Ray White Property outlook report for 2025

Contact

Ray White Property outlook report for 2025

As we head into 2025, Nerida Conisbee and Atom Go Tian The Ray White economics team have identified their top predictions for 2025 across Australia's residential property market.

As we head into 2025, the Australian property market continues to evolve. From shifting market dynamics to emerging regional hotspots, next year presents both exciting opportunities and complex challenges for property owners, investors, and industry participants alike.

The Ray White economics team have identified their top predictions for 2025 across Australia's residential property market.

Prediction 1: Rate cuts in 2025

Prediction 2: House price rises to continue but slowing

Prediction 3: Shake up in luxury markets

Prediction 4: Emergence of the Golden Arc

Prediction 5: Regional Australia’s $1 million club

Read more about their predictions for 2025 below.

Prediction 1: Rate cuts in 2025

By Nerida Conisbee, Ray White, Chief Economist

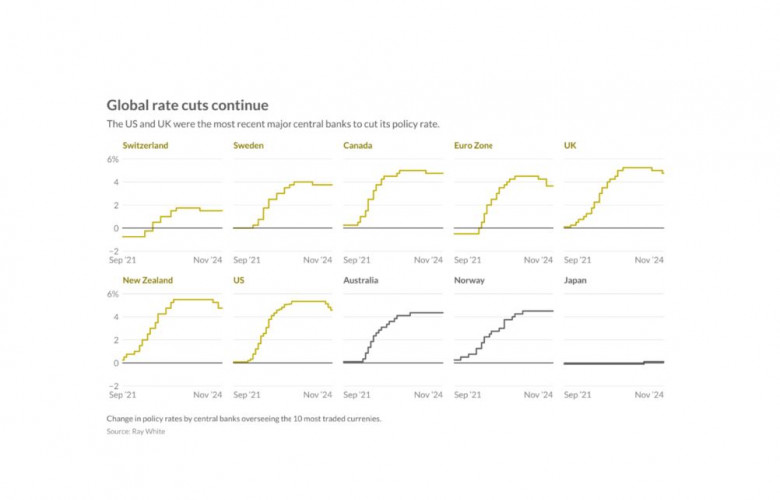

Interest rates in Australia have stayed high through 2024 even though other countries have started cutting theirs. This is mainly because Australia's economy has held up quite well - we're not in a recession and plenty of people still have jobs. However, many households are feeling the strain of high living costs.

Looking ahead to 2025, financial markets think the Reserve Bank of Australia (RBA) will cut interest rates twice in the second half of the year. But this prediction could change depending on how things play out.

Several factors will influence when and how much the RBA cuts rates.

The most important is inflation. While it's now back within the RBA's target range, there are risks it could rise again. One big unknown is what happens in the United States. With Donald Trump winning the presidential election, this will boost government spending and put high taxes on Chinese goods. This could push up prices worldwide, including in Australia, making it harder for the RBA to cut rates.

The health of Australia's economy is another key factor. If people start spending less in shops, house prices fall significantly, or unemployment begins to rise, the RBA might need to cut rates sooner than planned. They'll be watching these signs closely throughout the year.

But if the economy keeps doing well and inflation stays under control, the RBA will probably stick to its careful approach. This means making small, well-spaced cuts rather than rushing to lower rates quickly.

The rising cost of living is putting pressure on the RBA to provide some relief to households through lower rates. However, they'll want to be sure that cutting rates won't cause inflation to pick up again. They'll need to balance helping struggling households against keeping inflation under control.

In summary, while rate cuts are likely in 2025, their timing and size will depend on how inflation behaves, what happens in the global economy (especially in the US), and how well the Australian economy holds up through the year.

Prediction 2: House price rises to continue but slowing

By Nerida Conisbee, Ray White, Chief Economist

The Australian housing market is showing signs of cooling as we move into 2025, though the picture varies significantly across different cities. While Perth, south east Queensland, and Adelaide continue to show strength, the larger markets of Sydney and Melbourne have slowed considerably, with prices nearly flat. Hobart and Canberra are also seeing minimal growth.

This pattern is likely to continue in early 2025, driven by several factors. More homeowners are feeling the strain of high mortgage payments, and we're seeing an increase in property listings as some decide to sell. This higher supply of homes for sale could put downward pressure on prices in some areas.

However, there are three key factors that should help prevent any significant drop in house prices.

First, Australia's strong population growth continues to create ongoing housing demand. This creates a natural floor for how far prices might fall. This is particularly true in Perth and Brisbane where growth remains very strong, but is also the case in Melbourne and Sydney where international migration will remain strong, although potentially at lower levels compared to 2024.

Second, building costs remain high. The cost of constructing new homes hasn't come down, which means fewer new houses are being built. This pushes more buyers toward existing homes, helping support prices in established suburbs. The lack of new supply also means any excess demand can't be easily met with new housing.

Third, expected interest rate cuts later in 2025 could give the market a boost, particularly in more expensive cities like Sydney and Melbourne. These markets are more sensitive to interest rate changes because of their higher average mortgage sizes. When rates do start to fall, this could encourage more buyers back into the market and increase borrowing capacity.

The outlook suggests a period of modest price growth or stability rather than significant falls. Markets that have already slowed, like Sydney and Melbourne, might stay flat until rate cuts begin. Meanwhile, cities with stronger economic conditions like Perth could continue to see some growth, though likely at a slower pace than in 2024. The key timing to watch will be when interest rates start to fall, as this could mark a turning point for price growth in the larger markets.

Prediction 3: Shake up in luxury markets

By Atom Go Tian, Ray White, Senior Data Analyst

The pecking order of Australia's premium property markets is experiencing its most dramatic realignment in years, with traditional hierarchies being challenged and new players climbing to the fore. In this context, we refer to luxury houses as houses priced in the top five per cent of the house market in each region.

At the top of the market, Sydney maintains its long-held position as Australia's most expensive luxury housing market, though the story is far from dynamic. Despite experiencing one of the slowest growth rates in recent years, the top five per cent of Sydney house prices now exceeds $4 million, creating a substantial lead over other markets that appears unassailable in the near term.

Perhaps the most compelling development is occurring in regional Queensland's coastal markets, particularly in comparison to Melbourne's modest performance. The Gold Coast, with an impressive 50 per cent growth over five years, has finally achieved what many predicted: overtaking Melbourne as the second most expensive luxury market. With the top five per cent of Gold Coast houses now priced at $2.54 million compared to Melbourne's $2.51 million, the shift represents a significant change in the market hierarchy.

The Sunshine Coast appears set to follow suit, boasting a robust 48.73 per cent five-year growth rate and current top five per cent house price of $2.37 million. Given Melbourne's sluggish 9.75 per cent five-year growth rate, the Sunshine Coast is projected to join Sydney and the Gold Coast in the top three within the next 12 months.

The third notable shakeup involves the remarkable ascent of Brisbane, Perth, and Adelaide compared to Canberra's simultaneous decline. Both Brisbane and Perth have now surpassed the $2 million mark for houses in the top five per cent, driven by impressive five-year growth rates of 55 and 53 per cent respectively.

Canberra, once a strong performer, has plummeted from fourth to seventh place in just five years, with the top five per cent of house prices stagnating at $1.95 million. Adelaide, despite currently sitting at $1.8 million, shows the strongest momentum of all capitals with a 56 per cent five-year growth rate, suggesting it may soon push Canberra to eighth place.

Looking ahead, the market appears to be trending toward a new baseline, with all major cities except Darwin expected to reach or exceed the $2 million mark for luxury properties.

Prediction 4: Emergence of the Golden Arc

By Atom Go Tian, Ray White, Senior Data Analyst

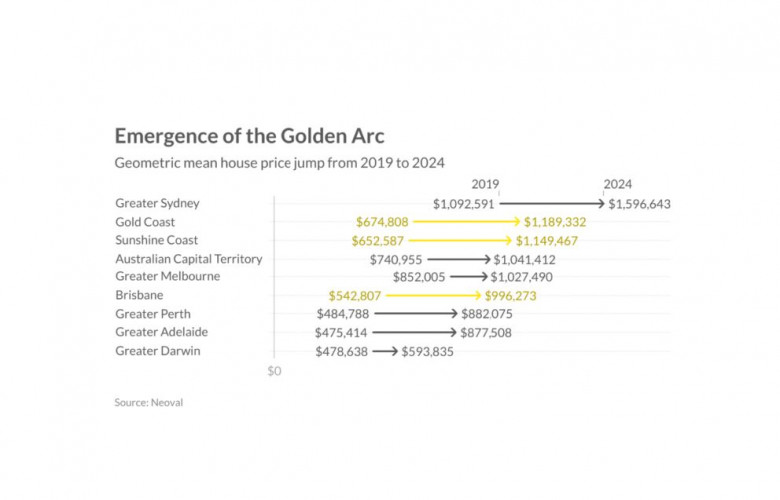

The Australian housing market is witnessing a fundamental restructuring, characterised by the emergence of distinct price bands and the formation of what could be termed the "Golden Arc."

Just as with the luxury house market, Sydney continues its solitary ascent with a geometric mean house price of $1.59 million. Sydney's divergence from other markets has intensified, with the price gap to Melbourne expanding from 30 per cent in 2014 to 55 per cent in 2024. This widening chasm indicates a "two-speed" market, where Sydney operates under distinct market dynamics from the rest of the country.

Meanwhile, Queensland's coastal markets have been experiencing remarkable growth to converge right behind Sydney. The Gold Coast and Sunshine Coast have established themselves as Australia's second and third most expensive housing markets, with remarkably similar geometric mean house prices of $1.18 million and $1.14 million respectively. Both regions have also witnessed an identical 76 per cent increase in prices over the past five years.

Notably, the Gold Coast overtook Melbourne in 2022, followed by the Sunshine Coast surpassing Melbourne in 2023. Brisbane, while still more affordable at a geometric mean house price of $996,000, is also showing signs of joining its coastal counterparts to complete the Golden Arc. The city has the second-highest five-year growth rate of 83.5 per cent, trailing only Adelaide.

In contrast to the upward trajectory of the Golden Arc, Melbourne's housing market has seen a significant decline. Once the second most expensive market in the country, Melbourne now sits in fourth, with a geometric mean house price of $1.02 million. Over the past five years, Melbourne's price growth has been the slowest among major cities, at just 20.6 per cent. Given these trends, it seems unlikely that Melbourne will return to the top three markets anytime soon.

Instead, Melbourne’s stagnation paves the way for a potential shift in the mid-market, with Perth ($882,000) and Adelaide ($877,000) now within a 17 per cent price range of Melbourne. Five years ago, these markets were spread across an 80 per cent price range. This compression suggests that Perth and Adelaide may soon overtake Melbourne in terms of house prices, further contributing to the formation of a distinct mid-market cluster between $850,000 and $1 million.

In summary, we can expect several key developments. Perth and Adelaide may surpass Melbourne in price, reinforcing the shift in the mid-market cluster. The Golden Arc is likely to emerge with Brisbane joining the Gold Coast and Sunshine Coast as premium markets. Finally, Sydney's isolation at the top is expected to widen, further emphasising the "two-speed" nature of the market.

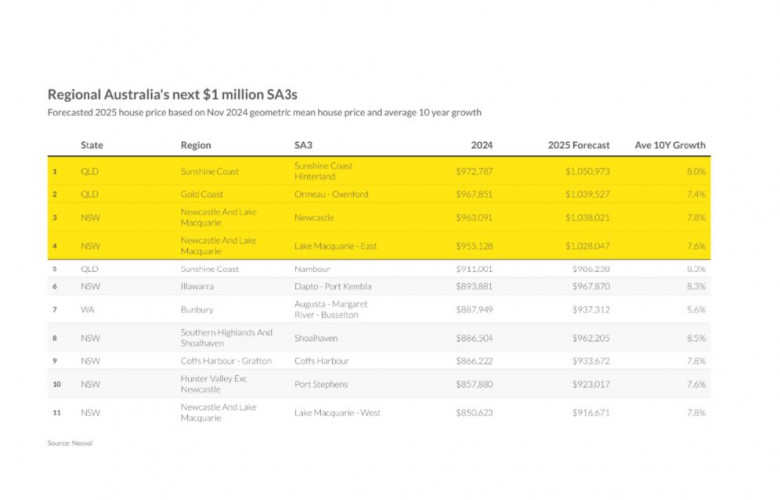

Prediction 5: Regional Australia’s $1 million club

By Atom Go Tian, Ray White, Senior Data Analyst

Regional Australia's million-dollar club has undergone a dramatic expansion, growing from just two areas five years ago to encompass 20 locations today. Leading this prestigious group is the Gold Coast's Surfers Paradise, where the geometric mean house price has reached an impressive $1.9 million, positioning it as the likely first regional area to breach the $2 million threshold. The Gold Coast's dominance is further reinforced by Broadbeach-Burleigh, which follows at $1.8 million, while the Sunshine Coast's Noosa rounds out the top three with properties averaging $1.5 million.

The concentration of $1 million areas in Queensland's coastal regions is unsurprising, with the Gold Coast and Sunshine Coast collectively accounting for 14 of the 20 million-dollar areas. New South Wales contributes five locations to this exclusive group—Wollongong, Coastal Richmond Valley, Southern Highlands, Tweed Valley, and Kiama-Shellharbour—while Victoria's sole representative is the Surf Coast-Bellarine Peninsula in the Geelong region.

Looking ahead, four additional areas are poised to join this prestigious group within the next 12 months. The Sunshine Coast Hinterland, currently at $972,787, is projected to reach $1.05 million, supported by an impressive eight per cent average annual growth over the past decade. Both Ormeau-Oxenford in the Gold Coast and Newcastle in regional New South Wales, currently hovering around $960,000, are expected to reach $1.03 million, driven by consistent seven per cent annual growth rates.

Lake Macquarie-East completes this emerging group, with current house prices of $955,128 expected to rise to $1.02 million in the coming year.

Beyond these imminent additions, seven more areas warrant attention, with current valuations ranging from $850,000 to $910,000 and decade-long growth rates between five per cent and eight per cent. While these markets may not reach the million-dollar threshold in the next 12 months, they show strong potential for inclusion within 24-36 months. Notably, Augusta-Margaret River-Busselton in Western Australia's Bunbury region stands poised to become WA's inaugural entry into the regional million-dollar club.

In contrast, Queensland continues to strengthen its position with emerging prospects in both the Gold Coast and Sunshine Coast regions, while New South Wales demonstrates the most diverse regional spread, with million-dollar areas distributed across six distinct regions.

Coastal areas feature prominently throughout this list, confirming the premium that buyers place on waterfront and seaside locations. Additionally, many of these high-value regions are satellite cities or areas within commuting distance of major metropolitan centres, suggesting that accessibility to urban amenities remains a key driver of property values. This combination of lifestyle appeal and practical connectivity appears to be a winning formula for regional property market success.