Weaker investor demand, tax concessions let first-home buyers back in: CoreLogic

Contact

Weaker investor demand, tax concessions let first-home buyers back in: CoreLogic

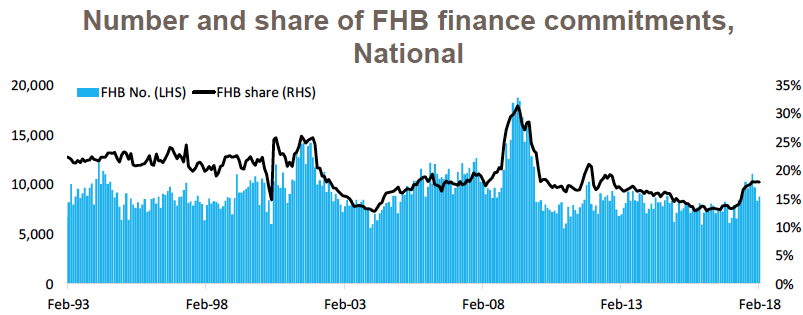

First-home buyers accounted for 17.9 per cent of all owner occupier commitments in February, up from 13.3 per cent at the same time in 2017, according to ABS data.

Recent ABS data shows there were 8,782 housing finance commitments made during the month of February 2018, down from the levels of late 2017, but 33.1 per cent higher than for the same time last year.

First-home buyers accounted for 17.9 per cent of all owner occupier commitments in February, up from 13.3 per cent at the same time in 2017.

The increase is largely attributable to all state and territories now offering some form of incentive to first-home buyers.

Source: CoreLogic.

CoreLogic research analyst, Cameron Kusher, wrote in his analysis of the data, “With each state and territory offering some level of incentive to first home buyers including grants and tax concessions, this segment is moving along quite nicely.”

In NSW, stamp duty concessions introduced at the end of June 2017 have contributed to first-home buyers now making up 15.1 per cent of owner occupier finance commitments - the highest level in five-and-a-half years. First-home buyer housing finance commitments more than doubled between February 2017 and February 2018.

Stamp duty concessions saw the number of first-home buyer housing commitments in Victoria rise 38.6 per cent over the year.

Kusher said prices at the more affordable ends of the Sydney and Melbourne housing markets aren't slowing at the same pace as the markets more broadly, and said the strength was likely to be caused by first-home buyer incentives driving increased demand.

“Despite overall slowing conditions in Sydney and Melbourne, the CoreLogic home value indices results show that the more affordable end of the housing markets in these cities as still seeing values rise and likely generated by first-home buyer activity," he said.

Kusher also said that weaker demand from investors could open up more buying opportunities for first-home buyers.

“With demand from the investment segment expected to continue to be weaker than it has over recent years, this may afford more opportunities for first home buyers to enter the market.”

Read more about first-home buyers:

First-home buyers are back in the market

Where are Australia's most popular places for first-home buyers?