House price report- Ray White

Contact

House price report- Ray White

By Nerida Conisbee, Ray White Group, Chief Economist.

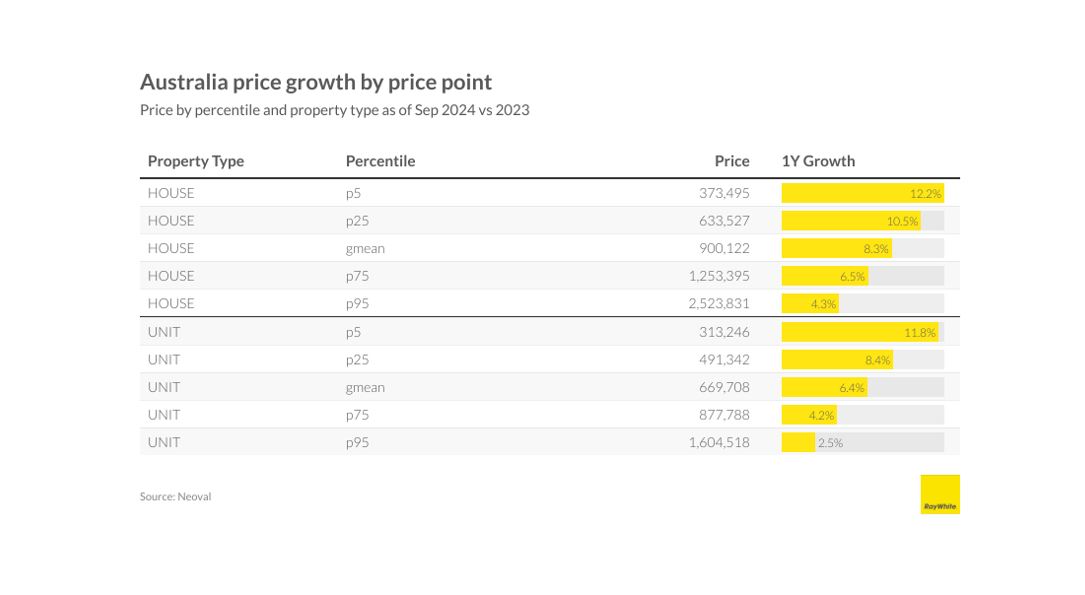

Cheaper properties saw the strongest price growth over the past 12 months with houses in the lowest percentile increasing by 12.2 per cent. In comparison, our most expensive homes have seen a price slowdown, perhaps now reflecting the prolonged impact of higher interest rates. Long term, Australia’s most expensive homes have generally outperformed the rest of the market.

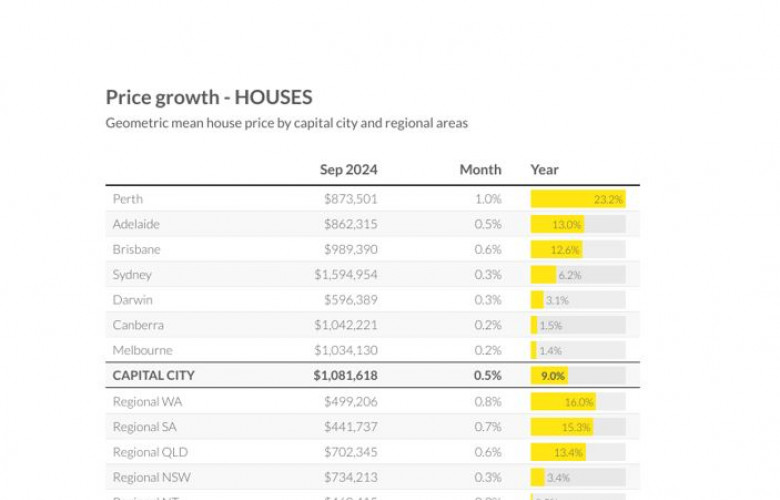

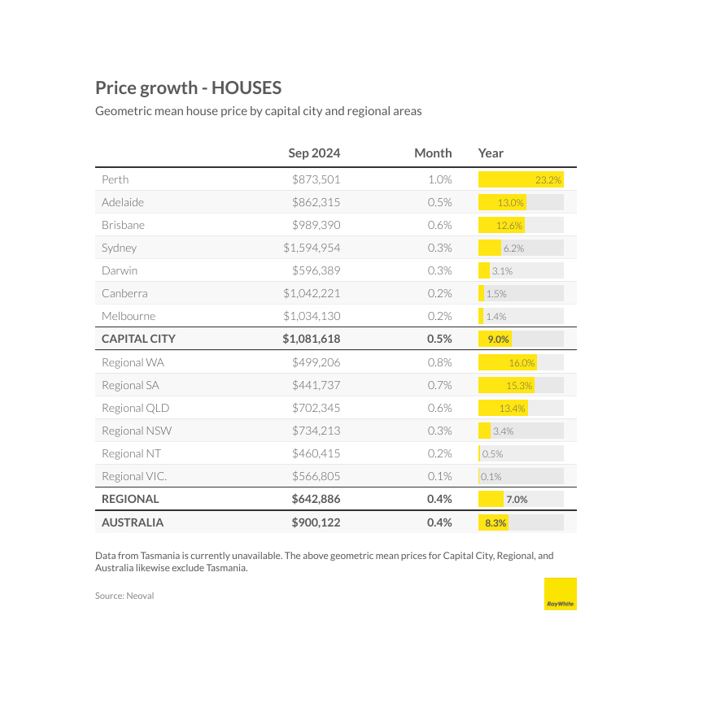

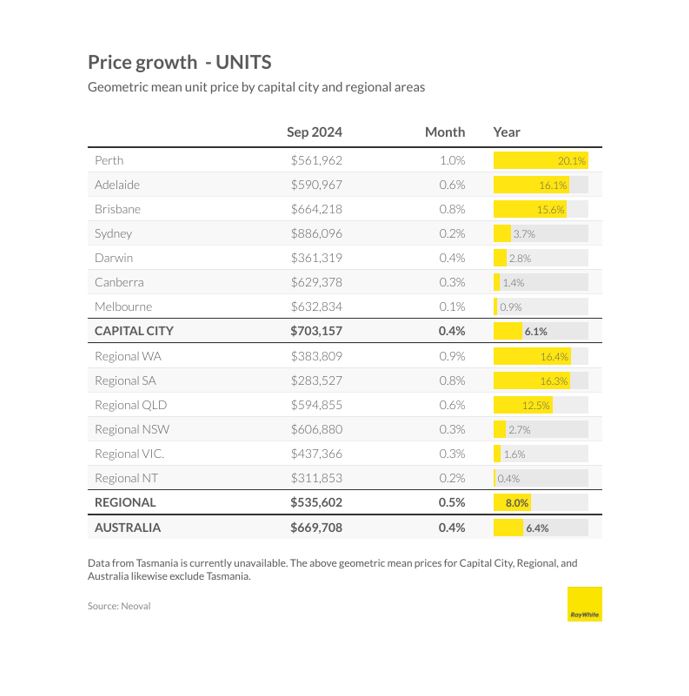

Perth and Regional WA continue their strong run. Perth typically moves more closely with mineral prices than interest rates however price growth is continuing despite relatively weak demand conditions for both iron ore and lithium. Perth house prices increased by one per cent over the month and over 23 per cent for the year. Unit growth was also strong, up over 20 per cent over the year. It is likely continued acceleration in construction costs is a driver, as is population growth.

Adelaide and Brisbane, while not as strong as Perth, continue to see growth well above the Australian average. Brisbane is now getting very close to a $1 million median, although is still some way off the next most expensive market, Melbourne. Unit prices in Adelaide and Brisbane are continuing to see stronger increases than house prices.

More surprisingly, fairly decent conditions were seen in our bigger cities of Sydney and Melbourne, despite other indicators showing rising weakness in demand. Both cities have seen lower numbers of active bidders at auction and a pick up in the number of properties for sale. Both cities saw an increase in pricing of 0.2 per cent or more in September. Melbourne continues to be the slowest market but is still recording year on year growth.

More reading by Nerida Conisbee Ray White Group Chief Economist.

With a rate cut imminent, what would be the impact on house prices? - Ray White

Auction data showing signs of a slowing market but there are exception - Ray White

Lots of choice in this year’s spring selling season - Ray White

House or Apartment: Which 2014 purchase would have paid off better today? - Ray White

No rate rise, despite inflation ticking upwards

Ray White weekly economic update | The Real Estate Conversation

The US presidential race: What it means for Australia's economy - Ray White