Rental growth is decelerating - Ray White

Contact

Rental growth is decelerating - Ray White

By Nerida Conisbee Ray White Group Chief Economist

It has been a tough four years for renters. Since the start of the pandemic, rents have risen on average $200 per week across Australia. Perth has topped the list, with an increase of $280 per week. Hobart has seen the lowest at $100 per week. Interestingly, the comparative strength in rental growth is broadly similar to what we've seen with price growth.

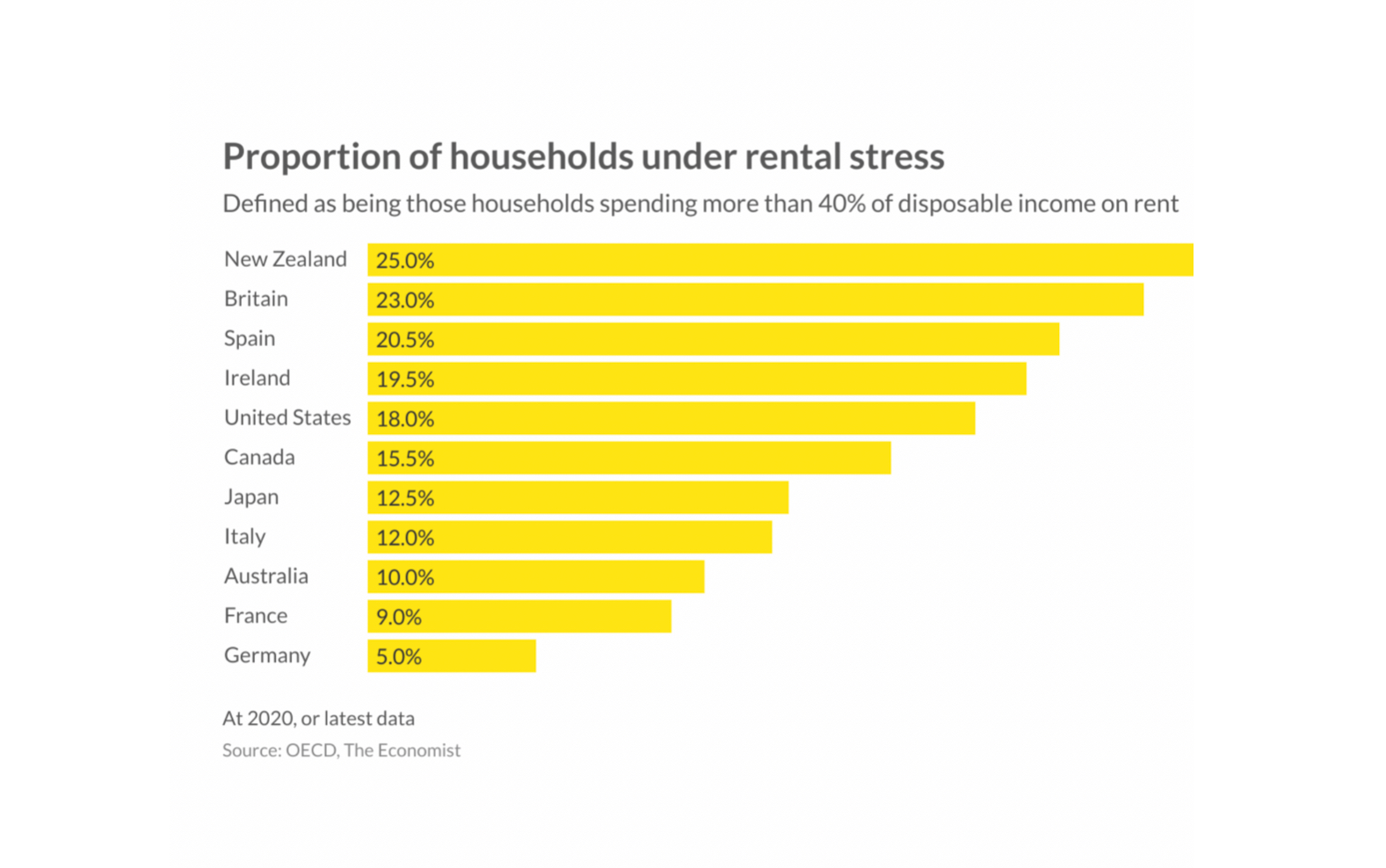

While rents have risen a lot, it comes after a prolonged period of very little rental growth. In the four years prior to the pandemic, rents nationally increased by only $25 per week. Rents actually declined by $30 a week in Perth. Brisbane units also saw a rental decline. Globally in 2020, according to the OECD, Australia was one of the best places to be a renter in the world with very low levels of rental stress.

While the 10 per cent of households under rental stress has increased in Australia since 2020, the ranking of Australia is unlikely to have changed significantly. Rental challenges are occurring pretty much everywhere - under building, relatively strong population growth and changes to household types are not just an Australian problem.

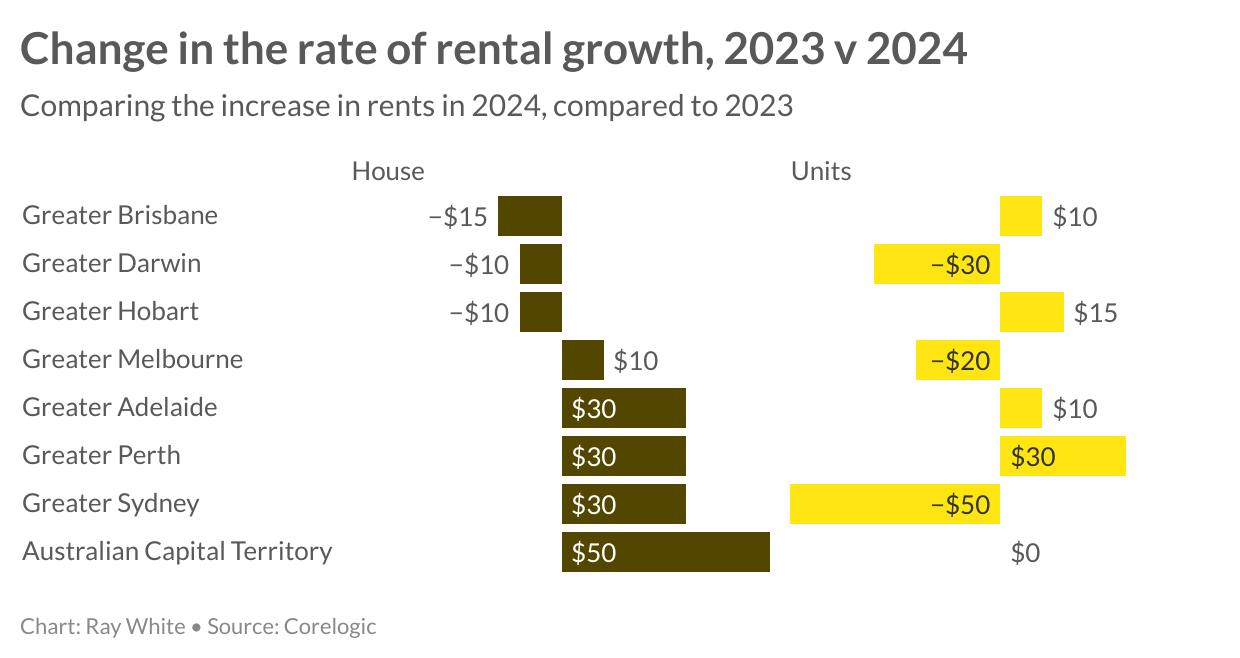

While rents have risen sharply, it does seem to be improving, although it depends on where you live. Hobart rents have actually declined over the past 12 months. Sydney and Melbourne units are now seeing a decelerating rate of rental growth, as are Brisbane houses. The opposite is occurring in Perth and Adelaide. Like their house prices, rental growth in these cities is amongst the strongest in Australia.

Rising levels of rental stress are a problem that can only be improved with an increase in the number of rental properties. Prior to the pandemic, rents were affordable because we had come off record levels of construction. And even though often criticised, negative gearing encouraged a lot of money to be invested in rental properties. Similarly, record levels of overseas investment was another driver. There was a lot of money flowing into housing, particularly new homes

Rental growth is decelerating and will continue to do so this year. Average household size is rising again after declining during the pandemic. Very high levels of population growth are moderating this year. Housing supply is still very low although moderating construction costs are likely to improve this a bit. However, we are unlikely to see rents moderate significantly until we start to reach targets set out by the Federal Government’s Housing Accord. Unfortunately, a marked increase in rental affordability is some years off.

Related Reading:

REIWA welcomes passing of Residential Tenancies Amendment Act | The Real Estate Conversation

John McGrath – Millennial investors go it alone in property | The Real Estate Conversation