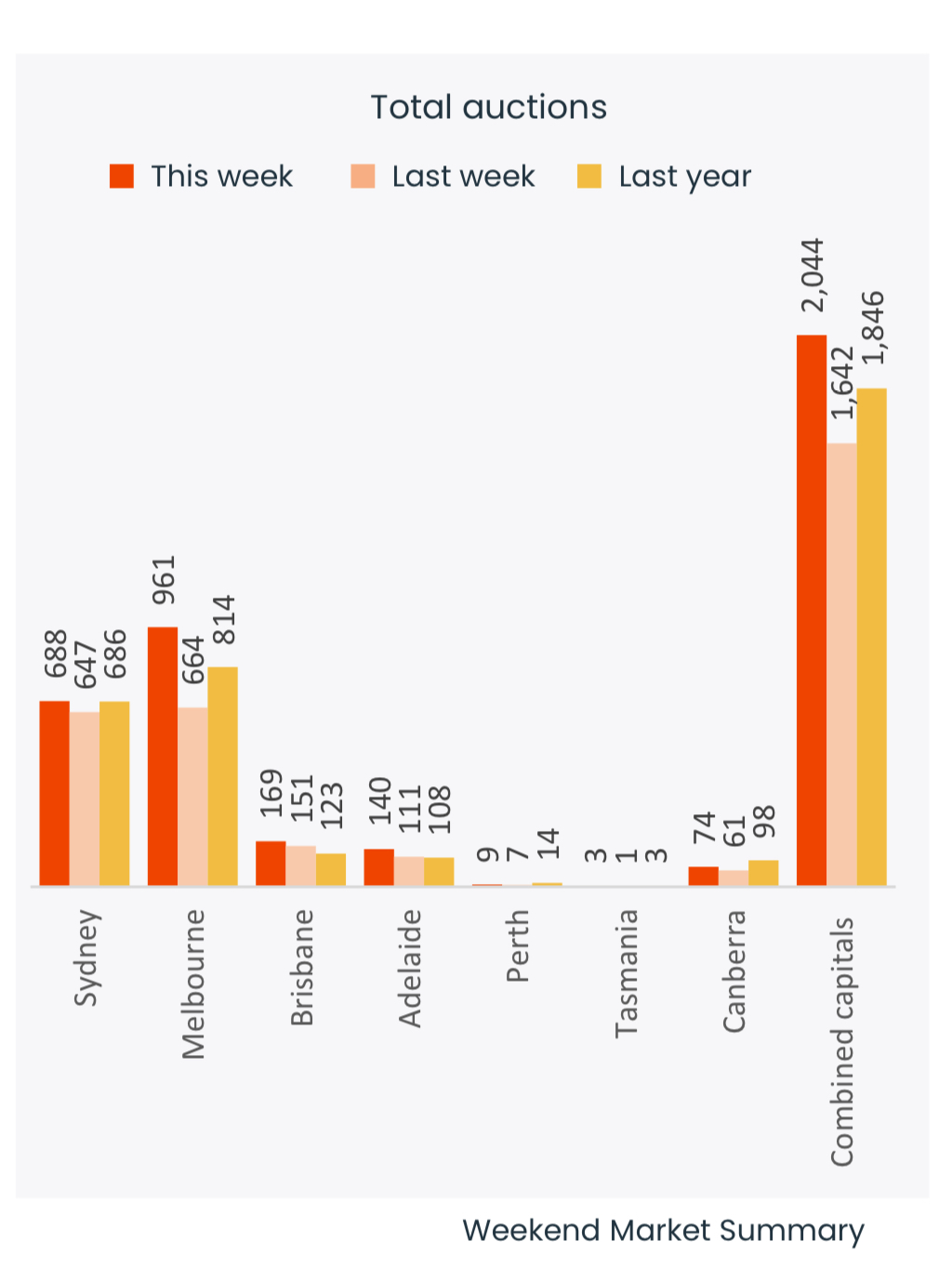

CoreLogic: 2,044 auctions held the highest volume of auctions so far this year

Contact

CoreLogic: 2,044 auctions held the highest volume of auctions so far this year

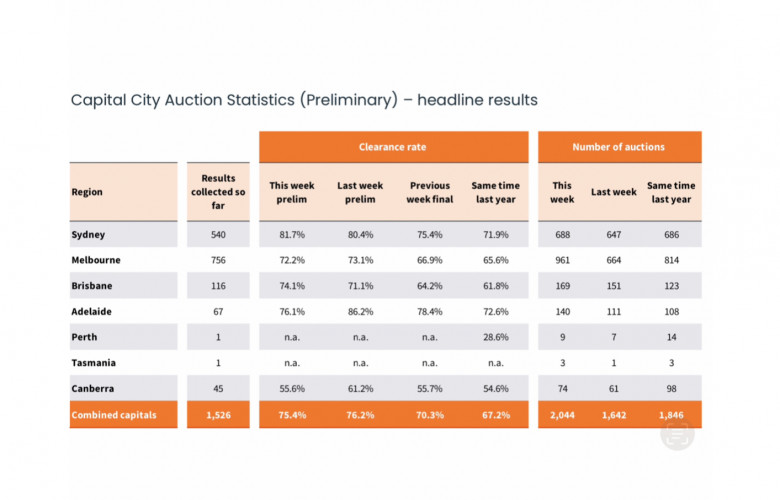

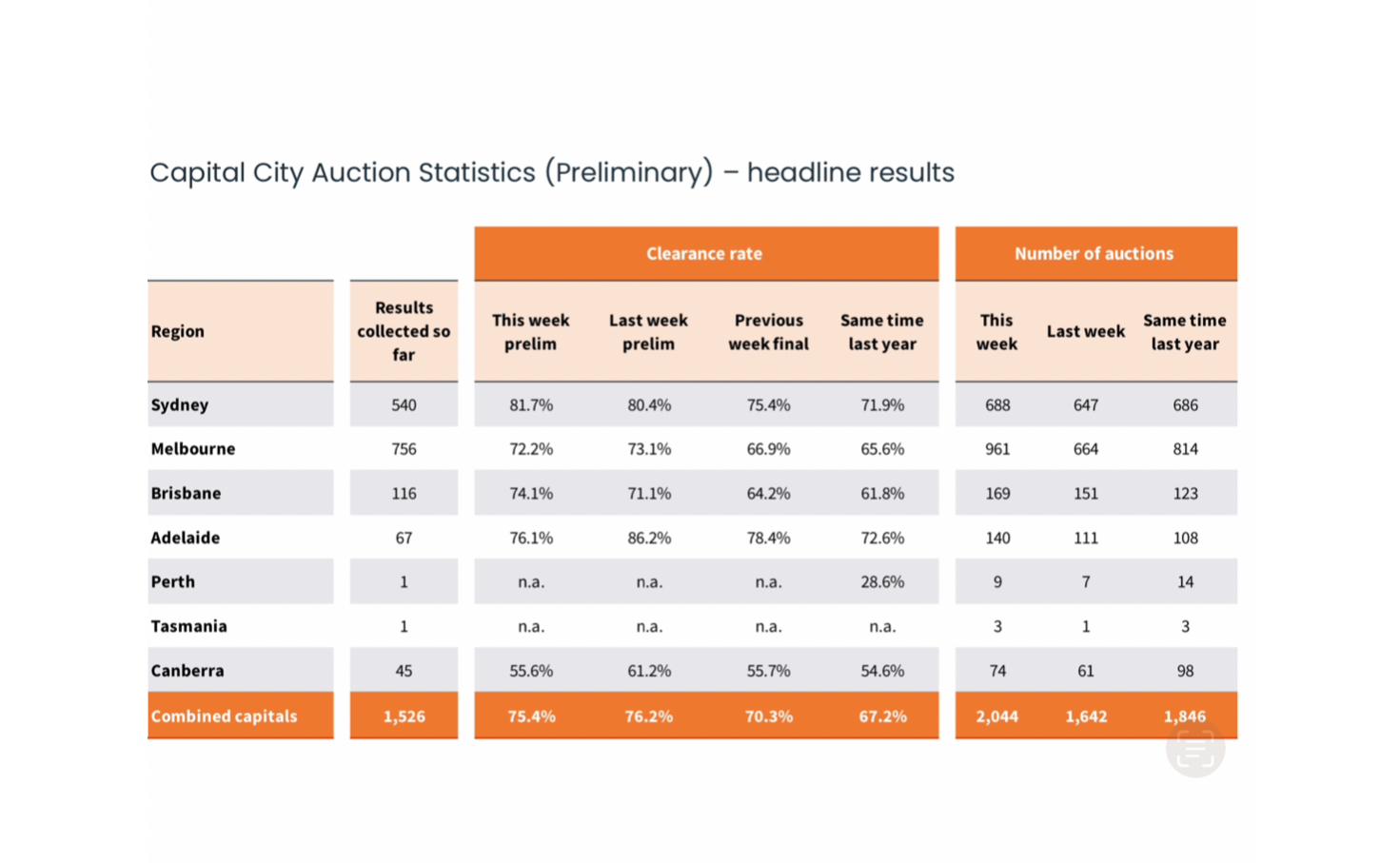

Demand from buyers has kept pace with the pick-up in activity, with the preliminary clearance rate coming in at 75.4%, down slightly from last week (76.2% which revised to 70.3% on final numbers), said CoreLogic research director, Tim Lawless.

CoreLogic research director, Tim Lawless said “With 2,044 auctions held, this was the highest volume of auctions so far this year. Demand from buyers has kept pace with the pick-up in activity, with the preliminary clearance rate coming in at 75.4%, down slightly from last week (76.2% which revised to 70.3% on final numbers).

For some context, the preliminary clearance rate settled in the mid 60% range at the end of last year and final clearance rates were in the mid 50%’s. With the preliminary clearance rate holding above 73% for the past three weeks, it’s probably fair to say the stronger auctions results are attributable to more than early year seasonality; some confidence has returned to the auction markets amid falling inflation and a growing expectation that lower interest rates later this year could see housing price growth accelerate.

Sydney recorded 688 auctions this week, returning a preliminary clearance rate of 81.7%, the highest preliminary outcome since mid-October in 2021. Melbourne held 961 auctions, with 72.2% selling at auction so far.

Melbourne’s preliminary clearance rate has held above the 70% mark through the year-to-date, but was down slightly from last week (73.1%).

The coming week is set to see a further pick up in auction activity with around 2,800 homes currently scheduled to go under the hammer.

By CoreLogic research director, Tim Lawless.

Related Reading:

Australian home values surge 8.1% in 2023 | The Real Estate Conversation

John McGrath – Market predictions for 2024 | The Real Estate Conversation

John McGrath – Where did prices rise the most in 2023? | The Real Estate Conversation