Demand rising for variable-rate mortgages, despite "growing speculation" rates headed higher this year

Contact

Demand rising for variable-rate mortgages, despite "growing speculation" rates headed higher this year

The proportion of borrowers choosing a variable-rate home loan has been rising steadily each month, according to the latest data from Mortgage Choice.

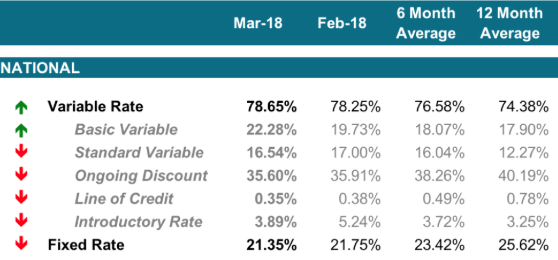

The proportion of borrowers choosing a variable-rate home loan has been rising steadily, now making 78.65 per cent of all loans written, up from 78.25 per cent the previous month, says Mortgage Choice.

“We have been seeing a steady increase in the proportion of borrowers choosing a variable rate home loan every month," said Mortgage Choice spokesperson Jacqueline Dearle.

“With the Reserve Bank of Australia leaving the official cash rate on hold at 1.5 per cent for another month, borrowers may not feel the impetus to fix their mortgages," she said.

Borrowers do not seem to be worried by "growing speculation" that rates could rise later in the year.

Dearle also attributed the growth in variable-rate loans to the favourable rates being offered by a number of lenders.

Source: Mortgage Choice.

Only one in five borrowers are opting for fixed-rate mortgages, says the mortgage broker. In the month of March, fixed-rate home loans accounted for 21.35 per cent of all loans written by Mortgage Choice, down 0.4 per cent from the previous month.

Read more about interest rates:

RBA holds cash rate at 1.50 per cent for twentieth month

Paying off the mortgage is the top goal of Australians in the new year

Interest rates on hold: what does it mean for the property market?