CoreLogic numbers dispel smashed avo theory

Contact

CoreLogic numbers dispel smashed avo theory

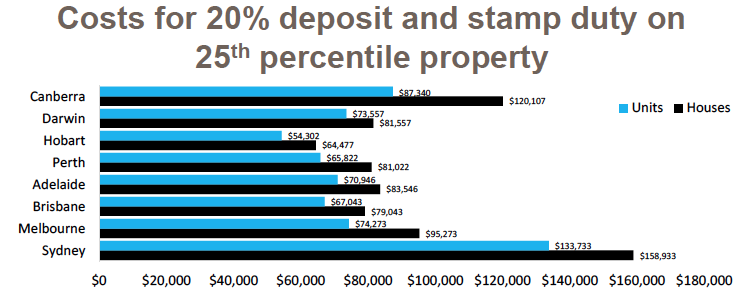

The 20% deposit and stamp duty required to buy a house in Sydney is $158,933, based on new CoreLogic data. That's equivalent to 20 years' worth of smashed avo.

The 20 per cent deposit and stamp duty required to buy a house in Sydney is $158,933, according to new data from CoreLogic. That's the equivalent of 7,224 serves of $22 avocado on toast - or avocado on toast every day for 20 years.

Even in the nation's most affordable city, Hobart, buyers must accumulate $64,477 for the deposit on a house and to cover stamp duty. That's 2,930 serves of your favourite brekkie - or avo on toast every day for eight years.

Source: CoreLogic.

The numbers put Bernard Salt's jocular observation of young adults wasting money on smashed avo into perspective: even if young Australian do give up extravagant brunches and put the funds towards saving for a house, it will take years, even decades, to accumulate enough cash for the deposit and stamp duty on a home.

Core Logic has used house and apartment prices in the 25th percentile to compile the data, considering that first-home buyers are generally purchasing at the more affordable end of the property spectrum.

Cameron Kusher, research analyst with CoreLogic, said the research does not factor in stamp duty exemptions below a certain price threshold in some states.

Kusher also said it's not always necessary to have the whole 20 per cent deposit, although a lesser deposit will usually mean that required lenders mortgage insurance, which is an additional cost for the home buyer.

In a paper on the research, Kusher said housing affordability is worsening as property prices soar higher as wages growth stagnates.

In the 12 months to April 2017, Sydney dwelling values increased by 16.0 per cent, and Melbourne values rose 15.3 per cent. Yet household incomes in Sydney only rose 4.6 per cent in the year to March 2017, while household incomes rose a mere 2.7 per cent in Melbourne, according to data from the Australian National University

"Entry into the housing market remains a real challenge," said Kusher.

"Even in cheaper areas, household income growth is fairly slow which makes saving a deposit difficult," he said.

“It is unclear as to how, absent a big fall in property prices, housing affordability for first home buyers can be greatly improved," he said.

So eat your smashed avo and enjoy it; scrimping on brunch isn't going to be enough to buy you a property in the current market.

Read more about housing affordability and smashed avocado on toast:

Rich-list developer Tim Gurner enters smashed avo debate

Ray White highlights Brisbane's affordability with smashed avo offer

Smashed avocado on toast is the reason I can’t afford a home, according to Bernard Salt