Equities outpace property in 2024 but fall short over the long run - CoreLogic

Contact

Equities outpace property in 2024 but fall short over the long run - CoreLogic

Residential real estate continues to underpin Australia's wealth, estimated at a total value of $11.1 trillion.

Residential real estate continues to underpin Australia's wealth, estimated at a total value of $11.1 trillion - significantly higher than the combined value of Australian superannuation funds ($4.1 trillion) and the Australian stock exchange ($3.3 trillion).

However, the housing market has underperformed throughout 2024, according to CoreLogic's Housing Chart Pack for January.

CoreLogic Economist Kaytlin Ezzy said that when accounting for capital gains and dividend income, the Australian equity market outstripped property in 2024, with equities up 11.4% over the year, compared to 8.3% growth for property.

"Despite uncertainty in the global and domestic economic outlook and the cost-of living crisis, the ASX reached a series of new record highs in 2024, buoyed by moderating inflation, coasting economic conditions and a strong outing from the banking sector."

By comparison, the total return from the housing sector, which considers both value growth and rental income, underperformed.

"Despite showing some resilience in the first half of the year, the accumulation of stock, and the higher for longer interest rate environment has seen the change in dwelling values slow, and, in some cities, shift into negative territory."

"Similarly, the normalisation in net overseas migration and the increase in the average household size has seen rental growth continue to ease over the year. "

She said these factors saw housing offer a total return of 8.3% over the 2024 calendar year, down from the 13.5% total return seen last year and approximately three percentage points below Australia's equity market.

Investing is a long-term game

Housing has outperformed equities in six of the past ten years and, cumulatively, has delivered total returns of 132.6% compared to 126.4% over the past decade.

"Whether it's housing or equities, it's normal to see some market volatility and both booms and busts are part of the usual asset pricing cycle. Regardless of asset type, time on the market has beat timing the market."

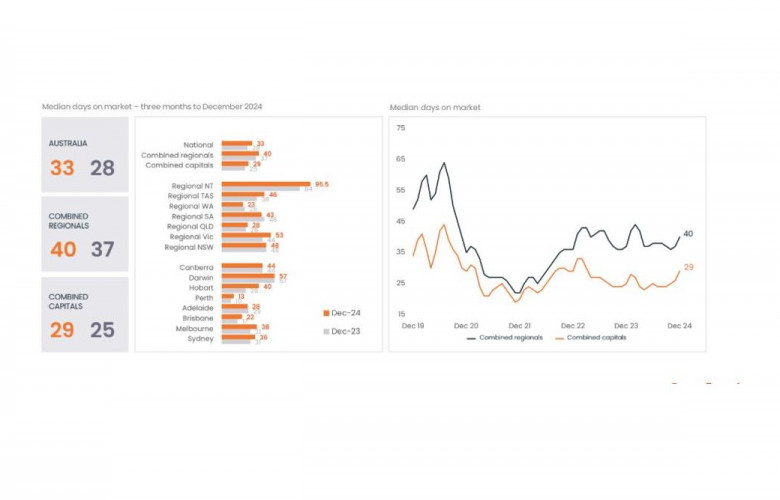

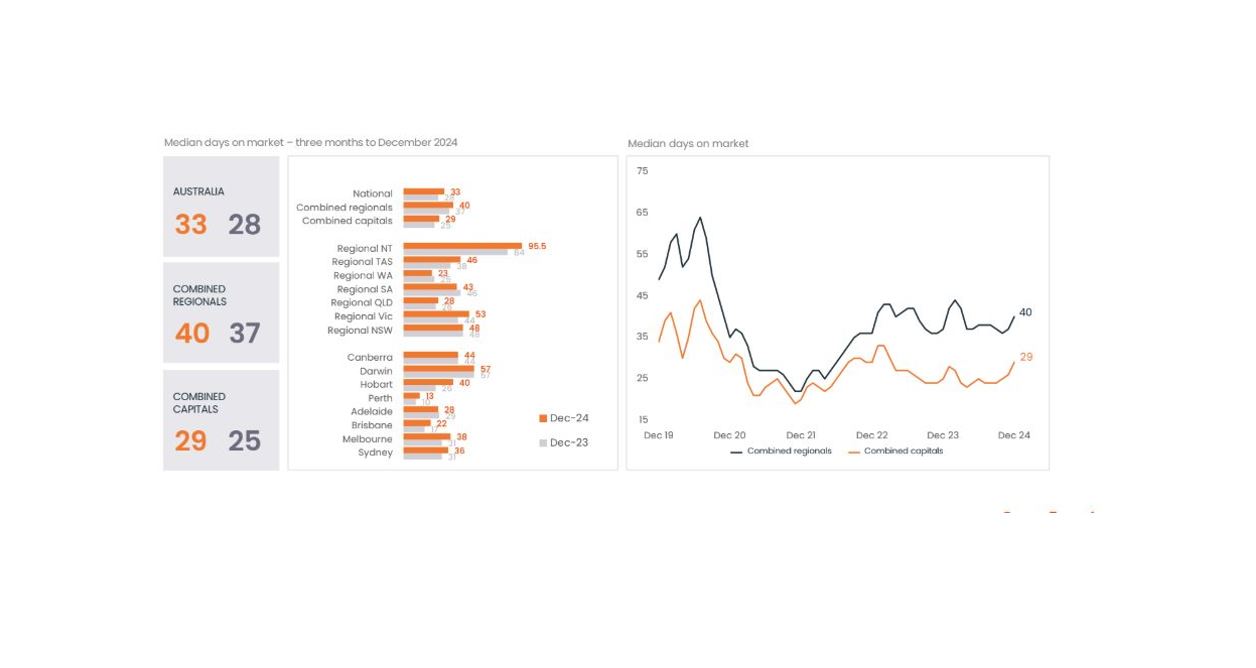

Median days on market trends higher

The Housing Chart Pack also found that after holding relatively steady around 28 days through much of 2024, the median time on market trended higher in the December quarter, at 33 days.

"Given current conditions are skewing in favour of buyers, it's unsurprising to see it take a little longer to secure a sale as buyers take their time assessing their options," Ms Ezzy commented.

Adelaide was the only capital to record a dip in the median days on market compared to last year, falling from 29 days in the December quarter of 2023, to 28 days in Q4 2024.

Darwin and Canberra saw median selling times hold steady at 57 days and 44 days, respectively, while all other cities recorded an increase in median selling time compared to a year ago.

Vendor discount rate improves marginally

Although selling conditions are deteriorating for vendors, with stock levels accumulating and selling time increasing, the median vendor discount rate tightened slightly in 2024, from -3.8% in the final quarter of 2023, to -3.6% in the three months to December 2024.

"Although subtle, this suggests that sellers have been relatively realistic and are more willing to meet the market when setting initial listing prices."

"However, if stock continues to accumulate and values trend further downward, the gap could widen and vendors may have to offer larger discounts in order to secure a sale."

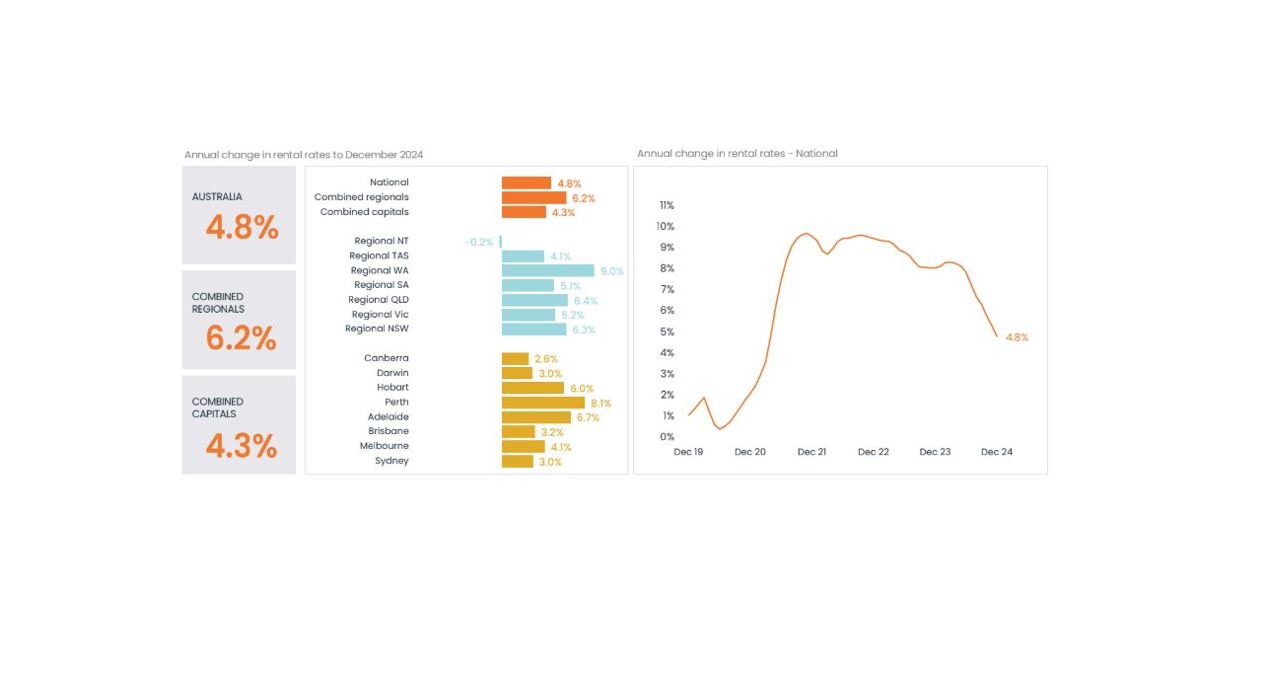

Rental growth continues to decelerate

The national rental index increased by 4.8% in the year to December, a notable decrease from the 8.1% rise observed in 2023 and the 9.5% growth recorded in 2022.

Ms Ezzy said this could be attributed to the ongoing normalisation of net overseas migration and the recent increase in average household size, both of which have helped to ease rental demand.

"With around 70% of overseas migrants renting when they first arrive, the continued easing in the net overseas migration trend towards pre-covid levels have helped alleviate the upward pressure on rents.

Additionally, with rental affordability near record highs, more potential renters may be delaying leaving the family home or are looking to form larger share houses as a way of distributing the additional rental burden."

"Outside of the usual seasonal uptick through Q1, we would expect to see growth in rents continue to lose momentum in 2025."

Related Readings

Spring selling season proves a win for buyers - CoreLogic | The Real Estate Conversation