Depreciation is a cash cow for farmers

Contact

Depreciation is a cash cow for farmers

Could you claim $149,187 from your rural property? Bradley Beer, CEO of BMT Tax Depreciation, shows how.

The most recent Commonwealth Bank Agri Insights Report suggests that investment in Australian rural properties remains strong.

The report revealed that investment intentions have strengthened among cotton, beef, lamb, summer grain and wool producers, while horticultural investment intentions are at their highest level to date.

Adding to the expected increase in production, the report projects that a significant proportion of farmers intend to spend more money on items used on their properties. 25 per cent of those surveyed nationally plan to purchase plant and equipment items, while 38 per cent planned to spend on fixed infrastructure.

While BMT Tax Depreciation experienced substantial growth in the number of depreciation schedules requested by agricultural property owners over the past two financial years (a 36 per cent increase during 2014-2015 and a 51 per cent increase during 2015-2016), many farmers are still failing to consult with a specialist Quantity Surveyor to ensure their claims are maximised.

Given that farmers can experience times of financial hardship (particularly during droughts, floods or fluctuations in the price of goods being sold) the additional cash flow that depreciation claims can deliver to rural property owners is often vital.

To demonstrate the difference that depreciation claims can make for farmers, we looked at how BMT helped the owner of one dairy farm.

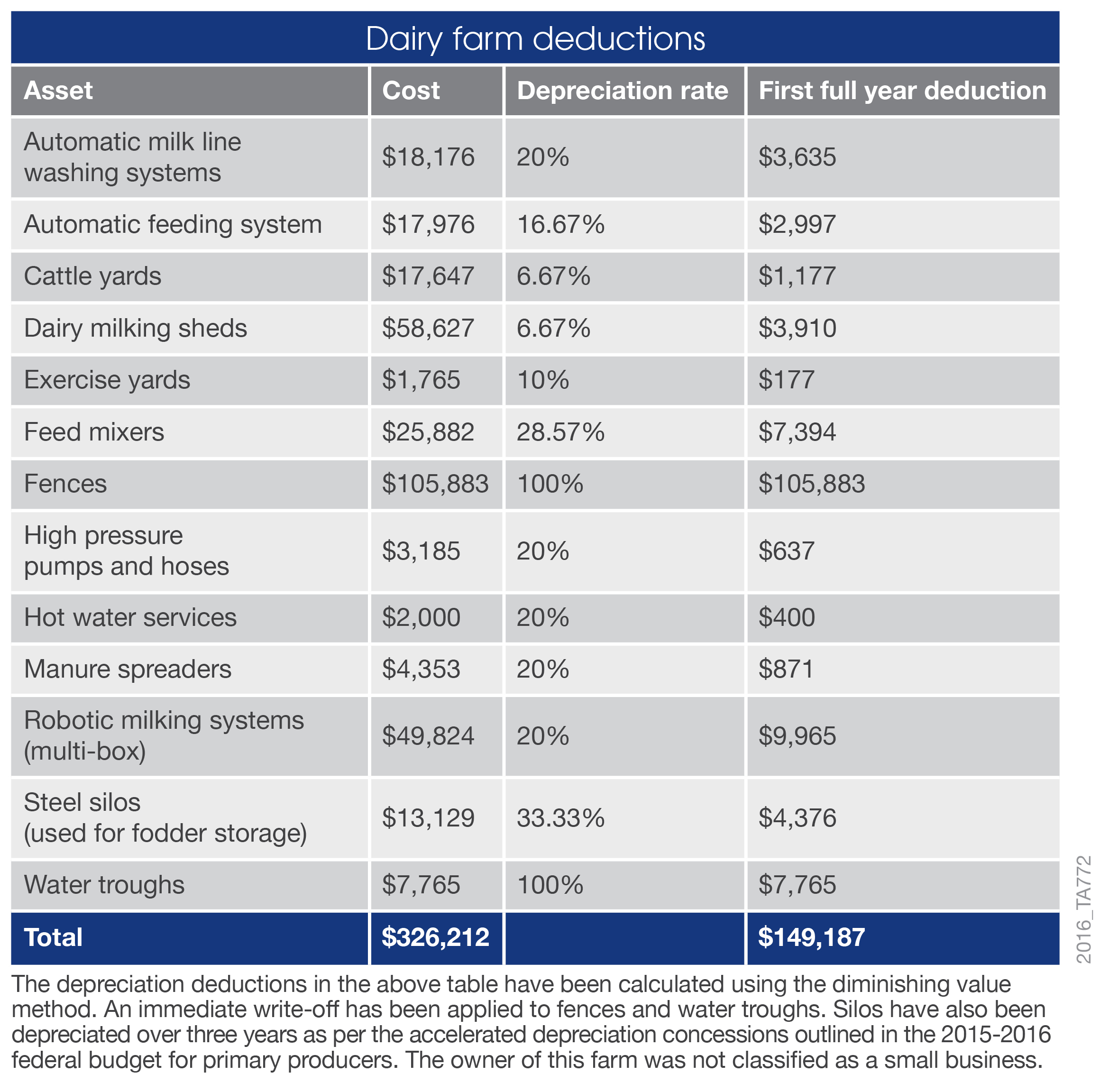

The farmer purchased a property for $1.75 million and on settlement they requested a depreciation schedule. A detailed site inspection completed by our expert team discovered they could claim deductions for the assets outlined in the table. The table also shows the first full financial year deductions the dairy farmer could claim.

In the first full financial year alone, BMT found $149,187 in depreciation deductions for the assets listed.

The dairy farm owner is also entitled to claim additional capital works deductions for the barn and a homestead.

In total, the owner of a typical dairy farm with these assets and structures could expect to claim between $850,000 and $1.1 million over the life of the property.

Incentives outlined in the 2015 budget for primary producers mean that farmers are entitled to write-off a number of assets immediately. This includes fences, dams, tanks and irrigation channels. However, the Australian Taxation Office does stipulate additional rules if owners are depreciating second-hand assets.

It is therefore essential to seek expert advice and to obtain a comprehensive depreciation schedule to ensure deductions are correct and maximised based on the individual circumstances and requirements of the property owner.

To learn more visit the commercial property depreciation page on the BMT Tax Depreciation website or speak with one of BMT’s expert staff on 1300 728 726 today.

Click here to read the original article published by BMT Tax Depreciation.

This article was written by Bradley Beer (B. Con. Mgt, AAIQS, MRICS, AVAA), Chief Executive Officer of BMT Tax Depreciation. Bradley joined BMT in 1998. He has substantial knowledge about property investment supported by expertise in property depreciation and the construction industry. Bradley is a regular keynote speaker and presenter covering depreciation services on television, radio, at conferences and exhibitions Australia-wide.

This is a sponsored article.

Read more from BMT Tax Depreciation:

The deductions property investors often throw away