House price drops in Sydney and Melbourne not as "dramatic" as we are led to believe

Contact

House price drops in Sydney and Melbourne not as "dramatic" as we are led to believe

While house prices in Sydney and Melbourne led the way in value declines across the nation according to CoreLogic's June Home Value Index, the price drops aren't as dramatic as what is being reported, experts say.

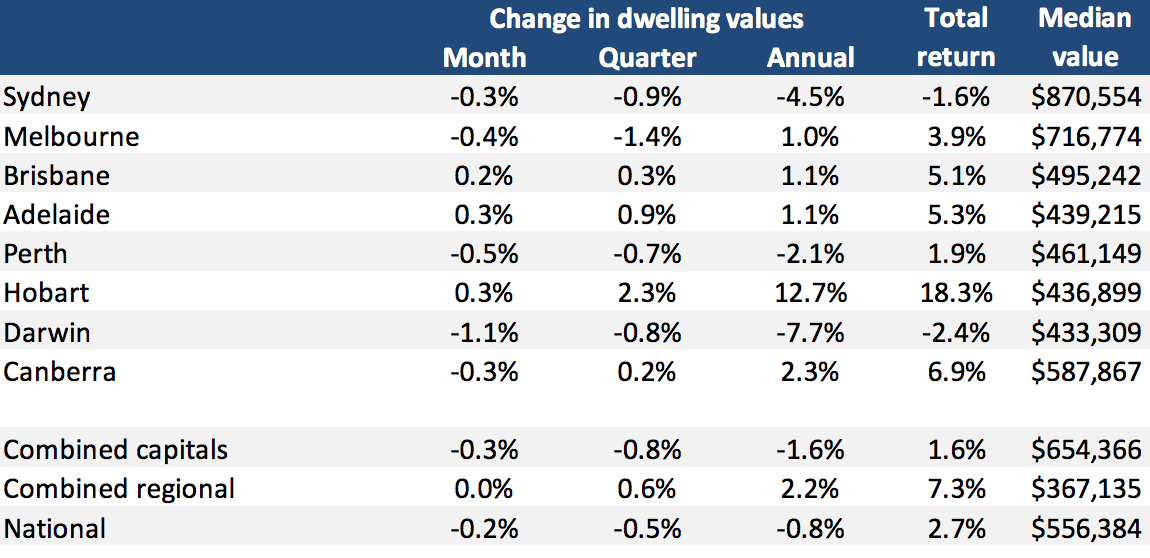

House prices fell 0.2 per cent in June around the nation, marking the ninth consecutive month-on-month fall in national home values, according to the latest report by property industry analysts CoreLogic.

National property prices peaked in September last year, and have since fallen 1.3 per cent to median house price of $556,384.

Despite that, house prices are actually 32.4 per cent higher than they were five years ago, according to CoreLogic research director Tim Lawless.

"This highlights the wealth creation that many home owners have experienced over the recent growth phase, but also the fact that recent home buyers could be facing negative equity," Lawless said.

Whether a property's value rose or fell depended on if it was in the most expensive, or least expensive parts of that city.

Property prices at the high end of the market fell by 3.6 per cent while those at the lower end of the market rose by 1.4 per cent.

Those differences were the most pronounced in Melbourne and Sydney, where properties in the most expensive end of the market fell by 7.3 per cent, while the cheaper end of the market rose by 2.5 per cent.

“A surge in first home buyer activity has helped support demand across the more affordable price points in these cities," Lawless said.

Alongside Sydney, both Perth and Darwin saw median house values fall over the year. Source: CoreLogic.

Expensive properties hardest hit

According to CoreLogic, the declines in house values were the most pronounced across the most expensive housing stock. The most expensive quartile of properties have dropped 1.3 per cent over the last three months, while the least expensive quartile remained stable.

The most expensive housing markets in the nation, Melbourne and Sydney, led the fall with property value declines sitting at 2.5 per cent and 7.5 per cent respectively across the last 12 months.

But Ken Jacobs, a Sydney agent at Christie's International Real Estate, told WILLIAMS MEDIA he thinks the decline in house values isn't quite as dramatic as what is being reported.

2/56 Wolseley Road sold through Ken Jacobs and Carys Adams of Christie's International Real Estate, as featured on Luxury List. Image: Christie's International Real Estate

2/56 Wolseley Road sold through Ken Jacobs and Carys Adams of Christie's International Real Estate, as featured on Luxury List. Image: Christie's International Real Estate

"I do agree that prices are softening in the market, but this isn't across the board. The banks are certainly an issue with the Royal Commission, which is making them tighten up their lending standards and become more compliant which is clogging up the system. The banks have been very slow to make decisions, so that is having an impact.

"But I just think there is a lot of uncertainty around. There are still transactions happening in our luxury end of the market, and prices that we would have expected and achieved last year, so it certainly isn't as dramatic as what the press is making out.

"There is also a lack of stock, because vendors are reading about prices dropping and they are thinking "well, why would I go into the market now?" so that is having an impact too," Jacobs said.

Jeremy Fox, a Melbourne agent at RT Edgar Toorak, told WILLIAMS MEDIA that the reported 2.5 per cent price drop is such a small percentage that to judge the state of the entire market on that is "illlogical".

6302/35 Queensbridge Street for sale through Jeremy Fox and Mandy Zhu of RT Edgar Toorak, as featured on Luxury List. Image: RT Edgar Toorak.

"That (2.5 per cent drop) is such a small percentage, I don't understand how people can judge the market based on that. I can't understand how CoreLogic can say it has fallen by only 2.5 per cent, it is such a small amount and it just doesn't make sense.

"The market is so unpredictable, 2.5 per cent is nothing. The market is levelling out at the moment, and it will play catchup and rise again. We are still selling heaps of property and there are still plenty of buyers for all these houses, so it is still your best investment.

"I think at the moment, there is a shortage of stock. Unless they really need to sell, vendors will pull back and take their houses off the market and wait, so I believe it is the beginnings of all that. People who don't need to sell will just wait. If there is any uncertainty, they will just wait it out," Fox told WILLIAMS MEDIA.

Hobart the best performer

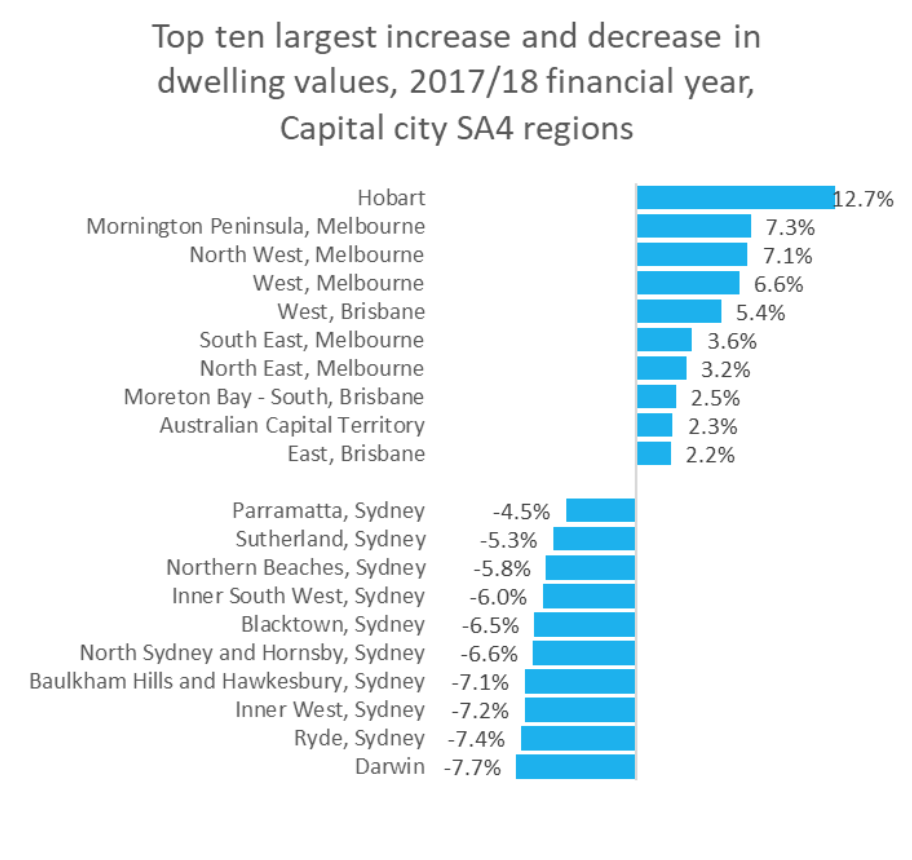

Hobart was the best performing capital city in the nation, with a 12.7 per cent increase over the year to a median house value of $436,899.

House values were also up in Adelaide (+0.9 per cent), Brisbane (+0.3 per cent) and Canberra (+0.2 per cent) over the second quarter of this year.

Sydney has been hit the hardest, with nine of the top 10 worst-performing regions for house values over the year, while Hobart was the best performing capital city. Source: CoreLogic.

Regional growth beating capital cities

The fall in capital city house prices was slightly offset by a 0.6 per cent rise in the combined regional markets.

The best performing regional markets over the year were Geelong (+11 percent), Launceston (+7.1 per cent) and southeast Tasmania (+6.8 per cent).

The strong performance in these areas was partially thanks to their overall affordability and an increase in first home buyer activity from July 2017, when first home buyer concessions became available.

“Markets such as Geelong, the Capital Region and Ballarat, have each benefitted from a spillover of demand emanating from the more expensive and often more congested metropolitan areas of Melbourne and Canberra. Areas adjacent to Sydney have also seen market conditions benefit from this ripple of demand, however conditions are now generally easing," Lawless said.

However, regional areas of Queensland and Western Australia recorded a drop in house values over the financial year, as these areas are linked with the mining and resources sector, where conditions have been struggling.

Read CoreLogic's Hedonic Home Value Index for June 2018 in full here.

Related reading:

New research shows property listings are soaring in regional towns, but are they really?

Slowdown in clearance rates not necessarily an indication of the market

Premium suburbs are leading the recovery of the Perth housing market