'Skyrocketing' stamp duty in Victoria needs to be reviewed - Property Council

Contact

'Skyrocketing' stamp duty in Victoria needs to be reviewed - Property Council

There are fresh calls for Victoria's stamp duty brackets to be reviewed in the wake of new data from the Property Council of Australia showing Melbournians now have to pay, on average, an additional 9 weeks of salary to cover the inflating cost of the tax.

Melbourne residents would need to save on average for 13 years just to cover stamp duty costs, new analysis from the Property Council has revealed.

The council found that given the average Australian saves roughly 6 per cent of their total income, stamp duty was making it more and more challenging for buyers looking to move or upsize.

According to Cressida Wall, Victorian Executive Director, Property Council of Australia, the problem for Victorians was that stamp duty brackets hadn’t been reviewed for over 10 years, whilst house prices continued to balloon, significantly increasing the rate of duty payable.

“Stamp duty has increased by 17.9 per cent as a percentage of yearly income in the last 5 years," she said.

"This means the average Melbournian now has to pay, on average, an additional 9 weeks of salary to cover the inflating cost of stamp duty.

“With over 80 Melbourne suburbs with a median house price above a million dollars, a top rate starting at $960,000 doesn’t reflect the reality of the Melbourne housing market.”

At a glance:

- New data from the Property Council of Australia shows Melbourne residents would need to save on average for 13 years just to cover stamp duty costs.

- The council found that given the average Australian saves roughly 6 per cent of their total income, skyrocketing stamp duty was making it more and more challenging for buyers looking to move or upsize.

- The REIV has also called for stamp duty brackets to be reviewed, saying they need to reflect the change in values within the Melbourne market.

Data from the Property Council indicates that in 2008 when the brackets were last set, the median Melbourne house price was $425,000 and was subject to approximately 4.1 per cent duty, or roughly $17,620.

Today, it has more than doubled to $882,000, meaning the average home sale now incurring 5.4 per cent stamp duty or $47,990, just one per cent shy of the top stamp duty rate of 5.5 per cent.

According to the Property Council, immediate stimulus measures are required to ease housing affordability pressures nationally, but particularly in Victoria where population growth is set to overtake Sydney in the next decade.

Source: REIV

'Competitive' property tax regime needed to encourage investment and jobs

The Property Council's calls for a review of stamp duty in the state have been echoed by the Real Estate Institute of Victoria, which has released its own data in relation to the tax.

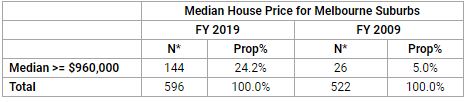

According to the REIV, just 6.6 per cent of Melbourne houses in 2008/2009 had a median house price of more than $960,000, in comparison with 28.4 per cent in today's market.

REIV CEO Gil King told WILLIAMS MEDIA the stamp duty brackets needed to reflect the change in values.

"A decade ago, a million dollars was what you would expect to pay for the premium, top end of the property market – Toorak and Brighton mansions – but today, million-dollar price tags are becoming the norm throughout Melbourne suburbs," he said.

“We know that the property industry accounts for 47 per cent of the Victorian Government’s income from tax which is an extraordinary proportion for a single industry to absorb.

“Victoria must have a competitive property tax regime to encourage investment and jobs.

"A more efficient tax system will have positive flow-on effects for our economy; it will make housing more affordable, ensure Victoria attracts foreign investment, unlock productivity, create jobs and provide a fairer revenue base for government.”

Similar to this:

Victorian government increases stamp duty for foreigners

State governments too dependent on stamp duty revenues, says report

'A serious disincentive' - REINSW calls for changes to stamp duty ahead of NSW budget