Latest CPI figures "good news for renters"

Contact

Latest CPI figures "good news for renters"

The June 2018 quarter CPI figures released by the Australian Bureau of Statistics (ABS) yesterday holds good news for renters, says the Real Estate Institute of Australia (REIA).

Tenants across the country can breathe a sigh of relief, after the latest CPI figures were released yesterday.

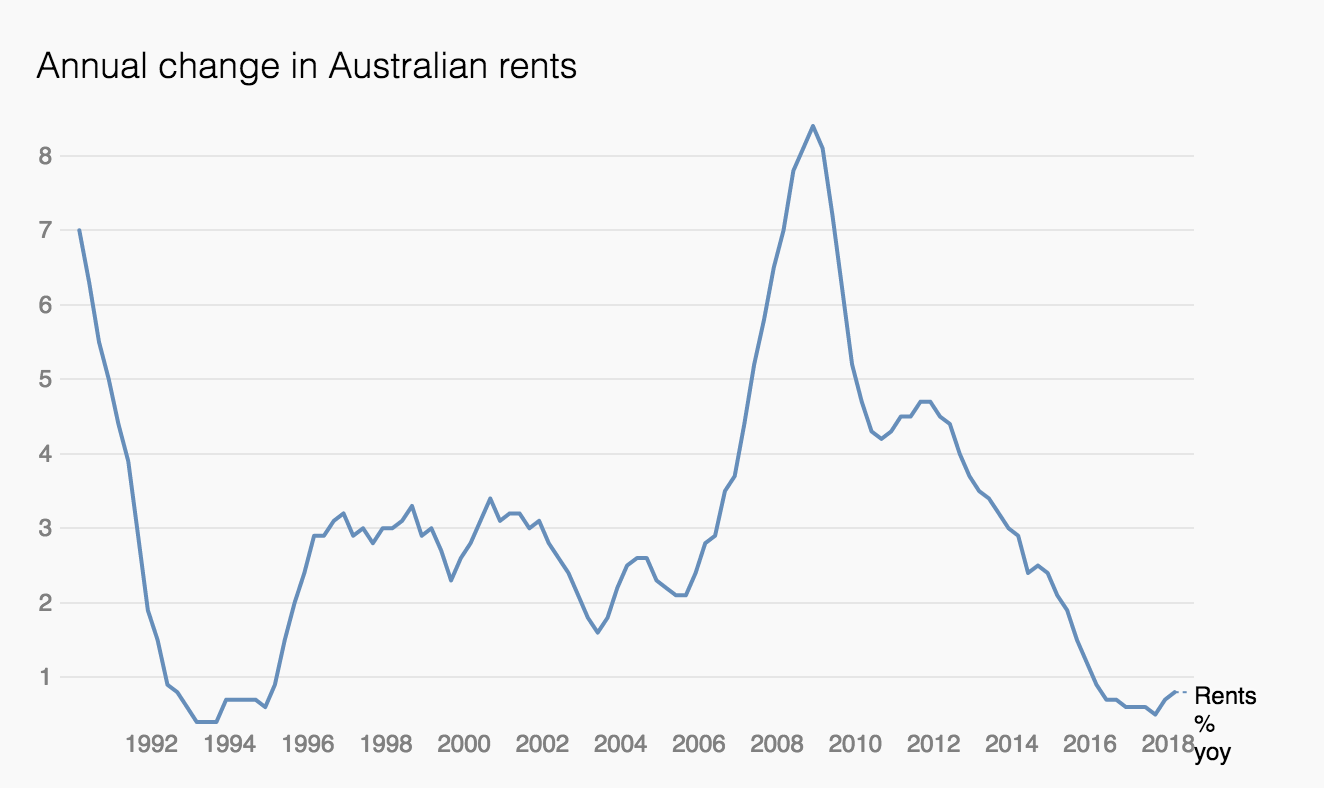

Renters saw no increase in rents on average in the June quarter, with rents only 0.6 per cent higher over the year.

“Rents remained unchanged for the quarter and increased by just 0.6 per cent for the year.

"For the last ten quarters the average annual change has been less than 1.0 per cent," REIA President Malcolm Gunning told WILLIAMS MEDIA.

“The CPI is good news for renters with the latest figures showing that the increase in rental stock through increased investment in housing has kept growth in rents lower than they have been historically.

Related reading: "A renters market" as Sydney rental vacancies hit a record high

“The continued environment of remarkably low interest rates is very beneficial for renters,” Shane Garrett, Senior Economist for the Housing Industry Association (HIA), told WILLIAMS MEDIA.

The slow growth in rents is attributable to the large volume of new homes built in recent years, and record-low mortgage rates, according to Garrett.

“The fact that interest rates have been so low and so stable over the past two years has really taken the pressure off rents," Garrett said.

Interest rates to remain the same... for now

Gunning predicts interest rates will remain the same.

“For home buyers the latest inflation data together with a cooling in the housing market would suggest the Reserve Bank of Australia (RBA) will hold official interest rates stable for 2018.

“Whilst official interest rates are likely to remain stable, we are seeing pressure mounting on banks to increase mortgage rates which together with the extremely cautious approach being currently taken by lenders means higher borrowing costs and runs the risk of hampering economic growth,” Gunning said.

The RBA is waiting to see clear signs of an increase in wages growth before it lifts interest rates from record lows, after a now unprecedented period of stability.

Real Estate Institute of New South Wales (REINSW) President, Leanne Pilkington believes the RBA has no reason to adjust interest rates right now.

"There is a strong argument to leave the cash rate unchanged for the forseeable future," Pilkington said.

"Given the downward slide in property prices, the marked drop in investor lending and other macro challenges to the economy - especially when the banks cannot be trusted not to hike rates independently, there is no need for the RBA to act," she said.

The news comes after rental vacanies in Sydney hit a record high, while rents dropped accordingly.

Source: SQMProperty analysis firm, SQM Research found the city's residential vacancy rate sitting at 2.8 per cent in June, up from 2.5 per cent in May and 2.0 per cent at the same time last year.

"Rental vacancies are rising and rents are easing in Sydney due to a surge in building completions and potentially a mild slowdown in the population growth rate. There is now a greater supply of rental accommodation at a time when the growth in rental demand is probably falling a little," SQM Managing Director, Louis Christopher said.

Related reading:

Unchartered territory ahead despite RBA stability

Rates on hold, but housing affordability remains 'hotly debated'