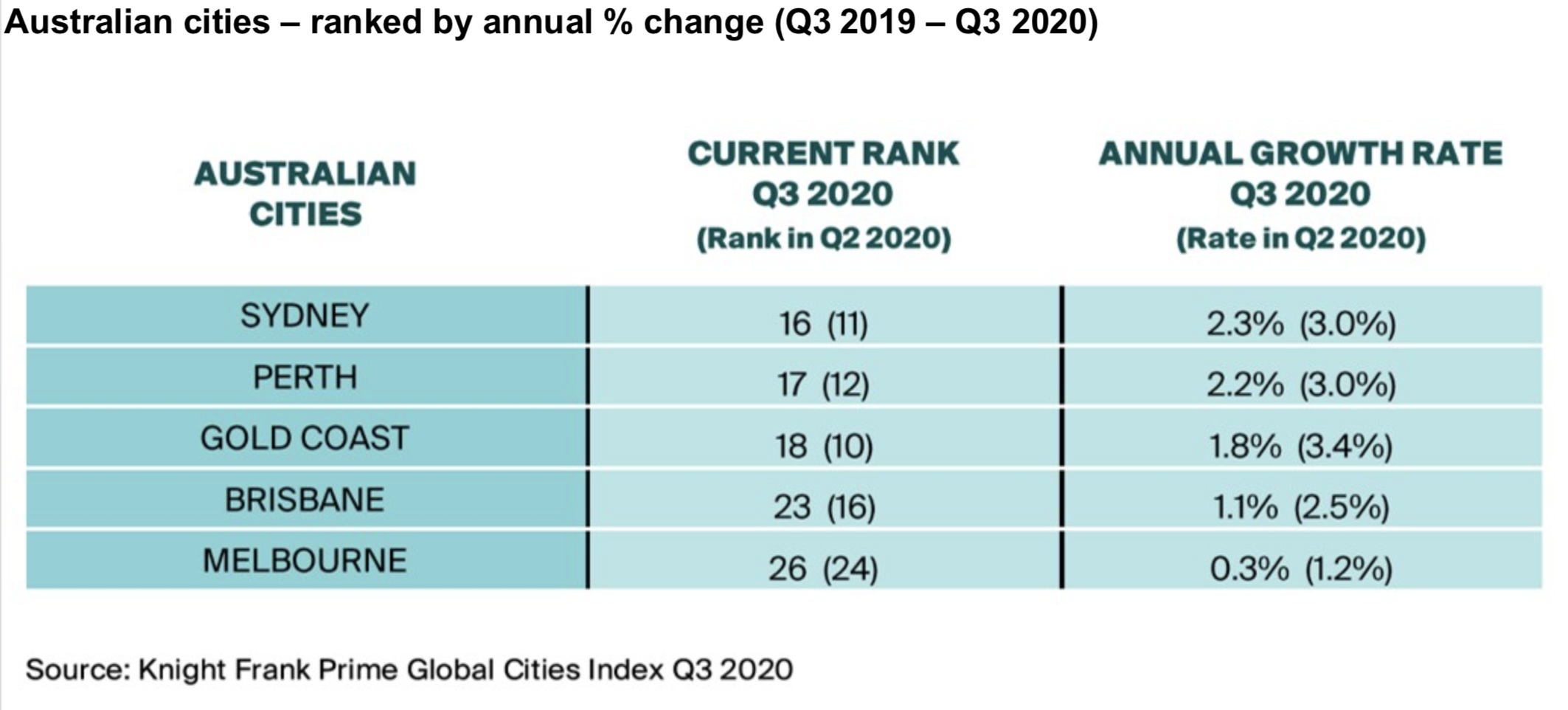

The Prime Global Cities Index, a valuation-based which tracks the movement in prime residential prices in local currency across 45 cities worldwide using data from Knight Frank’s global research network, found five Australian cities – Sydney, Perth, the Gold Coast, Brisbane and Melbourne - were ranked in the top 26 for luxury residential market performance over the past year.

Sydney was the top ranked city in Australia coming in at number 16 on the list of global cities, with 2.3% annual growth.

Perth was next, ranked 17 with annual growth of 2.2%, followed by the Gold Coast, ranked 18 with 1.8% growth. Brisbane was ranked 23 (1.1%) and Melbourne was ranked 26 (0.3%).

Knight Frank’s Head of Residential Research Australia Michelle Ciesielski a surge in demand post-lockdown, as luxury homeowners re-evaluated where they want to be and the type of property they want to live in, had boosted sales and supported luxury prices across several key markets globally, including Australia.

“Knight Frank’s Prime Global Cities Index increased by 1.6 per cent in the year to Q3 2020 with 62 per cent of cities continuing to see prime prices increase year-on-year,” she said.

“That said, the percentage of cities registering annual price declines is creeping up, from 23 per cent at the end of 2019 to 38 per cent in Q3 2020.

“Australia has so far bucked this trend, with Sydney, Perth, the Gold Coast, Brisbane and even Melbourne, which has had the most stringent lockdown of all the capitals, continuing to record positive annual growth.

“In fact, Sydney, Perth and the Gold Coast all recorded growth above the index’s average annual increase.

“Once lockdown was eased, the prime property market was supported by an upward trajectory in the stock market, low interest rates and ultra-wealthy money which remained at home.

“Most of Australia was fortunate to ease out of restrictions in time to take advantage of the idyllic spring selling season. The thin number of prime properties on the market had great exposure to the ultra-wealthy population who would have otherwise been returning from a European vacation.”

Knight Frank National Head of Residential Shayne Harris said: “In an age of uncertainty we tend to look for stability in our residential property markets to increase sentiment and this is currently playing out across the prestige markets of Australia, albeit at differing speeds.

“We expect this to continue into the last quarter of the year, as each state economy strengthens.

“Buyers are looking more favourably at luxury property, mirroring what we saw following the Global Financial Crisis, to build up their wealth portfolios. As a result of the pandemic, more are likely to buy a second home to enhance their lifestyle and use as a retreat in the event of future outbreaks.”

The top performing city in Knight Frank’s Prime Global Cities Index was Auckland, with annual luxury residential price growth of 12.9%, while North America was the strongest performing world region in the year to Q3 2020, with three cities in the top 10 annual rankings – Toronto (8%), Vancouver (7%) and Los Angeles (6%).

The index demonstrated the resilience of a number of cities, including Manila (10%), Seoul (7%), the Swiss cities of Zurich (7%), Geneva (6%) and Stockholm (5%), as well as the recovery of Chinese cities such as Shenzhen (9%) and Shanghai (6%).

“With global equity markets volatile, Brexit looming large, the repercussions from the US presidential election expected to rumble on, and further waves of the pandemic hitting Europe and the US, property’s credentials as a safe and tangible asset class are rising to the fore.”

“It is perhaps not surprising that traditional safe havens, countries that are considered to have handled the pandemic efficiently or applied a lighter touch, plus those markets that are already witnessing an economic rebound have moved higher in the rankings,” said Ms Ciesielski.

“With travel restrictions in place across much of the world this demand remains primarily domestic in nature.”

Click here to view and download the Knight Frank Prime Global Cities Q3 2020 Report.

Similar to this:

Luxury residential growth in Australian cities: Knight Frank

Sydney tops Knight Frank City Wellbeing Index for Australasia

Gold Coast premium property market remains strong says Kollosche

John McGrath – Sydney market turns & new infrastructure underway