These missed deductions add up

Contact

These missed deductions add up

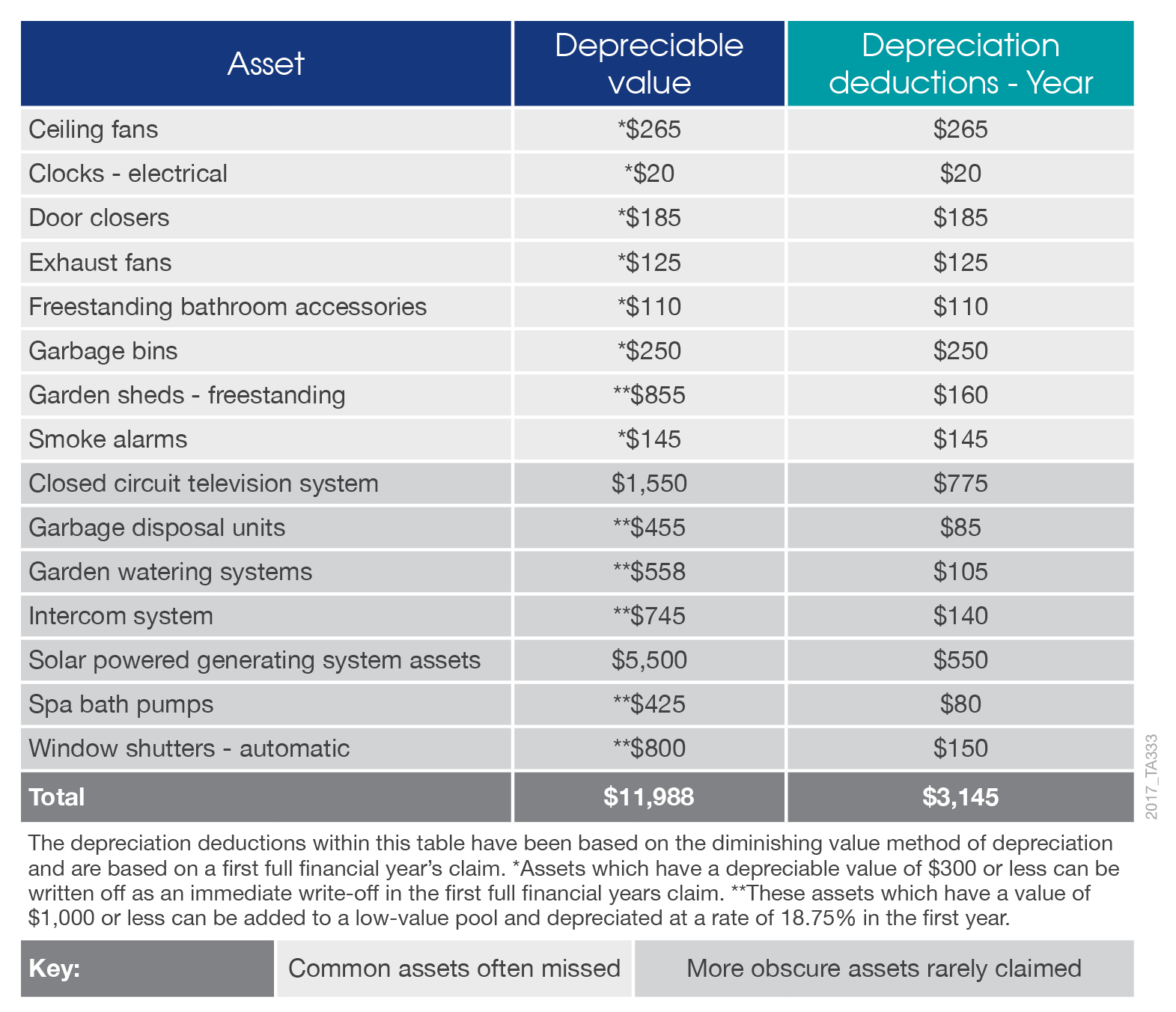

BMT has created a list of assets that property investors commonly overlook when claiming depreciation, including garden sheds, exhaust fans, garden watering systems, garbage bins, intercom systems, door closers, and shower curtains.

Exhaust fans, garden watering systems, garbage bins and intercom systems are all assets commonly missed by property investors when claiming depreciation.

These and other assets such as door closers, shower curtains and closed circuit television systems are part of a list of the most commonly overlooked assets which BMT has created to help investors avoid missing out on valuable deductions.

Although many of these items have a low depreciable value - as shown in the table below - the depreciation deductions that can be claimed for these items can add up to thousands of dollars for an investor and should not be overlooked.

Source: BMT Tax Depreciation.

Therefore, in order to maximise deductions, it’s important that these easily missed items are included in a depreciation schedule.

So how can investors ensure no item is missed in order to maximise deductions?

Firstly, take note of the assets listed in the above table. If you have a depreciation schedule and you own any of these assets, confirm with your Accountant that they are included in your schedule and your depreciation claim. If items have been missed, however, the Australian Taxation Office will allow you to go back and amend the previous two years of missed deductions. Then ensure these assets are included in your schedule for future year’s claims.

If you don’t have a depreciation schedule you should talk to a specialist Quantity Surveyor as soon as possible in order to maximise deductions. Ensure your Quantity Surveyor can outline the deductions available for assets which are eligible* to be written off immediately or added to the low-value pool. This may include some of the assets listed above in addition to more obvious assets.

* Under proposed changes outlined in draft legislation (section 2 of Treasury Laws Amendment Bill 2017), investors who exchange contracts on a second hand residential property after 7:30pm on 9th May 2017 will no longer be able to claim depreciation on plant and equipment assets. Investors who purchased prior to this date and those who purchase a brand new property will still be able to claim depreciation as they were previously. BMT Tax Depreciation will be making an official submission outlining our concerns along with suggestions of alternative methods to better resolve the Government’s integrity issue. To learn more visit www.bmtqs.com.au/budget-2017.

This is a sponsored article.

Read more about real estate tax deductions:

The dangers of 'DIY' depreciation this tax time