Westpac research reveals more homeowners are planning to sell a property

Contact

Westpac research reveals more homeowners are planning to sell a property

Westpac research released today has found more Australians are thinking about selling their home with four in ten (39%) homeowners planning to list in the next five years, an increase of 9 percentage points since November 2020.

Westpac research released today has found more Australians are thinking about selling their home with four in ten (39%) homeowners planning to list in the next five years, an increase of 9 percentage points since November 2020.

The report found a growing number of homeowners are looking to downsize, with more than a quarter (26%) saying they will seek out a smaller property1.

Westpac’s Managing Director of Mortgages Anthony Hughes said the findings could be promising news for buyers as property demand continues to surge.

“Our research shows that while buying intentions have tapered slightly, demand still remains stronger than it did prior to the pandemic, reinforcing that the great Aussie dream of owning a home continues to remain a priority.

“In welcome news for buyers, the report also found more people are now thinking about selling. This is largely being driven by confidence in getting a good return on their home, as well as an increasing desire to live in a new area as people seek more living space.

“Properties further from the city boasting backyards and a more relaxed lifestyle remain top of mind for buyers, and for the first time, more homeowners are telling us increased infrastructure and amenities in their desired area is also motivating them to sell, with public transport, local shops and parks ranking as the most desirable suburban features.

“While the report found houses are most in demand, units and apartments still remain a popular option – particularly among younger buyers who are more likely to seek the convenience and access to local cafes, restaurants, and bars, as well as downsizers who might be seeking a coastal lifestyle.”

The report found seven in ten (71%) first home buyers are seeking a house or townhouse and three in five (62%) want a property with at least three bedrooms.

Despite a slight decrease recorded in the number of Australians planning to buy a first home2, competition with other buyers remains a top challenge (43%) with three in ten (29%) citing a lack of listed options as a barrier to achieving home ownership – a sentiment that’s increased by 10 percentage points in the last three months.

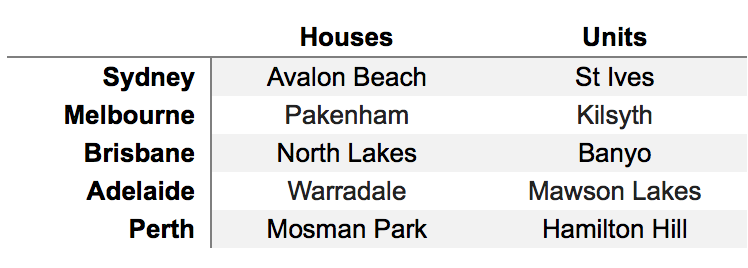

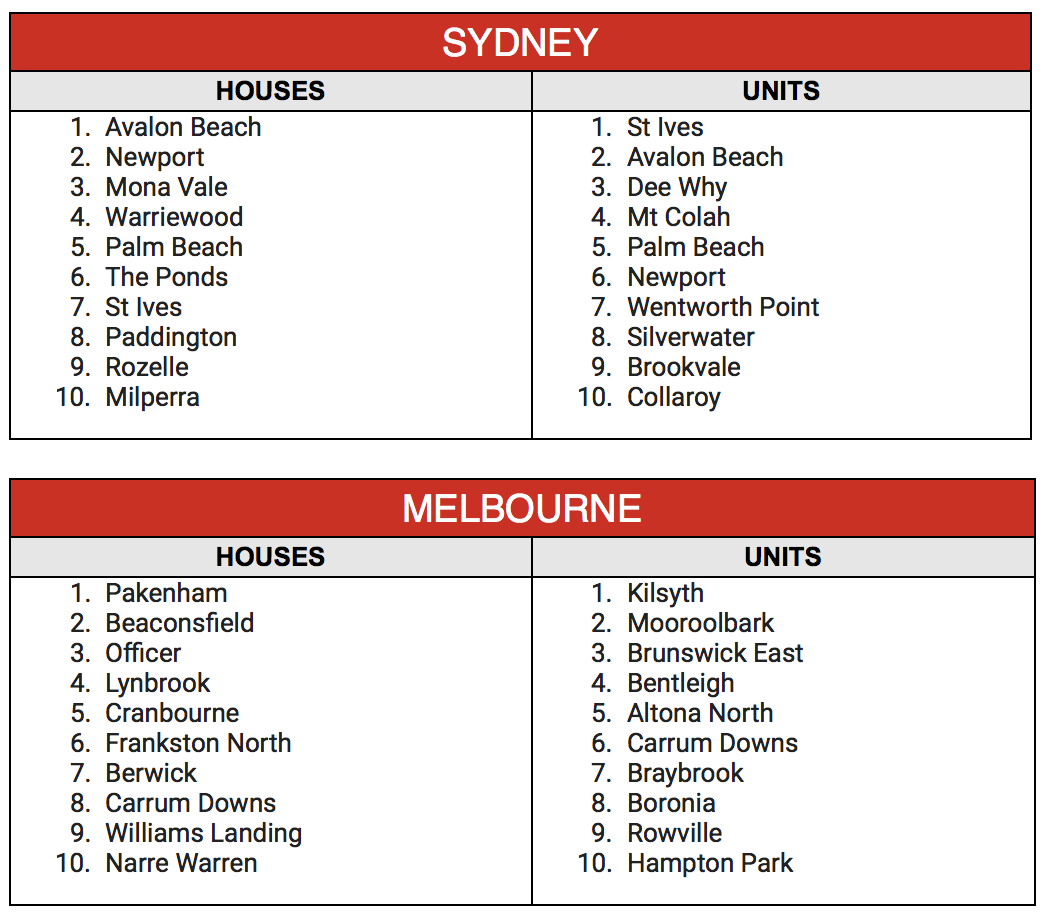

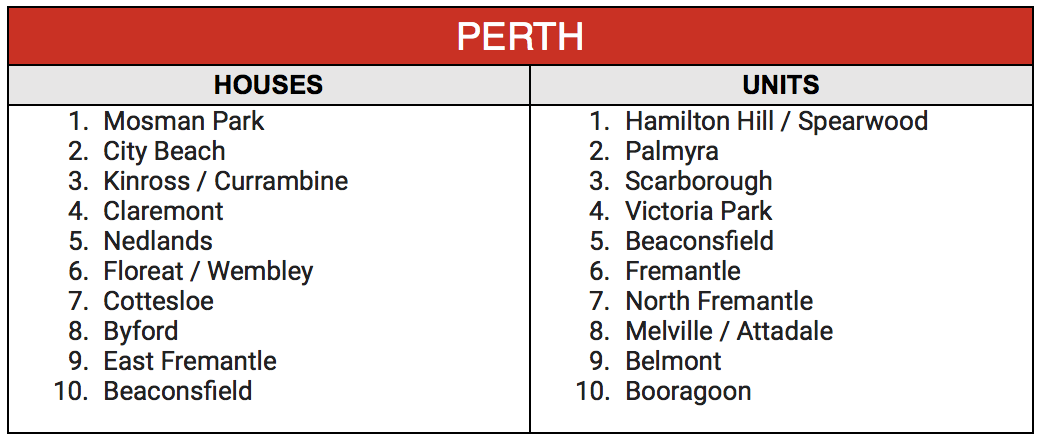

In what could be welcome news for house hunters, Westpac has also released a list of the top areas where homeowners are most likely to list a property in the next six months.

According to the report, the suburbs most likely to put a property on the market across the nations’ capital cities include:

“Areas featured on the list offer a diverse range of living options for prospective buyers that also cater to the changing preferences we’ve seen since the start of the pandemic, including stronger demand for more space through a dedicated study or spare bedroom as many continue to work from home.

“Buyers can also consider areas that are poised to have units come onto the market. Newly developed suburbs like Sydney’s Wentworth Point or established areas like Adelaide’s Glenelg can be appealing with waterside living options, as well as access to restaurants, recreational facilities and transport,” added Mr Hughes.

Westpac offers a range of resources for both buying and selling a property, including free borrowing and refinancing calculators. For more information visit westpac.com.au/homeloans.

Top areas likely to list in the next six months:

---------------------------------------

1 26% plan to downsize in the next five years. This is compared to 22% who were planning to do so in November 2020.

2 19% of Australians are planning to buy a first home in the next five years – decreasing by 3 percentage points (from 22%) of intending first home buyers recorded in February 2021.