Over 2,300 auctions set to take place across the combined capitals - CoreLogic

Contact

Over 2,300 auctions set to take place across the combined capitals - CoreLogic

By Caitlin Fono, Research Analyst, CoreLogic Australia.

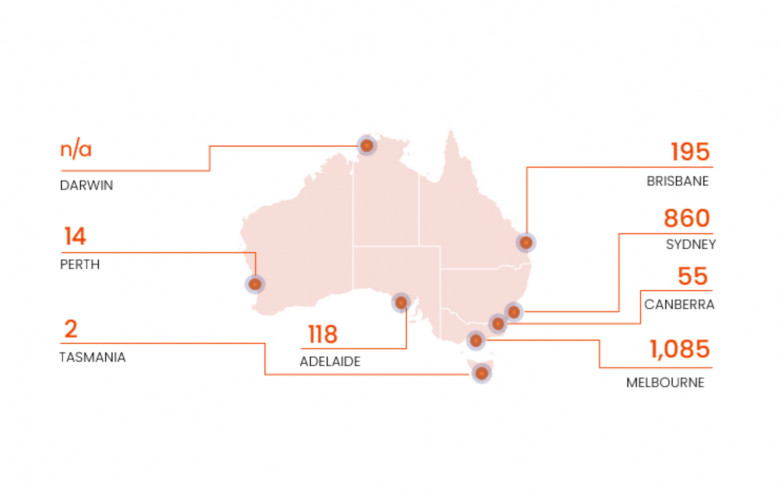

There are 2,329 capital city homes currently scheduled for auction this week, up 76.8% from last week when just 1,317 auctions were held. The lower volumes last week were attributed to the King’s Birthday long weekend in six of the eight states and territories. This time last year, 1,945 auctions were held across the combined capital cities.

The number of homes taken to auction across Melbourne is expected to rise above 1,000 again this week with 1,085 homes currently set to go under the hammer, after dipping to just 488 last week. This time last year, 864 auctions were held across the city.

There are 860 auctions scheduled in Sydney this week, up from 523 last week and 764 this time last year.

Across the smaller capitals, Brisbane is set to host the most auctions this week (195), up from 126 last week and 139 this time last year.

There are 118 auctions scheduled in Adelaide, up from 97 last week and 108 last year, while Canberra is set to host 55 auctions, compared to 67 last week and 52 one year ago. There are 14 auctions scheduled in Perth, one more than last week (15) and in line with this time last year (14), while there are just two auctions scheduled in Tasmania, compared to one last week and four one year ago.

An early view of auction numbers suggests there are just shy of 2,100 homes currently scheduled for auction across the combined capitals next week.

Summary of last week’s results

There were 1,317 homes taken to auction across the combined capitals last week, down -44.7% from the previous week (2,380) but 27.5% higher than this time last year (1,033). As mentioned, the lower volumes were attributed to the King’s Birthday long weekend in six of the eight states and territories.

The combined capital city final clearance rate came in at 62.0% last week, falling -4.2 percentage points on the previous week (66.2%), making it the lowest final clearance rate so far this year. Over the same week last year, 68.2% of homes taken to auction across the combined capital cities were successful. The withdrawal rate increased from 7.9% over the previous week to 9.7% last week which is the highest withdrawal rate so far this year. The portion of properties passed in at auction also increased last week (28.3%), up from 25.9% over the previous week.

Sydney's auction numbers were down -41.8% last week, with 523 homes auctioned across the city. The previous week saw 899 homes go under the hammer, while this time last year, 468 auctions were held. Sydney’s final clearance rate came in at 65.0% last week, down from 65.9% over the previous week. This is the second lowest clearance rate the city has seen so far this year, behind the week ending 28th January (63.9%) when just 83 auctions were held across the city. One year ago, 72.2% of Sydney auctions were successful.

There were 488 homes taken to auction in Melbourne last week, down -56.0% from the previous week (1,109) but 54.9% higher than the same week last year (315). Melbourne’s final clearance rate dropped -8.7 percentage points to 55.6% last week, down from 64.3% over the previous week and 68.7% this time last year. This is Melbourne’s lowest final clearance rate since Easter 2023 (50.9%) when just 108 auctions were held.

Brisbane (126) was the busiest auction market across the smaller capitals last week, followed by Adelaide (97), Canberra (67) and Perth (15). Adelaide (80.4%) recorded the highest clearance rate, followed by Perth (66.7%), Brisbane (62.9%) and Canberra (56.7%). There was just one auction in Tasmania last week which was unsuccessful.

For the full Auction Market Review which includes a summary of last week’s clearance rates by sub-region.

By Caitlin Fono, Research Analyst, CoreLogic Australia

Related readings

Preliminary clearance rate falls to 67.3% across the combined capitals - CoreLogic

Auction volumes hold steady week-on-week across the combined capitals - Corelogic

Solid bounce back in preliminary clearance rate to 75.9% - CoreLogic | The Real Estate Conversation

Australian home values surge 8.1% in 2023 | The Real Estate Conversation

John McGrath – Market predictions for 2024 | The Real Estate Conversation

John McGrath – Where did prices rise the most in 2023? | The Real Estate Conversation