Sydney market headed for "a few years of flat capital growth": REINSW

Contact

Sydney market headed for "a few years of flat capital growth": REINSW

Buyers and sellers in the Sydney real estate market should expect a strong spring, but then a few years of flat capital growth, says John Cunningham, president of the REINSW.

Buyers and sellers in the Sydney real estate market should expect a strong spring, but then a few years of flat capital growth, John Cunningham, president of the REINSW, told SCHWARTZWILLIAMS.

Despite media reports the market has turned, said Cunningham, it remains "business as usual for agents across Sydney".

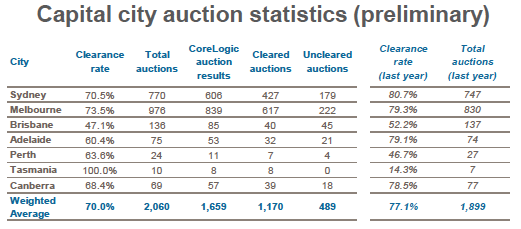

Sydney's preliminary clearance rate was 70.5 per cent on the weekend, according to CoreLogic.

Source: CoreLogic.

Volumes are up across most markets and strong sales are happening before, at, and soon after auction, said Cunningham, adding that "many agencies are selling more property than during the boom years".

But Cunningham said "the market peaked in April and has subsequently stabilized with minimal adjustment."

Buyers and sellers should expect a buoyant and very active spring season "and then a few years ahead of almost flat capital growth."

"This is essential to correct affordability issues," said Cunningham, adding that Sydneysiders should sell before they buy to keep the supply of established homes flowing onto the market

Chris Wilkins, agent with Ray White Drummoyne, agrees that we are entering a period a flat capital growth.

"Buyers have been running so hard, and at some time you've got to catch your breath," he told SCHWARTZWILLIAMS.

"Our open home numbers are drastically down. Our interest, emails, calls, are drastically down," he said.

Wilkins said he has a property on the market that in peak market days would have attracted 40 interested parties, but on the weekend only drew nine viewers.

Joe Campisi, agent with Devine Real Estate, said he is still achieving strong sales for exclusive properties. On the weekend he sold a deceased estate, four-bedroom house on a 1,416sqm block at 73 Newton Road, Strathfield, for $5.5 million.

But in general, Compisi said there were clear signs the market is slowing. "We're noticing that demand is dropping off at some open homes and there's not as much interest as six to eight months ago," he sold SCHWARTZWILLIAMS.

Daniel Gillespie, agent with Belle Property Bondi Junction, told SCHWARTZWILLIAMS flat capital growth for the next few years "seems to be the cycle".

"Demand is still good, but buyers aren't prepared to pay the big prices," he said.

Related content: Twenty per cent of Newcastle sales from Sydney buyers: PRDnationwide

Melbourne

REIV president Joseph Walton told SCHWARTZWILLIAMS, "we’ve seen one of the quietest starts to spring in recent years."

REIV data shows 745 auctions were held in Melbourne on the weekend, with a preliminary clearance rate of 73 per cent. Both figures were down on the same period last year, when 779 homes went to auction and 77 per cent sold.

“While , auction activity is set to increase in the coming weeks with several Super Saturday weekends scheduled.”

“Regional Victoria recorded solid results under the hammer this weekend, with Greater Geelong selling 21 of its 23 auction listings.”

Related content: Selling up in Melbourne to be mortgage free in Geelong

Adelaide

Alex Ouwens, president of the REISA, told SCHWARTZWILLIAMS the top end of the Adelaide market is performing strongly.

"The middle to upper end (of the) auction market is getting stronger in the inner metro areas," he said.

While the clearance rate of 62 per cent was "slightly lower than expected", but "the middle to upper-end market is responding well to the auction environment," he said.

Ouwens is predicting the Adelaide market will pick up after the AFL finals.

"With both Adelaide teams in the finals and a wet September predicted, agents are bracing for a strong run home post the October long weekend," he said.

Related content: Malvern, Adelaide, popular with buyers, says agent Bonnie Whyte of klemich

Read more about the real estate markets of our major capital cities:

Selling up in Melbourne to be mortgage free in Geelong

Why is Melbourne's property market outpacing Sydney's?

Weekend auctions litmus test of new first-home-buyer benefits