Melbourne property market continues to streak ahead of Sydney's

Contact

Melbourne property market continues to streak ahead of Sydney's

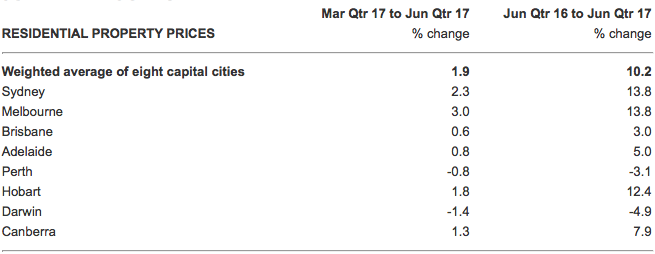

New ABS data shows Melbourne property prices rose 3.0 per cent during the June quarter, compared with 2.3 per cent for Sydney.

Melbourne's real estate prices are still streaking ahead of Sydney's, with the latest data from the Australian Bureau of Statistics confirming the moves, and Reserve Bank board minutes also noting the trend.

Melbourne property prices rose 3.0 per cent during the June quarter, according to yesterday's ABS data, compared with 2.3 per cent for Sydney.

Related content: Why is Melbourne's property market outpacing Sydney's?

Overall, Australian home prices rose 1.9 per cent during the quarter, to stand 10.2 per cent higher for the year.

For the year, Sydney and Melbourne prices were both up 13.8 per cent.

Source: ABS.

Another standout performer was Hobart, where prices rose 12.4 per cent for the year to June.

Property prices eased in Perth and Darwin.

Sydney new homes the lowest in three years

As of June 2017, the ABS said there were 9,906,100 homes in Australia, 40,000 more than there were at the end of March.

A total of 11,200 homes were added in Victoria during the June quarter.

But NSW added only 7,700 new home during the quarter, the lowest quarterly gain in three years, according to Craig James, chief economist of CommSec.

"The latest data suggests housing undersupply is still more of a risk in Sydney and Melbourne markets than over-supply," said James.

Strong housing market means Australians are wealthier than ever

With 9.9 million homes in Australia as of the end of June, and with home values rising overall by 10.4 per cent, "the average homeowner has seen a near $52,000 increase in the value of their homes over the past year," said James.

"Australians have never been wealthier," he said.

The median price of houses sold in Sydney during the June quarter was $1.02 million, $110,000 more than a year ago.

The median price Melbourne houses was $713,000, up $87,000 on the year.

Reserve Bank board minutes reflect the view the Sydney market is cooling

The Reserve Bank yesterday released the minutes from its recent monetary policy meeting, when it decided to leave the cash rate on hold.

The minutes noted the economy is gaining strength, and noted clear signs of a slowdown in the Sydney housing market, but said it is less clear if the market is slowing in Melbourne.

Read the minutes from the 5 September Reserve Bank Board meeting in full.

"In the established housing market, a number of indicators suggested that conditions had eased in Sydney, but to a lesser extent in Melbourne. Housing price growth had slowed over 2017 in Sydney, but had remained strong in Melbourne.

"A similar pattern was evident in auction clearance rates, which had declined by more in Sydney than in Melbourne. Auction volumes had also remained relatively low in Sydney.

Rent increases had remained low in most cities and rents had continued to decline in Perth."

The minutes said "building approvals had stepped down and the pipeline of residential construction work appeared to have passed its peak".

Fewer people in each home

The number of people per home in Australia fell from 2.483 to 2.481 over the June quarter, according to CommSec estimates.

Read the minutes from the 5 September Reserve Bank Board meeting.

Read more about property prices around Australia:

Why is Melbourne's property market outpacing Sydney's?

Hobart vacancy rates at record low: SQM Research

Australia ranks 11th on Knight Frank's Global House Price Index