Sydney records 100 sales of US$10m+ properties in 2024 - Knight Frank Research

Contact

Sydney records 100 sales of US$10m+ properties in 2024 - Knight Frank Research

Sydney had 100 sales of super-prime residential properties, those selling for US$10m+ in 2024, according to Knight Frank’s latest research says Adam Ross, Associate Director at McGrath Estate Agents, Knight Frank’s partner Australia.

Sydney had 100 sales of super-prime residential properties – that is, those selling for US$10m+ - in 2024, almost on par with the 103 sales in 2023, according to Knight Frank’s latest research.

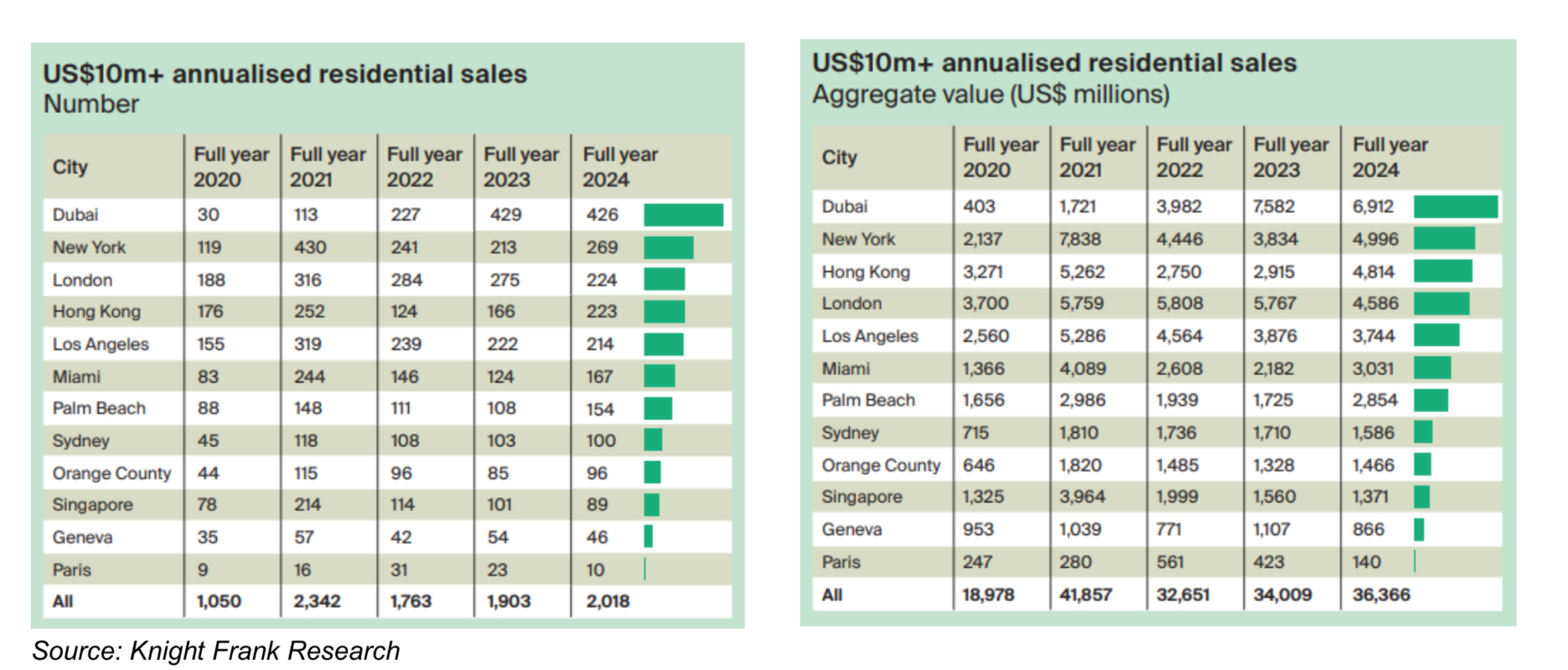

The firm’s Global Super-Prime Intelligence Q4 2024 report, which provides a snapshot of US$10m+ residential sales conditions across 12 key international markets, found the 100 sales of US$10m+ properties in Sydney last year totalled US$1.586 billion, down from US$1.71 billion in 2023.

Source: Knight Frank Research

NB: the above tables record publicly available information on US$10m+ sales in key global markets, exchange rates are calculated at the date of sale

In 2024 Sydney had more sales of super-prime properties in 2024 than Orange County (96), Singapore (89), Geneva (46) and Paris (10).

The average price for super-prime properties in Sydney was US$15.9 million at the end of 2024, compared to Hong Kong at US$22.9 million and London at US$20.4 million.

The Knight Frank report found that globally, sales of super-prime residential homes across the 12 major city markets analysed hit 2,018 – a 6% increase on the 2023 total. The global total was largely driven by a surge in Q4 sales, which were up 31% compared to the same period a year earlier with 558 sales.

However, Sydney recorded 25 sales in Q4, the same as Q3, and recorded 50 sales in each half of the year.

With a total of $36.366 billion in US$10m+ properties selling over 2024 across the 12 analysed cities, the average sale price globally was US$18 million, up from US$17.4 million a year earlier.

Dubai recorded the highest number of sales over 2024, with 426 US$10m+ properties selling for a total of US$6.912 billion. It was followed by New York, with 269 sales totalling US$4.996 billion.

In 2024, five markets experienced an increase in sales over 2023 levels, led by a revival in key US centres such as Miami, Palm Beach, and New York, and a notable recovery in Hong Kong.

European markets experienced a weaker 2024, with London, Geneva, and Paris all seeing sales decline over the year by between 12% and 19%.

Knight Frank’s Global Head of Research Liam Bailey said Sydney was one of four markets to have seen a continual contraction in the number of sales since the post-COVID 2021 market peak, along with London, Los Angeles and Singapore.

“The contraction in Sydney has only been mild, with the number of sales falling by 15% from 2021 to 2024, to return to more normal levels,” he said.

“There is ongoing demand for super-prime residential property in Sydney, with a significant number of cash buyers looking to downsize in particular, but supply does not match the demand, which has constrained the number of sales.

“The latest data from Knight Frank’s The Wealth Report, released earlier this month, points to strong continued demand for luxury property – and hence continued healthy deal flow in 2025 - due to the growth in wealthy populations.

“Sydney will continue to attract buyers, including expats looking to take advantage of the favourable currency exchange in Australia and enjoy a wonderful lifestyle at the same time.”

Knight Frank’s The Wealth Report 2025 found the global wealthy population - those with more than US$10m in assets - grew by 4.4% through 2024.

Australia sits at 9th out of 10 countries for the highest population of these wealthy people, with 1.8% of the global US$10m+ population, with 42,789 HNWIs.

Moving forward, Australasia, which has a current HNWI population of 49,367 – the majority of which is located in Australia - is expected to see a rise of 5.3% in its US$10m+ population by 2028. The global HNWI population is expected to rise by 6.9% by the same year.

The Wealth Report report also confirmed continued demand for residential property from wealthy buyers, with 25% of global family offices managing private residential portfolios confirming their plans to expand their holdings over the next 18 months.

Adam Ross, Associate Director at McGrath Estate Agents, Knight Frank’s partner in Australia*, said: “The Super Prime market kicked off this year with a fairly positive sentiment.

“Parties on both sides of the fence seem to have more confidence and greater levels of decisiveness. Unlike previous election years, we have not yet seen hesitation in the market.

“We’ve achieved some really strong results across the business, but stock levels still remain really tight at the top end.”

Related Readings

More luxury real estate reading:

Park front Melbourne CBD apartment for sale - Colliers

Waterview Flinders acreage for sale - RT Edgar

Woronganack 1886 Hawthorn entertainer for sale - Marshall White

Record breaking sold Newcastle Penthouse - Colliers | The Real Estate Conversation

Above Zero introduces Glyndon: A new vision of home | The Real Estate Conversation