HILDA report puts declining rates of home ownership for young Australians in clear view

Contact

HILDA report puts declining rates of home ownership for young Australians in clear view

The 2017 HILDA report reveals income stagnation in Australia, and declining rates of home ownership for young Australians.

The 2017 HILDA report, which has examined economic and social data from 17,000 people since 2001, shows persistent and alarming income stagnation, and declining rates of home ownership for young Australians.

The Melbourne Institute's Household, Income and Labour Dynamics in Australia report highlights the decline in the rate of home ownership for young adults in Australia.

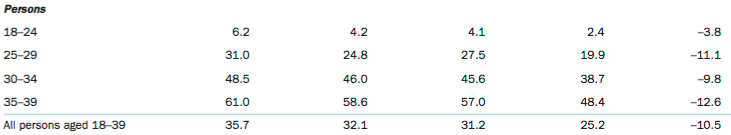

Home ownership for those aged under-40 has plunged from 36 per cent to 25 per cent since 2002.

The situation is worst in the nation's most expensive property market, where less than 20 per cent of young people own a home.

Home-ownership rates by by age group, 2002 to 2014 (%)

Source: HILDA report.

As a consequence, young adults are living at home with their parents for longer.

In 2015, 60 per cent of men aged 22-25 and nearly half of women that age were living with their parents, up from 43 per cent and 27 per cent respectively in 2001.

The proportion of people living in multiple-family homes rose by 1.5 percentage points to 4.0 per cent of people in 2015, compared with the rates at the beginning of the 15-year period.

The report also showed the slowdown in growth in disposable income, particularly between 2009 and 2015 when median household income fell slightly, and the mean grew by only $2,296. Both the mean and median fell in real terms between 2014 and 2015.

The declining rates of home ownership are a concern, Patrick Nolan, ME’s Head of Home Loans, told SCHWARTZWILLIAMS.

“There are a number of benefits in owning your own home," he said, in particular, owning your home is the key to accumulating wealth over the course of your life.

"But it’s not the end of the world if you chose not to," he said. "The unfortunate reality is it’s harder than ever before for young first home buyers. There are a number of alternative options in building wealth, such as buying shares or buying in a less expensive area."

Nolan advised young Australian still hoping to buy a home to start saving for a deposit, and to adopt a consistent saving strategy from early on.

In a bid to improve housing affordability in Western Australia, Hayden Groves, president of the REIWA, is calling on the state government reintroduce a $3,000 first-home owners grant for purchases of established homes, and not just limit incentives to new builds.

Read the HILDA report in full here.

Read more about housing affordability:

First-home buyers remain out in the cold, despite affordability improvements