Local buyers and upgraders most active in Australia’s prestige residential market -CBRE

Contact

Local buyers and upgraders most active in Australia’s prestige residential market -CBRE

Demand for houses valued up to $20 million is strong in the Australian prestige residential market with local buyers and upgraders the most active, said CBRE’s Head of Prestige Valuations NSW Bader Naaman.

Demand for houses valued up to $20 million is strong in the Australian prestige residential market with local buyers and upgraders the most active, new CBRE research shows.

CBRE’s Prestige Residential Valuer Insights Q3 2024 surveyed valuers from across Australia who specialise in high-end residential properties.

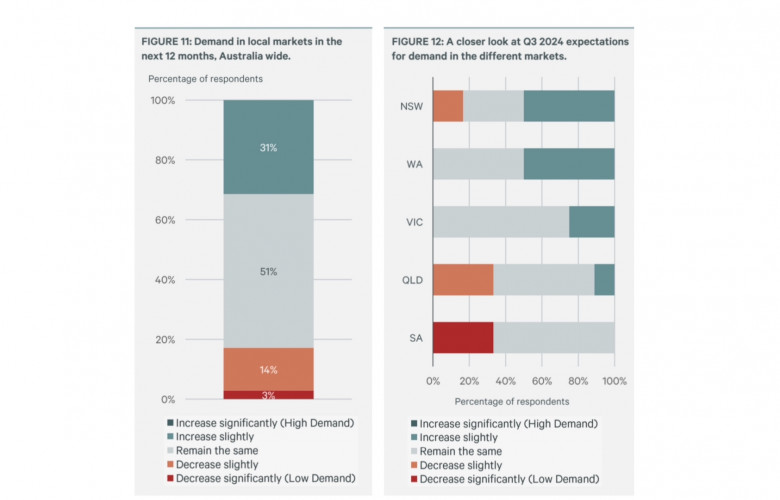

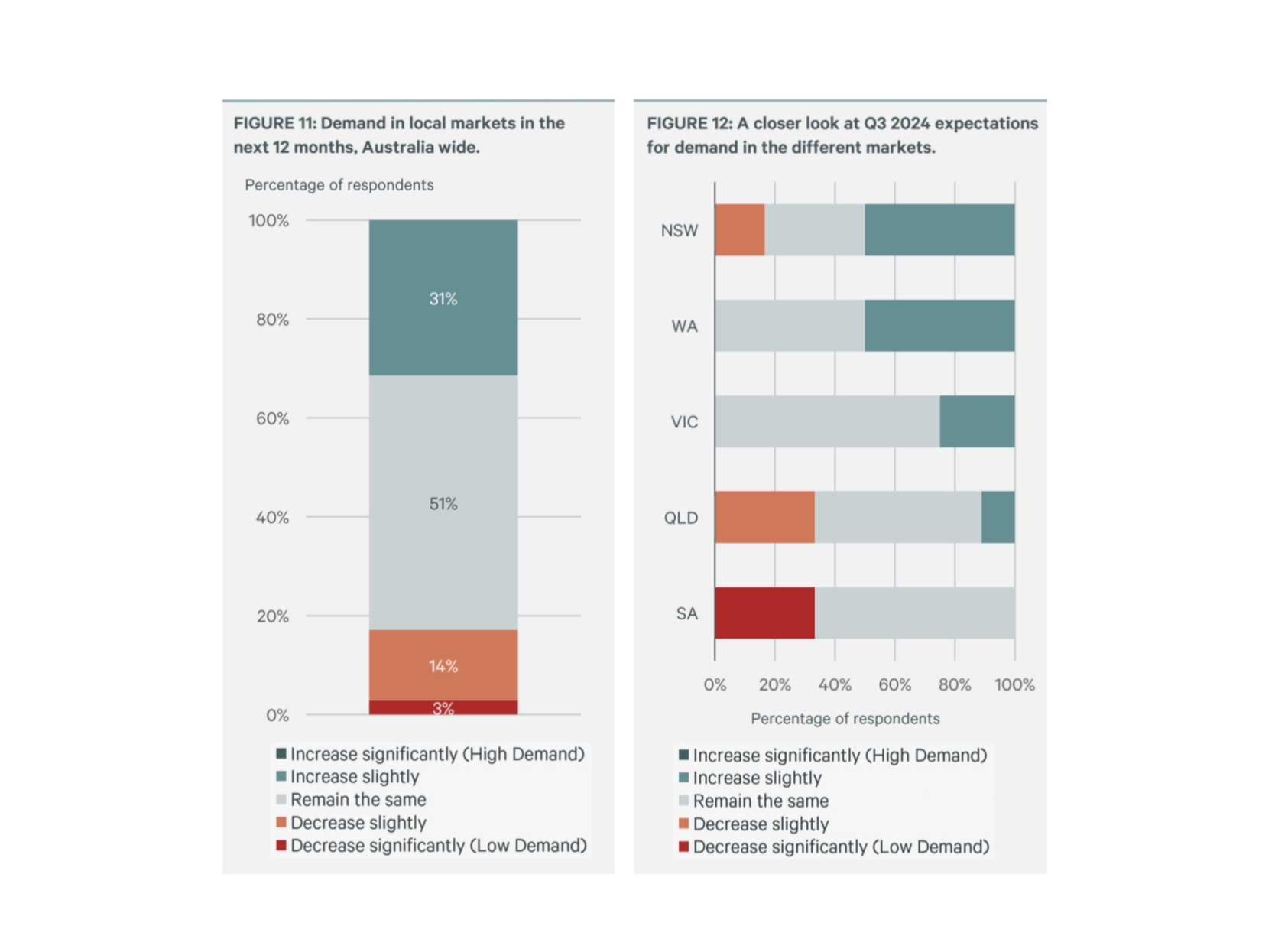

A total of 40% of valuers reported demand for prestige property as ‘strong’ to ‘very strong’ in their local markets with 51% reporting ‘moderate’ demand. SA and WA had the strongest demand while the market was softer in VIC and the ACT.

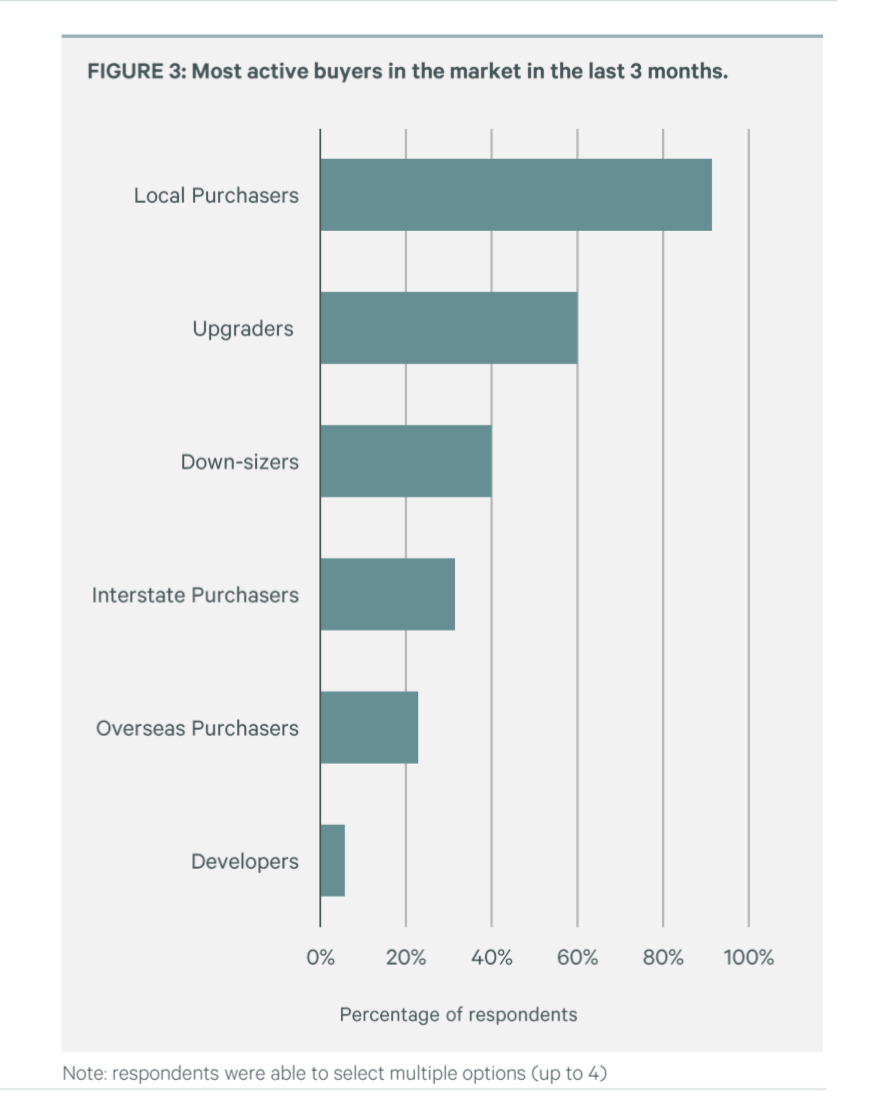

Local buyers and upgraders were reported as the most active buyer types with downsizers and interstate purchasers also active. Developers and overseas purchasers were less active.

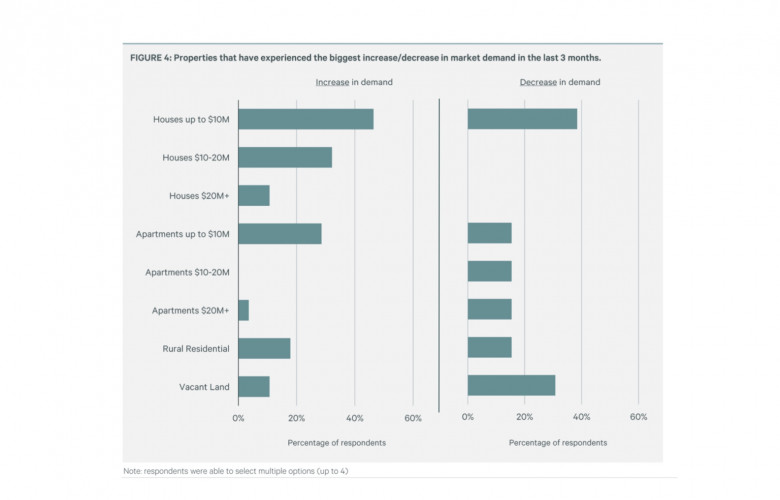

Valuers reported demand as being strongest for houses valued up to $10 million and valued between $10- $20 million. A total of 54% of valuers expect house value growth over the next 12 months and 17% of valuers forecast price growth of more than 5%. The highest price growth is expected in WA, SA and NSW.

CBRE’s Head of Prestige Valuations NSW Bader Naaman said, “The strong prices that continue to be seen in the Sydney prestige market are underpinned by the combination of a continued lack of upper-end supply and the return of wealthy overseas purchasers as well as the strong appeal of Australia as a desirable destination in which to invest.

“Despite many of our valuers across the state expecting a slight increase in stock level across the next 12 months by way of listings, any increase in stock available is likely to be outweighed by the strong increase in demand we are witnessing for prestige properties within the $10m to $20m range. The resilience of the Sydney prestige market is largely impacted by the inherent scarcity of land across some of the city’s prestigious locations, desirable inner-city areas and waterfront property types have a finite supply,” Mr Naaman added.

Most valuers (51%) expect demand to remain the same in their local prestige markets over the next 12 months while 31% expect to see demand increase ‘slightly’. NSW and WA are expected to see demand increase the most. A total of 88% of valuers in VIC expect an increase in listings in the next 12 months while 67% of valuers in NSW also expect an increase.

CBRE’s Head of Prestige Valuations VIC, John Beresford said the market in Melbourne has shown stability and modest house price growth was expected in the coming year.

“The high-end metropolitan Melbourne market has been relatively stable over recent times, although there has been some seasonal softening in buyer demand and some price sensitivity, particularly in the $5 to $10 million range. Notwithstanding, valuer expectations are for some modest house price growth in the broader premium housing market,” he said.

“Growth expectations for penthouses and likely new home sites are neutral, with the latter still suffering the lingering effects of the 2022-23 spike in building costs, although this construction-cost price growth has stabilised in 2024, which may again drive the desire for ‘dream home’ and speculative builds.”

Looking at apartments, 41% of valuers predict an increase in values in the next 12 months while 52% anticipate prices will remain stable. The highest growth is expected to be in WA and SA.

To view the full CBRE’s Prestige Residential Valuer Insights Q3 2024 report

Related Readings

First home buyers drive demand for residential property nationally - CBRE