Make it easier for pensioners to downsize, says Property Council

Contact

Make it easier for pensioners to downsize, says Property Council

Reducing transaction costs for the elderly could add 50,000 properties to the market and improve overall housing affordability, says Ken Morrison, chief executive of the Property Council.

Help pensioners over the age of 75 to downsize, and you could potentially add 50,000 family residences onto the market, taking some pressure off housing prices, says Ken Morrison, chief executive of the Property Council of Australia.

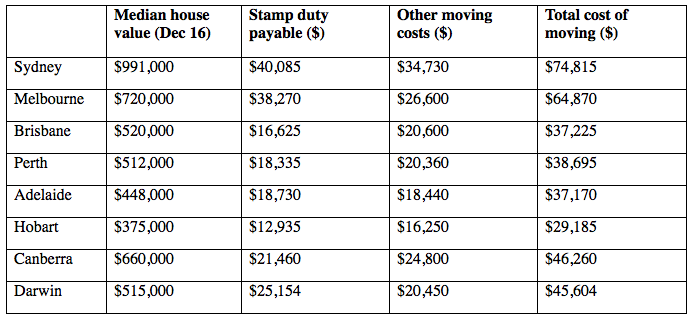

New research from the Property Council shows that Australians are paying tens of thousands of dollars when buying a property and moving, costs that are compounding the nation's housing affordability problems.

“The biggest cost of moving is stamp duty which you have to pay if you are upsizing or downsizing," said Ken Morrison, chief executive of the Property Council of Australia.

Add in the costs of removalists, conveyancing fees, bank fees, and real estate commissions, and the cost of moving is substantial, preventing people from moving at all, says Morrison.

Source: The Property Council of Australia.

“With the transaction costs of selling being more than $74,000 in Sydney and $64,000 in Melbourne, we can assume there are tens of thousands of family homes not in the market simply because of the transaction costs," said Morrison.

Morrison used stamp duty as an example.

“In NSW, for example, stamp duty has doubled in just six years from $20,000 for the average property, to $40,000," said Morrison, adding that other states are seeing similar changes.

"If the state governments are serious about housing affordability they can start with stamp duty as well as reform planning systems," said Morrison.

“In our major cities, we have tens of thousands of older couples who see no financial reason to downsize. In so many of these properties, instead of a family occupying a three or four-bedroom residence, it is just one or two people," he said.

“Our proposal to help pensioners over the age of 75 to downsize could potentially bring up to 50,000 family residences into the market, which would help take pressure off housing prices," said Morrison.

Research undertaken for the Property Council by Deloitte Access Economics has found that Australia would witness an additional 340,000 property transactions a year without stamp duty.

“We know state budgets cannot afford such a step but it does highlight how stamp duties and other fees inhibit the efficient use of housing," said Morrison.

Australians currently hold their property for an average of 13 years, but the removal of the stamp duty arrangements would see that fall to 8 years.

See also:

Help older Australians sell property, says REINSW