Which depreciation method is best for you?

Contact

Which depreciation method is best for you?

There are two ways to calculate depreciation on plant and equipment in an investment property - by using the diminishing value method, or the prime cost method.

When claiming depreciation on plant and equipment assets in an investment property, there are two different methods you can choose from. These are known as the diminishing value and the prime cost methods of depreciation.

When an investor makes their depreciation claim, they can choose only one of these two methods, so it is important to understand how this choice will affect investment returns.

Each method has its own advantages, which should be considered in line with your investment strategy when making the decision.

Every property investor is likely to have a different investment strategy, so it is important for them to understand how their choice between the two different methods of claiming depreciation will affect their return.

Both the diminishing value and the prime cost methods claim the total depreciation value available over the life of a property. However, the two methods use different formulas to calculate depreciation deductions, achieving different short and long-term cash flow positions for the property investor.

Here’s a breakdown of these two methods, their respective advantages, and which general investment strategies they’d be best suited to.

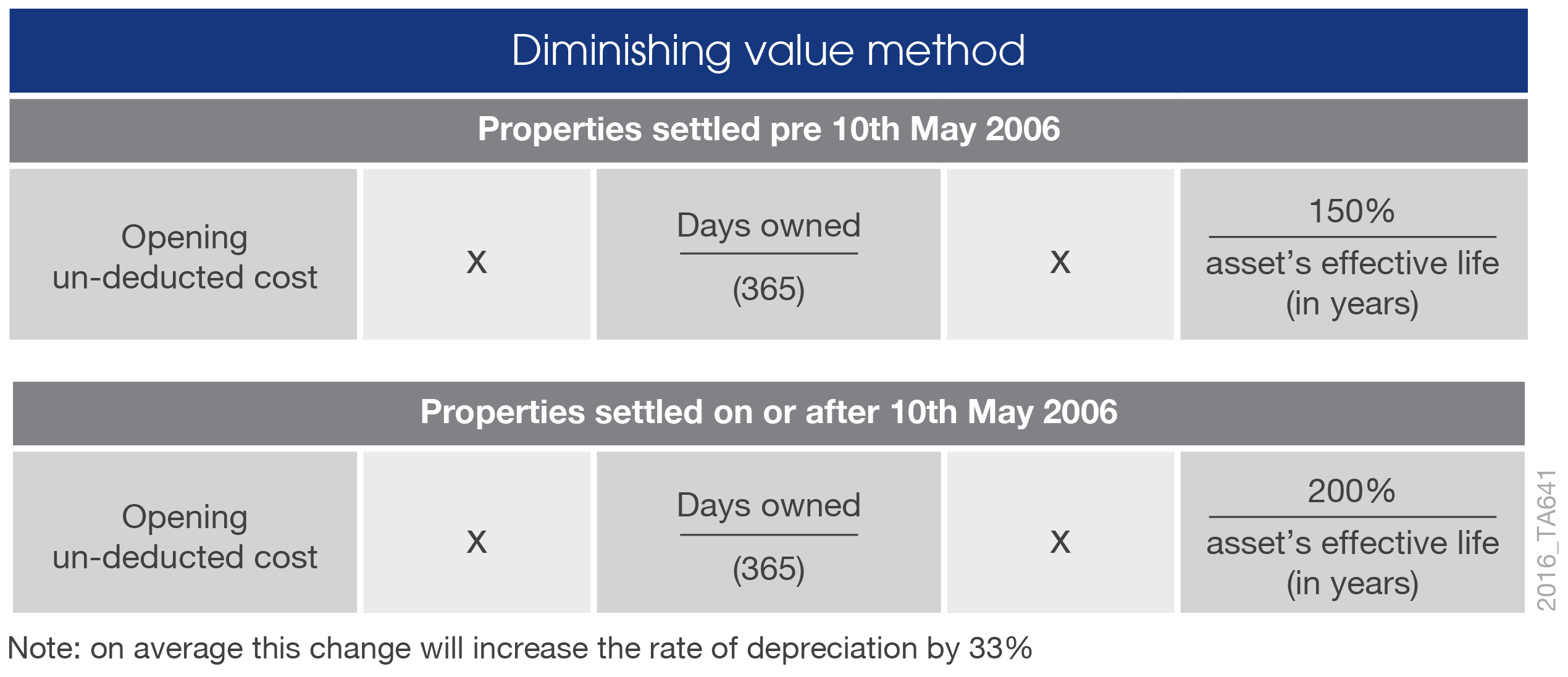

Diminishing value method

Under the diminishing value method of depreciation, the deduction is calculated as a percentage of the balance you have left to deduct. This increases the rate an asset depreciates at, increasing deductions sooner.

The formula a Quantity Surveyor will use to calculate depreciation using the diminishing value method is shown below.

Source: BMT Tax Depreciation.

If an investor uses the diminishing value method, they are claiming a greater proportion of the asset’s cost in the earlier years of the effective life of the asset as set by the ATO, therefore receiving greater deductions in the earlier years of owning the property.

This strategy might best suit an investor looking to receive greater deductions in the earlier years of owning a property or those who don’t intent to hold on to their property long-term.

Prime cost method

Under the prime cost method, the deduction for each year is calculated as a percentage of the cost.

The formula a Quantity Surveyor will use to determine the amount of depreciation deduction under the prime cost method is shown below.

Source: BMT Tax Depreciation.

By selecting the prime cost method the investor is claiming a lower but more constant proportion of the available deductions over a longer period.

This might better suit an investor who plans to hold an investment property long term and wishes to benefit from deductions more evenly over time.

No matter what strategy an investor has, it is recommended they seek advice from an Accountant when making a decision.

A specialist Quantity Surveyor will always be able to provide a Capital Allowance and Tax Depreciation Schedule that outlines the depreciation deductions available to claim using both methods for comparison.

* Under new legislation outlined in the Treasury Laws Amendment (Housing Tax Integrity) Bill 2017 passed by Parliament on 15 November 2017, investors who exchange contracts on a second-hand residential property after 7:30pm on 9 May 2017 will no longer be able to claim depreciation on previously used plant and equipment assets. Investors can claim deductions on plant and equipment assets they purchase and directly incur the expense for. Investors who purchased prior to this date and those who purchase a brand-new property will still be able to claim depreciation as they were previously. To learn more visit the BMT Tax Depreciation website or read BMT’s comprehensive White Paper.

To learn more about property depreciation, visit the residential property depreciation page on the BMT Tax Depreciation website. Alternatively, for obligation free advice contact the expert team at BMT on 1300 728 726.

Bradley Beer is the chief executive officer of BMT Tax Depreciation. Please contact 1300 728 726 or visit the BMT Tax Depreciation website for an Australia-wide service.

Article provided by BMT Tax Depreciation.

This is a sponsored article.

Read more from BMT Tax Depreciation:

The nine experts you should include on your property investment team

Depreciation is a cash cow for farmers

Create some extra splash this spring by claiming depreciation for your pool: BMT