Rate relief: RBA cuts the cash rate by 25 basis points - CoreLogic

Contact

Rate relief: RBA cuts the cash rate by 25 basis points - CoreLogic

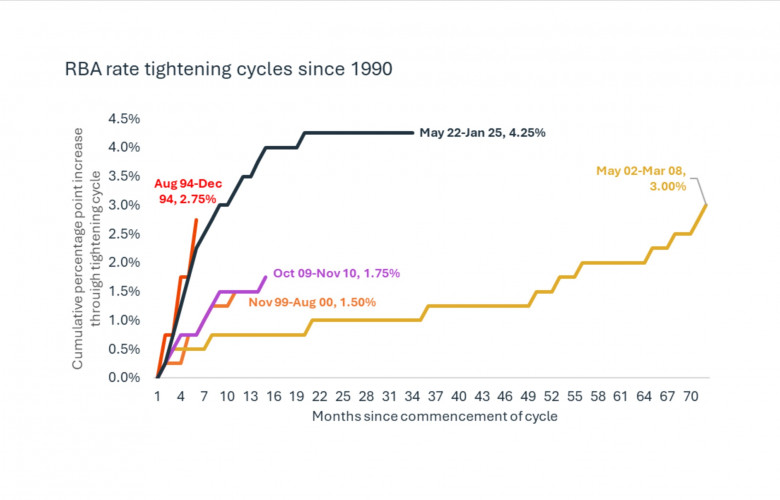

After the most aggressive rate hiking cycle on record, the RBA has reduced the cash rate from a thirteen-year high of 4.35% to 4.1%.

After the most aggressive rate hiking cycle on record, the RBA has reduced the cash rate from a thirteen-year high of 4.35% to 4.1%.

With annualised 6-month core inflation around the middle of the RBA’s 2-3% target range, the easing in cost-of-living pressures was a key factor behind the RBA’s decision to cut rates.

Australia has moved through seven straight quarters of negative per-capita GDP growth, which may have provided another compelling reason to cut rates. Other factors supporting the decision were a weakening wages growth, which undershot the RBA’s most recent forecast and generally soft retail spending outcomes.

But we shouldn’t get our hopes up for a rapid or significant rate cutting cycle in the near term. The RBA is likely to remain alert to the data flows, with persistently tight labour markets, a weak Australian dollar and elevated levels of global uncertainty remaining as downside factors that are likely to keep the loosening cycle a gradual and cautious one.

From a housing perspective, the 25bp cut will provide some modest relief to borrowers, with the average mortgage rate for owner occupier loans set to ease from around 6.32% to 6.07% if passed on in full (which is highly likely). A variable rate borrower with $750k of debt should see their monthly repayments reduce by around $121/month.

Arguably the greater effect on housing markets will be the confidence injection received from the commencement of the rate cutting cycle. Measures of consumer sentiment have already shown a solid rise through the second half of 2024 as households became more certain the rate hiking cycle was over and the outlook for household finances started to improve.

Historically there has been a clear relationship between changes in consumer sentiment and home purchasing activity.

Whether the commencement of rate cuts will be enough to stave off further declines in home values is yet to be seen. CoreLogic’s national measure of housing values, the Home Value Index, peaked in October last year and has nudged 0.3% lower since then, with Melbourne, Canberra and Hobart all recording an annual decline in home values over the 12 months to January.

Lower interest rates should help to stabilise values, but we aren’t expecting the early phase of rates cuts to be the catalyst for a new phase of material growth in housing values due to factors like stretched housing affordability.

As outlined in earlier research from CoreLogic, previous periods of rate reductions suggest national dwelling values could increase an average of 6.1% for each 1 percentage point decline in the cash rate. Additionally, relatively expensive markets have historically shown stronger responses to reduced cash rate settings.

A reduction in the cash rate could spur a recovery trend in the high end of the Sydney and Melbourne housing market, which tend to be the bellwether for broader market recoveries in those cities.