Improvement in auction preliminary clearance rate over first week of July

Contact

Improvement in auction preliminary clearance rate over first week of July

By Caitlin Fono, Research Analyst, CoreLogic Australia.

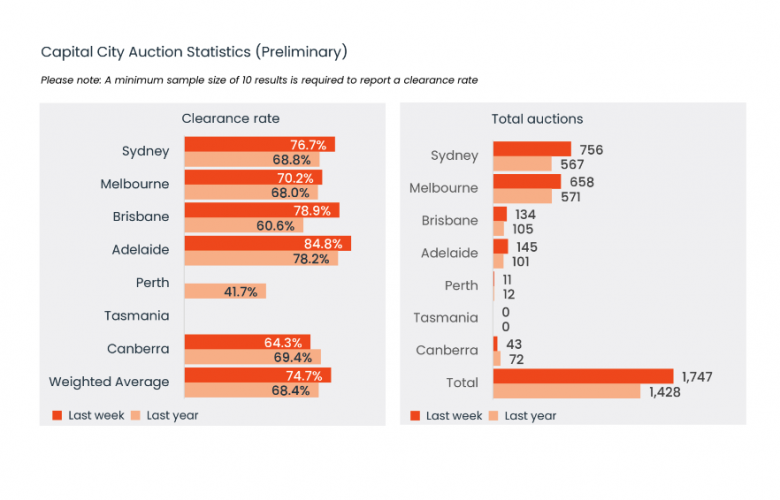

The preliminary auction clearance rate stepped higher last week, rising to 74.7%, the highest early result since the first week of April (75.9%).

Both of the major auction markets recorded a rise in the preliminary clearance rate.

In Sydney, 76.7% of auctions have returned a successful result so far, up 4.7 percentage points from the prior week and the strongest early result since the first week of May (78.1%).

Melbourne’s preliminary clearance rate came in at 70.2% last week, up 2.0 percentage points from the previous week (68.2%) and roughly in line with the average preliminary clearance rate through the year to-date.

Across the smaller auction markets, the preliminary clearance rate was led by Adelaide at 84.8%, followed closely by Brisbane at 78.9%.

Canberra was the only capital city auction market to record a drop in the preliminary clearance rate relative to the previous week, coming in at 64.3%.

From a volume perspective, 1,747 auctions were recorded last week, the lowest count since the Kings Birthday long weekend in mid-June. However, the number of auctions continues to track well ahead of levels recorded at the same time last year (+22%) when 1,428 auctions were held.

The winter slowdown is set to continue, with around 1,500 auctions currently scheduled this week with a bounce back to around 1,700 the following week.

Related readings

Resilient Clearance Rates Despite Higher Volumes - CoreLogic

Preliminary clearance rate falls to 67.3% across the combined capitals - CoreLogic

Auction volumes hold steady week-on-week across the combined capitals - Corelogic

Solid bounce back in preliminary clearance rate to 75.9% - CoreLogic | The Real Estate Conversation