Australia in the top 10 for US$10m+ populations globally - Knight Frank

Contact

Australia in the top 10 for US$10m+ populations globally - Knight Frank

Australia is within the top 10 countries in the world for being home to the highest population of high-net-worth individuals (HNWIs).

Australia is within the top 10 countries in the world for being home to the highest population of high-net-worth individuals (HNWIs) - defined as those with more than US$10m in assets – according to Knight Frank’s just-released flagship report The Wealth Report 2025.

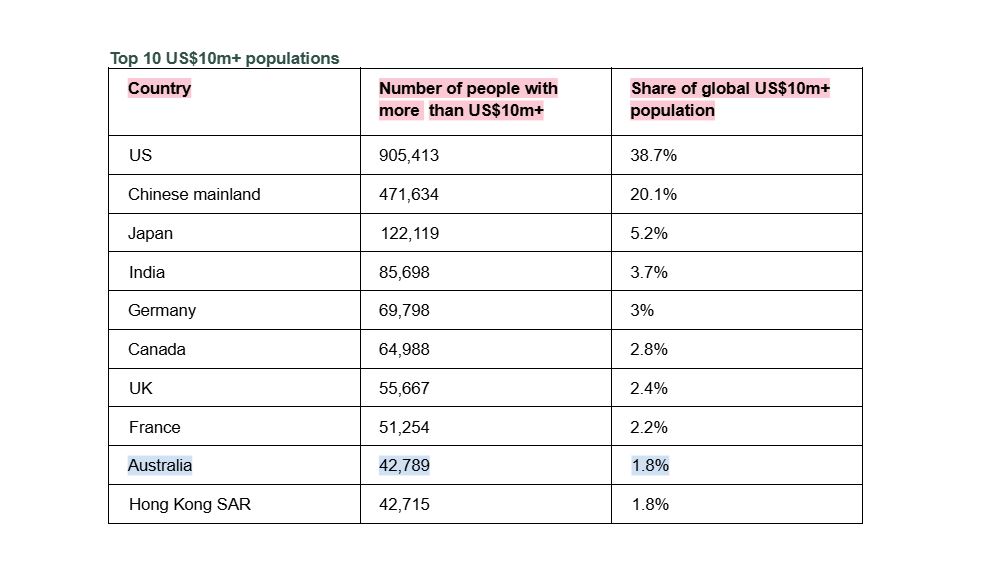

Sitting at ninth place out of 10 countries, Australia has 1.8% of the global US$10m+ population, with 42,789 HNWIs.

Australia’s wealthy population was slightly ahead of Hong Kong SAR, which has 42,715 HNWIs, Italy (41,080), South Korea (39,210), Taiwan (28,391), Brazil (21,974) and Spain (21,275).

The US is in first place, with almost 39% of the global US$10m+ population, nearly twice the level of China at 20.1%. In the US$100 million+ bracket, the figure rises to over 40%.

Globally the number of HNWIs – those with more than US$10m in assets – rose by 4.4% in 2024 to 2,341,378 from 2,243,300 one year earlier, according to Knight Frank’s The Wealth Report 2025.

All regions saw an uptick, but North America led with growth of 5.2%. Asia saw the second highest increase at 5%, followed by Africa at 4.7%. Australasia (3.9%), the Middle East (2.7%), Latin America (1.5%) and Europe (1.4%) also experienced gains.

Knight Frank Chief Economist Ben Burston said: “While several major economies, including Australia, saw sluggish growth in 2024 as higher interest rates took a toll on household incomes, robust growth in the United States supported the global economy and underpinned ongoing wealth creation. Moves by major central banks to reduce interest rates have also buoyed investor confidence and supported a strong rally in equity markets, resulting in rising numbers of HNWIs globally and in Australia.”

Future growth in Australasia’s wealth population

Moving forward, Australasia, which has a current HNWI population of 49,367 – the majority of which is located in Australia - is expected to see a rise of 5.3% in its US$10m+ population by 2028. The global HNWI population is expected to rise by 6.9% by the same year.

The number of people with a net worth of US$100m+ in Australasia is expected to increase from 1,918 in 2024 to 2,010 in 2028, a rise of 4.8%. Globally this figure is expected to rise by 6.6% over the same period.

Where are the wealthy investing?

Property plays a significant role in wealth portfolios.

Knight Frank’s The Wealth Report 2025 found, via a survey of 150 family offices*, that wealthy investors are keen to broaden their exposure to real estate, a sector they view as offering both growth potential and wealth preservation.

Assets under management (AUM) by the FOs surveyed averaged US$560 million, totalling more than US$84 billion across the 150 FOs. Around 40% of FOs surveyed had operating businesses with a focus on real estate within their portfolios.

Globally, the survey found that investor allocations to real estate rose over the past 18 months, with 28% of FOs increasing their allocation, compared with 17% reducing their exposure.

Future plans

In Australia, 31% of FOs surveyed reported that they would increase their portfolio allocation to direct real estate over the next 18 months, with 19% planning to reduce their allocation. This compares to 44% and 10% respectively globally.

In Australia the top three real estate sectors for investment moving forward are industrial (42%), data centres (21%) and infrastructure (18%), compared to living sectors (14%), industrial/logistics (13%) and luxury residential (12%) globally.

The Australian survey results found that the top objective for wealthy investing in property was growth and capital appreciation (48%), followed by income generation (21%) and wealth preservation (21%).

In terms of portfolios, some 70% of real estate investment is domestic, with the most domestically minded FOs based in New Zealand (93%), Australia (90%) and the US (86%).

Knight Frank Chief Executive Officer James Patterson said: “Despite concerns over the recent downturn in commercial property markets, more than 30 per cent of respondents expect to increase their exposure to real estate over the next 18 months. From the family offices surveyed it’s evident investors are increasingly conscious that they can now acquire assets at an attractive entry point off the back of the downturn and with strong prospects of cyclical recovery in the medium term.

“The sector preferences of family offices highlight the widespread desire to raise their allocation to the industrial sector, and also to access the nascent data centre market. However, allocating capital to data centres is far more challenging than traditional sectors, and we expect to see more private investor activity in the deeper and more liquid office and retail markets.”

Next generation

Knight Frank’s Family Office survey found that while primary decision making in investing was tightly held by older age groups, 58% of FOs are actively involving the next generation, with 40% saying this had led to a change in investing strategy.

A separate survey in Knight Frank’s The Wealth Report 2025, The Next Generation Survey – a first of its kind global study of 1,788 wealthy 18 to 35-year--olds - found real estate topped the luxury asset list for them - that is, it’s the asset they would most like to own.

John McGrath, CEO of McGrath Estate Agents, Knight Frank’s Partner in Australia**, said: “The next generation desires luxury real estate from a lifestyle point of view, but they can also see the strength of this asset class as an investment with continuing price growth around the world delivering ongoing capital gains.

“Having an exposure to real estate provides wealthy investors with growth potential for their portfolio and wealth preservation, with property being an inflation hedge, and indeed this is how many investors have created their immense wealth over many years and generations.

“Real estate prices in Australia are underpinned largely by an undersupply, including in the luxury market, and with the demand continuing to grow, prices will also continue to appreciate in the future.

“Australia is a particularly desirable market for luxury real estate due to its plentiful lifestyle locations, as well as being on the doorstep of all the global powerhouse nations within the Asian region.”

Related McGrath Estate Agents and Knight Frank reading:

Knight Frank and Bayleys agree to acquire 100% of McGrath Limited | The Real Estate Conversation