How can a capital partner help you build your future?

Contact

How can a capital partner help you build your future?

Dan Holden, director of HoldenCAPITAL Partners discusses how a capital partner can benefit property developers.

A capital partner can work with property developers in a number of ways to help them deliver outcomes and grow their pipeline of projects by providing reliable and flexible

capital.

HoldenCAPITAL helps its clientel to achieve this by providing a full service of capital products, from arranging and negotiating everything from bank debt to more flexible

non-bank debt options, as well as funding via HoldenCAPITAL Partners (HCP) private investors for qualified projects.

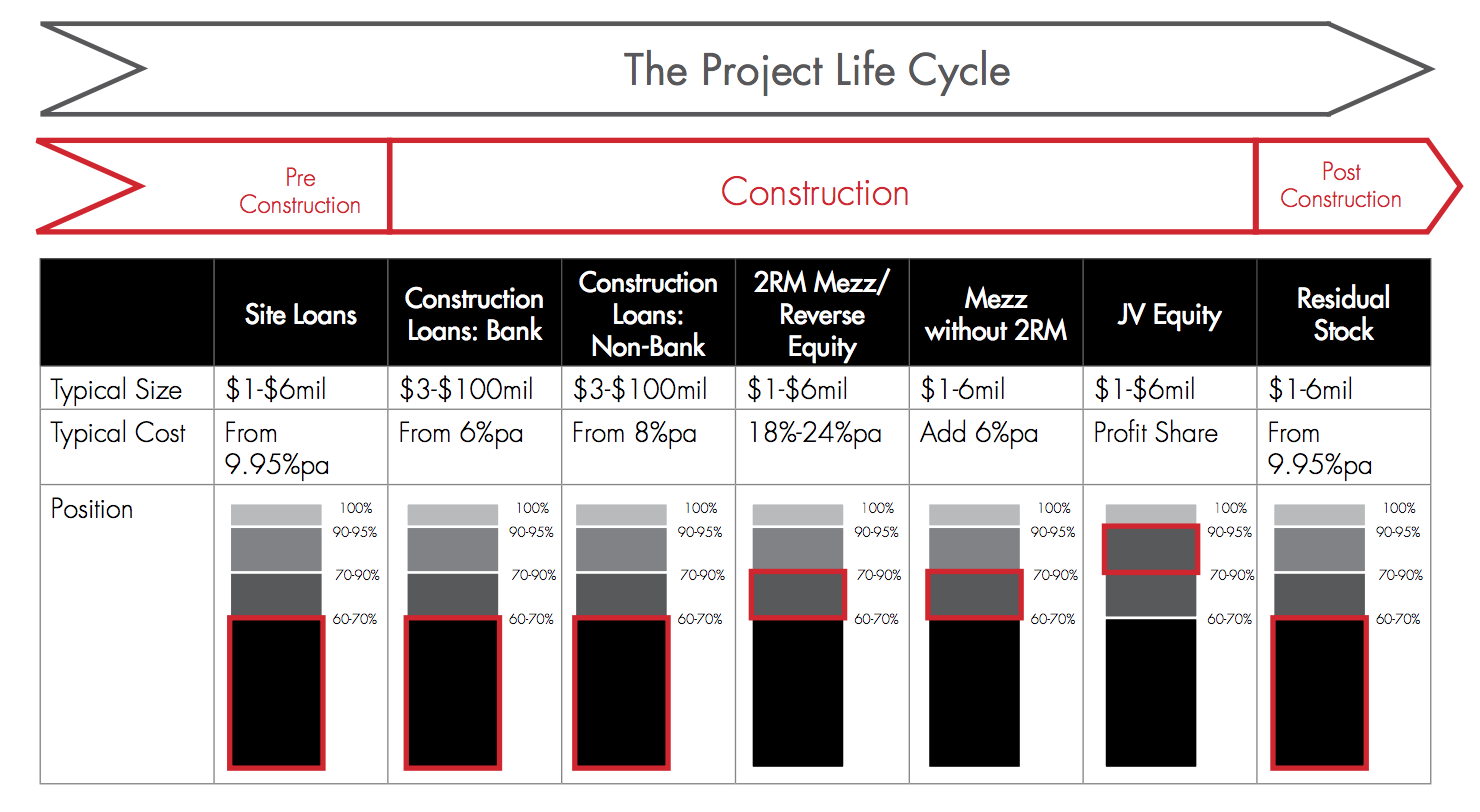

Dan Holden, director of HCP told WILLIAMS MEDIA “We bring many benefits to property developers as a capital partner, as we get involved in all stages of the project.”

Related reading: Sydney: It's hot in the city, but there are still opportunities to be had

“Right from the beginning by helping to settle the site, through to the residual stock loan at the end.

“We work best where we manage the whole funding process, which allows the developer to concentrate on what they do best, which is identify new projects and deliver them.”

Mr Holden said with APRA tightening the constraints on the banks over the last few years resulting in dramatically reduced construction lending and with pre sales hard to achieve, non-bank options have become a key option for borrowers to get their projects up and running.

The HoldenCAPITAL Partners project life cycle“HCP works with privately owned and operated, entrepreneurial developers who often have multiple projects in various stages of the cycle across their portfolio.

“This can also be someone who has more opportunities than capital, hence they see the benefit of partnering with a passive investor to under-write their business growth

and provide balance sheet support.

“We do this by providing debt and or equity into projects from site settlement, right through to completion, and even completed stock loans.”

Related reading: Melbourne - steady as she goes in the world's most liveable city

A recently funded project by HCP was a 16 townhouse development located in a high end north shore suburb of Sydney.

“It was a good project with solid presales.”

“Council approval added a cost item of $2.1 million that wasn’t budgeted for, and we provided a quick turn-around funding solution secured by a registered second mortgage with additional collateral security putting the project back on track.”

This is a sponsored article.

Read more about HoldenCAPITAL Partners:

Get to know Gary Connolly, Head of Investments at HoldenCAPITAL Partners