Women ahead of men in home ownership

Contact

Women ahead of men in home ownership

Women are increasingly turning to property to provide financial security through different stages of their life.

Westpac's annual Home Ownership Report reveals that women are overtaking men when it comes to home ownership.

A survey of more than 1,000 Australian home owners and first-home buyers found that women are ahead of men in most categories:

- more women have bought a home to live in (women 28 per cent of survey respondents compared with men 20 per cent)

- more women have bought an investment property (16 per cent compared with men 13 per cent)

- more women are renovating (29 per cent compared with men 27 per cent)

- and more women are selling a property (17 per cent compared with men 14 per cent).

Source: Westpac Home Ownership Report.

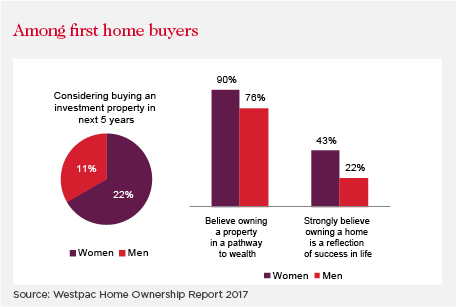

The report also found that more women than men 'strongly believe' that ‘owning your own home is a reflection of your success in life’ (up 26 per cent on last year) and that ‘property is a pathway to wealth’ (up 10 per cent on last year).

Female first-home buyers were twice as likely as men to consider good investment potential in a home as essential (35 per cent vs men 18 per cent), and were also twice as likely to consider buying an investment property in the next five years (22 per cent vs men 11 per cent).

Overall, 71 per cent of women are 'considering housing actions in the next five years', as opposed to 61 per cent of men.

Source: Westpac Home Ownership Report.

The report relays findings from a survey of more than 1,000 Australian home owners and first-home buyers.

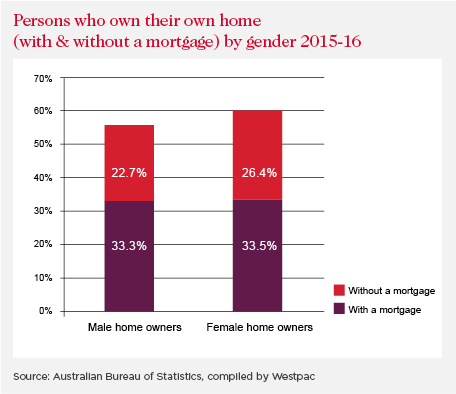

Westpac's findings support recent ABS data, which show that 60 per cent of women live in homes they own outright or have a mortgage on, compared with 56 per cent of men.

ATO data suggests that 47 per cent of all investment properties are owned by women

And data from the ATO shows the number of female taxpayers receiving rent has risen from just under 14 per cent in 2010-11 to 15.4 per cent in 2014-15. By comparison, over that period men only saw an increase from 14.7 per cent to 15.9 per cent. The ATO data indicates that approximately 47 per cent of all investment properties are owned by women.

Fewer first-home-owner women think buying a 'move-in ready' home is important, down 19 per cent on last year's result, while male first-home buyers are more likely to consider a 'move-in ready' home is essential.

ABS data also shows that more women (23 per cent) than men (20 per cent) own their homes outright.

Women have more to consider than men when it comes to securing their financial future

Head of women’s markets for Westpac Group, Felicity Duffy, said women have more to consider than men when it comes to securing their financial future.

“Women have a lot to take into consideration when it comes to looking after their finances throughout their lifetime. Whether it’s taking time out of the workforce to have children or care for elderly relatives, concerns about gender pay gap issues, or just living longer lives, all these things can impact a woman’s short term and long term financial security,” she said.

“It seems women are becoming savvier in the property market, and understand that home ownership can lead to greater financial security."

Read more about women and real estate:

Get to know Rita Galati, set to open her own office, Ray White Yarraville

Women In Strata, connecting women in strata management

Esti Cogger receives Crystal Vision award for women in construction