Tasmanian market going from strength to strength: REIT quarterly report

Contact

Tasmanian market going from strength to strength: REIT quarterly report

The REIT's September 2017 Quarterly Report confirms that the Tasmanian real estate market remains the fastest growing property market in Australia.

The REIT's September 2017 Quarterly Report confirms that the Tasmanian real estate market remains Australia’s fastest growing property market.

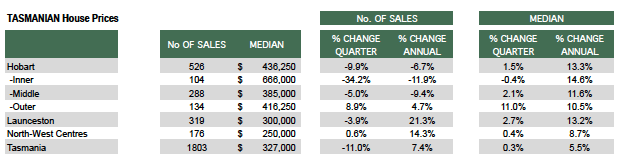

Most Hobart suburbs are at their highest median prices ever. Hobart's median house price is $436,250, up 1.5 per cent for the quarter, and 13.3 per cent for the year. House prices in inner Hobart grew even more strongly, with the median price up 14.6 per cent for the year to $666,000.

Launceston house prices grew just as strongly, gaining 13.2 per cent for the year, to a median price of $300,000.

Source: REIT September 2017 Quarterly Report.

Launceston's figures stands out among the state's phenomenal growth numbers. The city achieved 319 sales during the September quarter, up a spectacular 21.3 per cent on last year.

Hobart is beginning to see shortages of housing stock, which contributed to the number of sales in the city declining 6.7 per cent over the year to 526.

Robert Evans of LJ Hooker Bicheno said the market remains strong on the east coast. "I'm seeing a solid market," he told SCHWARTZWILLIAMS. What is on the market tends to sell."

"We've just been so busy," he said.

Evans said that properties on the market for less than $350,000 tend to sell quickly, while properties on the market for higher prices can take longer to find a buyer.

The ratio of Tasmanians to interstate and offshore buyers is around 70/30, he said.

"I think the market's going to remain strong," he said.

According to the REIT, if the market continues to perform at current levels in the final quarter, Tasmania will record the highest number of sales in a decade, and the highest ever accumulated market value of sales.

The apartment market

The number of unit sales in Tasmania were up a whopping 24.9 per cent compared with last year.

Hobart apartment sales rocketed 34.5 per cent higher, with 238 sales, and Launceston sales were up 25.9 per cent with 68 sales.

The median unit price across the state increased from $250,000 in 2016 to $277,750 in 2017.

Source: REIT September 2017 Quarterly Report.

Interstate buyers and investors

The REIT data confirms that the Tasmania’s market is not being driven by mainland investors. Tasmanians accounted for 76 per cent of transactions during the September quarter. Foreign investors accounted for only 1 per cent of sales during the quarter, with only 13 sales recorded. Mainlanders accounted for the remaining 23 per cent of sales, with 412 sales.

Investors only accounted for 362 sales, or 20 per cent of sales during the September quarter.

First home buyers who accounted for 220 sales at a median price of $275,000, and remained steady at 13 per cent. Retirees accounted for 3 per cent of sales over the quarter, and developers accounted for 1 per cent of sales.

Click here to view key data and purchase the REIT's September Quarter 2017 report.

The rental market

The rental market continues to tighten. Vacancy rates are falling. In Hobart, vacancy rates are at historic lows at below 2 per cent, and rents have increased approximately 12 per cent in the last year from an average of $330 for a three-bedroom house in 2016 to $370 in 2017.

REIT President, Tony Collidge said Tasmania’s real estate and rental markets continue are being driven by "favourable economic conditions, a robust tourism market, and consumer optimism".

"It is encouraging to see strong improvement in sales activity in the North and North-West markets.

Of concern is our ability, particularly in Hobart to continue to meet the demands of such growth. I envisage the shortage of rental properties and properties for sale will see demand continue to push rents and prices higher," he said.

"Unless we can find a way to fill the gap between demand and supply, prices will continue their upward movement for some time to come," he said.

Collidge said that Tasmania remains Australia's most affordable state, but its prices have risen in line with the mainland capitals.

Read more about Tasmanian real estate:

Hobart property market has "changed forever": Jim Playsted, Knight Frank