These are the 12 steps to take to research a home before you buy

Contact

These are the 12 steps to take to research a home before you buy

Buying a property is a huge financial and emotional commitment. Before you take the plunge, follow these steps (and check out a few powerful free tools) from mortgage and home loan brokers, Hunter Galloway.

The single most important rule to follow before buying a house is to do your research.

After all, it's the single biggest purchase you're likely to ever make.

Before you hand over that fat wad of cash, follow these tips from mortgage brokers, Hunter Galloway.

1. Work out your property criteria

It's easy to get excited during the house hunting process and fall in love with certain areas of the home, like a huge backyard or state-of-the-art kitchen.

But it's important to remain objective and make sure the entire home ticks all the boxes.

Read Hunter Galloway's first-home buyer guide.

Some questions to ask yourself include:

- Consider why you're buying the property. Are you going to live in the home, or rent it out short-term?

- Is it a starter home, or your forever home?

- Can you afford repairs and upkeep on the property if it's an older home? Does it need any renovations, like a new kitchen or bathroom?

- When you eventually sell, who will buy it from you? If it's going to be a narrow market like retirees, will that harm the potential growth of the property?

Image supplied by Hunter Galloway.

Other important factors to consider are commute times to work, street noise, the number of bedrooms and bathrooms you need, proximity to transport, schools and shopping centres.

2. Research your suburb and surrounding areas

Even if you're already familiar with the suburb, it's still a good idea to think about who might buy it off you in the future.

Microburbs provides information on the suburb's demographic based on Census data, such as:

- Hip Score: Stats on how many people are commuters & data from the Census to give you an idea on who your future rental tenants might be.

- Family Score: Stats on local schools, daycare and universities.

- Lifestyle Score: Stats on local cafes, pubs, gyms and pools.

- Community Score: Stats on long-term residents and other community actives in the area.

WalkScore is another tool that provides information on local transportation, while their Travel Time Map shows you how far you can get from your potential new home by walking 20 minutes, driving 10 minutes, etc.

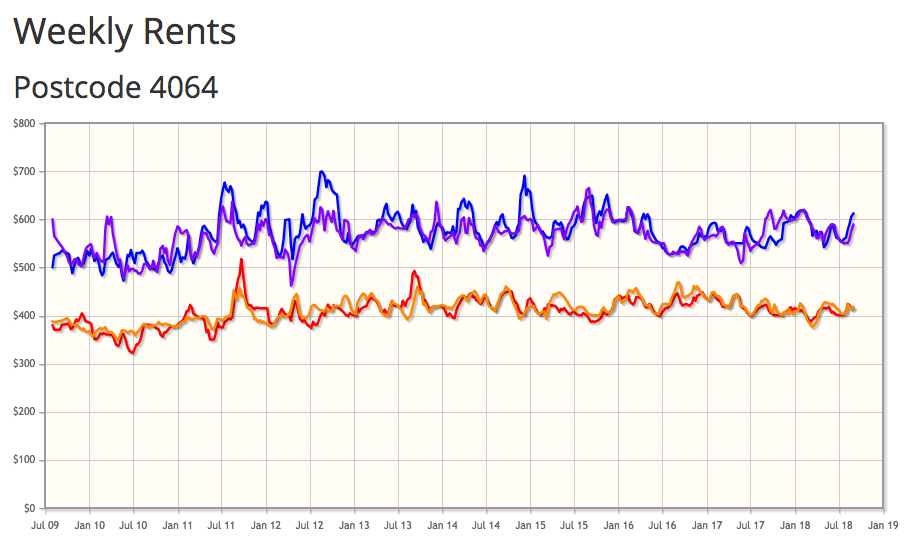

3. Research the rental income per week

It's always worth knowing how much you could rent your property out for in the future, even if you only intend on living there.

The fundamentals for a strong rental market includes low vacancy rates, a stable weekly rental, good rental yields, and a balance of supply and demand.

Image supplied by Hunter Galloway.

Ask the real estate agent for a rental appraisal to find out much you could potentially make, or work it out yourself which brings us to our next point:

4. Calculate the potential rental income

Working out the potential rental per week isn't an exact science, but it's easy to get a broad idea.

Jump on any listing website, filter your target suburb, match your property characteristics (three-bedroom, two-bathroom house) so you can see the rental range for those properties.

Image supplied by Hunter Galloway.

5. Research similar property sales

Agents won't always advertise the selling price for a home, instead leaving it to the market to decide.

To find out if the property market is strong in your suburb, look for things like low days on the market, stable weekly asking property prices, a balanced demand and supply, and a good demand to supply ratio score - anything over 50 is considered a healthy market.

6. Determine the value of the property

Working out the potential value of your home isn't an exact science, as markets are always changing.

Image supplied by Hunter Galloway.

But you can get an indication of what it's worth.

To determine a home’s value, you need to look at recent sales of similar properties with these characteristics:

- The sales within 2 km of home, in the same suburb

- The same property type (unit/house/townhouse/land)

- The same number of bedrooms, bathrooms and car parks.

- The same, or similar land size

- The sale occurred within the last 6 months

- Property is in similar condition/has a similar level of improvements (i.e. both have a pool, renovated kitchen, etc)

7. Confirm the value of the property with a free RP Data Valuation

Hunter Galloway can also help you determine the value of a home.

Visit their Contact Page, input your details and in the message include the property address.

They will then complete a free RP Data electronic valuation for you. That report includes location highlights, recent sales, properties on the market, and an estimated value and price range.

8. Research the history of your home

There are several websites that allow you to research the history of your home.

Visit the National Library of Australia website to find resources for your state.

9. Research the flood history of your home

Before you buy, it's important to research the flood history of your home and the likelihood of future flooding events.

Real estate agents don’t need to tell you if the home was flooded before, but it can drastically affect the homes resale value if a bank can (and can’t) give you a loan and more importantly can cost you double and triple the amount in insurance.

10. Negotiate with an agent

Once you've worked out what you want to pay, it's time to put your offer into the real estate agent.

Image supplied by Hunter Galloway.

A good real estate agent will work hard for the seller to get the best price, so it's worth remembering they aren't working for you as the buyer.

Find out more tips about negotiating with a real estate agent here

Most agents won't waste their time on buyers who are unsure or unwilling to commit. Doing your research and going in with a solid price will set you apart from other buyers in the market.

As a buyer, you need to put your best foot forward but you also need to ask the right questions to identify any potential issues the property might have or any information that might help with your negotiations.

Find out as much as you can about the vendor, other competing buyers, and terms they are looking for.

- Why are they selling the property?

- How long has the property been up for sale?

- What was the original asking price?

- Are the sellers willing to negotiate on price?

- What's the lowest offer they're willing to accept?

Try not to give away too much about your position, like the amount you have been pre-approved for.

Image supplied by Hunter Galloway.

11. Make an offer

Hunter Galloway says it's always best to submit an offer in writing.

Visit Hunter Galloway to read more about pre-approval

Always have your finance pre-approved, be organised, and make your offer as competitive as possible.

12. Next steps and settle into your new home

The team at Hunter Galloway can assist you with purchasing a home, with an entire team of experts on hand to make your home loan journey easy.

To find out more, phone or email Nathan Vecchio, Mortgage Broker at Hunter Galloway via the contact details below.

This is a sponsored post.

Visit Hunter Galloway here to find out more about their services.