APRA measures push investors out, let first-home buyers in

Contact

APRA measures push investors out, let first-home buyers in

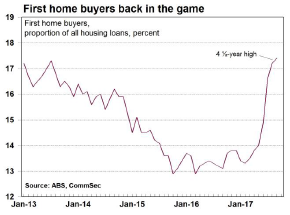

APRA's efforts to clamp down on investor lending are taking effect, with the latest data from the Australian Bureau of Statistics showing that as investor lending declines, first-home buyers are increasing their presence in the housing market.

APRA's efforts to clamp down on investor lending are taking effect, with the latest data from the Australian Bureau of Statistics showing that as investor lending declines, first-home buyers are increasing their presence in the housing market.

“The proportion of first home buyers, as part of the total owner-occupied housing finance commitments, increased to 17.4 per cent and is the highest proportion since November,” said REIA president, Malcolm Gunning.

Source: CommSec.

However, Cameron Kusher, head of research with CoreLogic, noted that the number of first-home buyer housing finance commitments fell 1.1 per cent in NSW and 5.0 per cent in Victoria in September, following large increases during the previous two months.

“The value of investment housing commitments decreased by 0.5 per cent in September in trend terms, following falls in the previous four months and is well down from its 2015 peak," said Gunning.

The seasonally adjusted figures for the value of housing finance commitments to investors fell a whopping 6.2 per cent, the largest monthly fall since September 2015.

“Overall the figures for September 2017 show, in trend terms, that the number of owner-occupied finance commitments increased by 0.7 per cent," said Gunning.

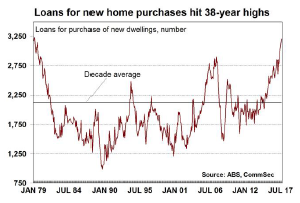

“In trend terms, the number of established dwellings purchase commitments increased by 0.7 per cent while new dwelling construction increased by 0.4 per cent and the purchase of new dwellings increased by 1.4 per cent," said Gunning.

Source: CommSec.

“It is pleasing to see the increased presence of first home buyers," said Gunning.

"The figures show that owner occupiers and first home buyers responding to more stable conditions and, in the case of first home buyers, state government incentives."

Click here to view the ABS housing finance data.

Read more about housing finance in Australia:

Affordability is improving, and first-home buyers are back in the market