Art leads the Knight Frank Luxury Investment Index while growth in other asset classes is starting to slow or even reverse

Contact

Art leads the Knight Frank Luxury Investment Index while growth in other asset classes is starting to slow or even reverse

Art has seen the greatest growth out of 10 luxury collectible asset classes over the past year, according to the Luxury Investments instalment of Knight Frank’s The Wealth Report Series.

Art has seen the greatest growth out of 10 luxury collectible asset classes over the past year, according to the Luxury Investments instalment of Knight Frank’s The Wealth Report Series.

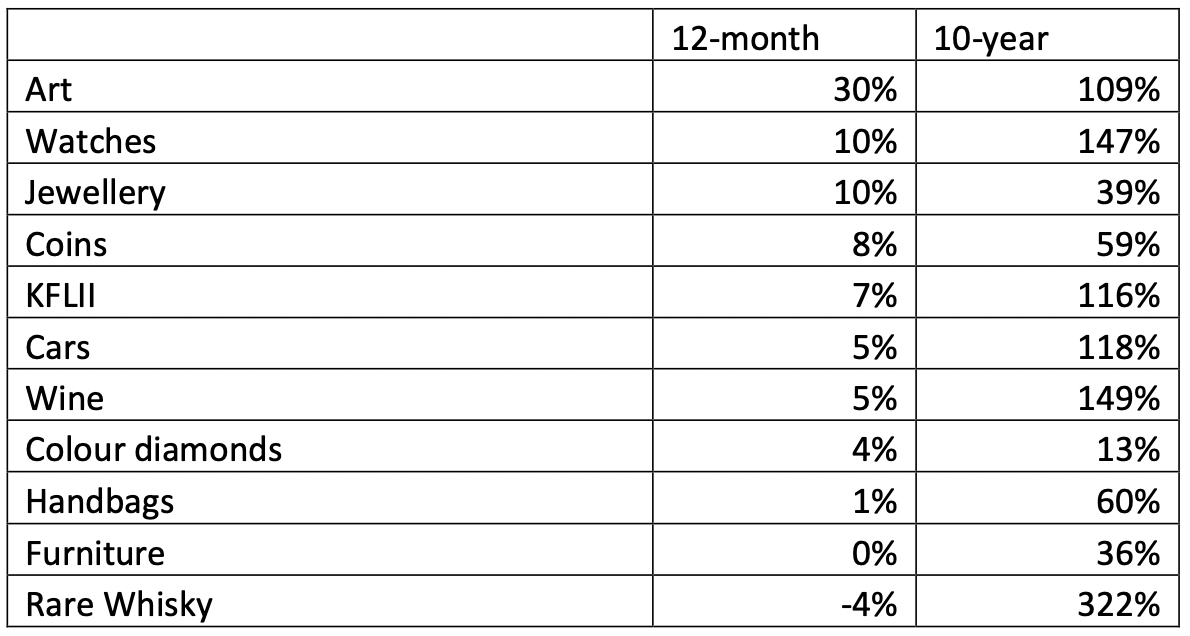

Art topped the Knight Frank Luxury Investment Index (KFLII), which tracks a weighted basket of 10 luxury collectibles, as at June 30 this year, with 12-month growth of 30 per cent, as measured by Art Market Research’s All Art index.

Watches and jewellery, both recording growth of 10 per cent, completed the top three rankings of the KFLII.

Art also led the KFLII in this year’s The Wealth Report, with the highest growth over the calendar year of 2022, and six months later in retains its place as the number one spot.

However, classic cars, which were second in the KFLII over 2022, have dropped back to the fifth spot with growth of five per cent, with watches moving up from third to second spot, and jewellery moving from the eighth to third spot.

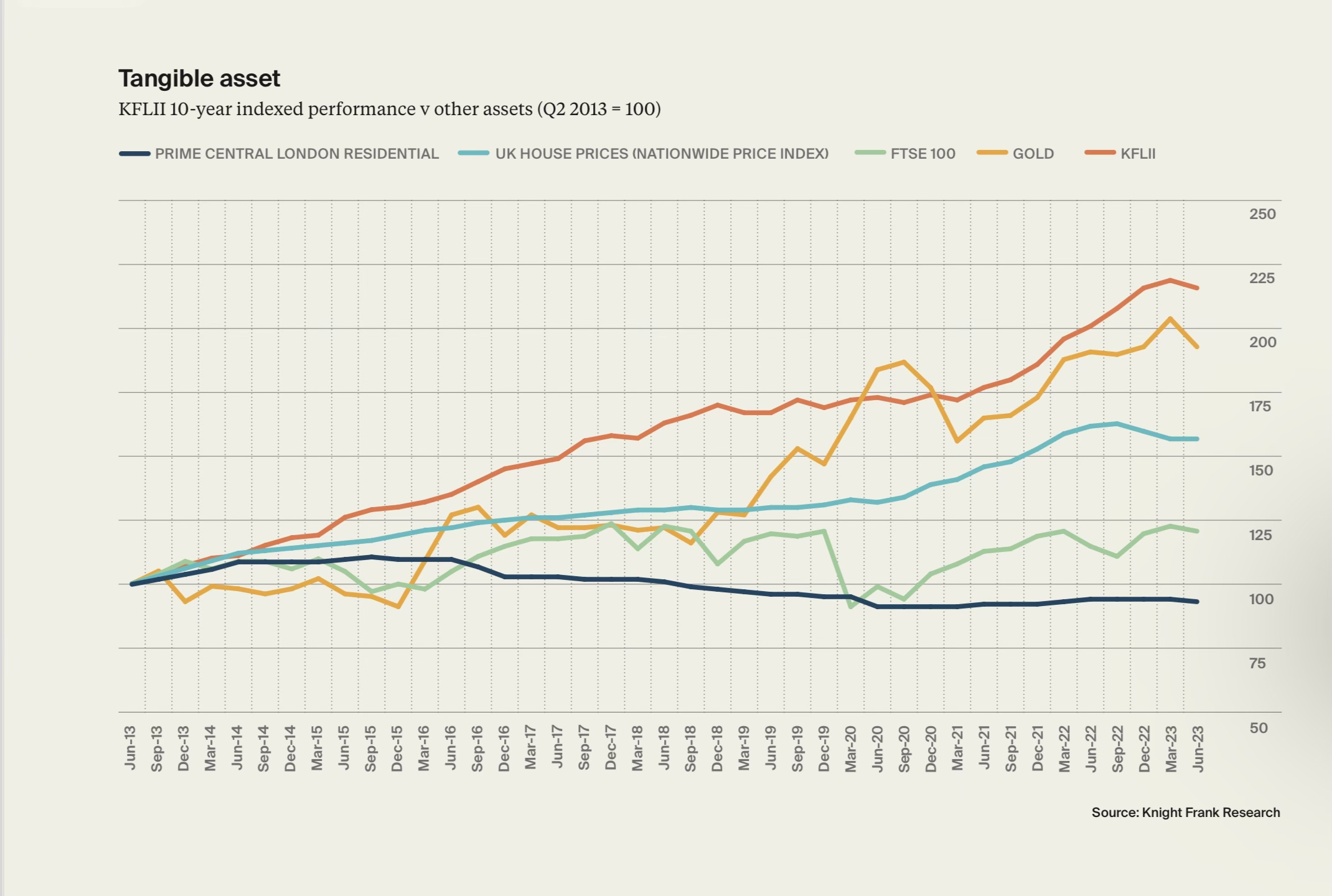

The KFLII rose by seven per cent in the 12 months to the end of June 2023.

Knight Frank Head of Residential Research Michelle Ciesielski said this was a credible performance compared with prime luxury residential prices across Australia which grew 1.7 per cent over the same period, gold which rose by 5 per cent, and was just shy of the S&P/ASX 200 which was up in value by 9.7 per cent.

“It was, however, the weakest annual performance by KFLII since Q2 2021, proving that even tangible assets are not immune to market uncertainty,” she said.

Knight Frank’s Luxury Investment Index, Q2 2023

Ms Ciesielski said the results of the KFLII, with ongoing growth for most luxury assets, highlight that people are still willing to spend on personal luxury items despite economic uncertainty and interest rate rises having an impact on the level of growth.

“It is the slowdown in the wine and classic car markets, both in sixth and seventh place respectively with five per cent growth over the past 12 months, that have tempered overall growth, as these asset classes previously have had double-digit rises that have often underpinned the index’s performance,” she said.

“Despite the investible car market being up five per cent on an annual basis, it has fallen seven per cent so far this year off-the-back of the mixed performance of classic cars.

“We may experience a similar trajectory with the performance of art collections over the coming year given the slower auction results in 2023, challenging the asset class topping the luxury index.”

Knight Frank Head of Residential Erin van Tuil said there was an inextricable synergy between the prime residential real estate and luxury investments, whether that be in city, coastal or country locations across Australia.

“The collections of high-net-worth-individuals can shape their homes, but equally their homes can shape their collections,” she said.

“Space to show off luxury collectibles is often on the wish list for wealthy home hunters, including garage spaces, great wine storage, a safe for watches and jewellery, and space to hang their art.

“Accordingly, developers are also increasingly factoring the collecting habits of potential buyers into their projects.”

The Knight Frank Luxury Investment Index provides further in-depth analysis including:

- Changing social attitudes that are influencing luxury investment markets (page 18, 24 and 44)

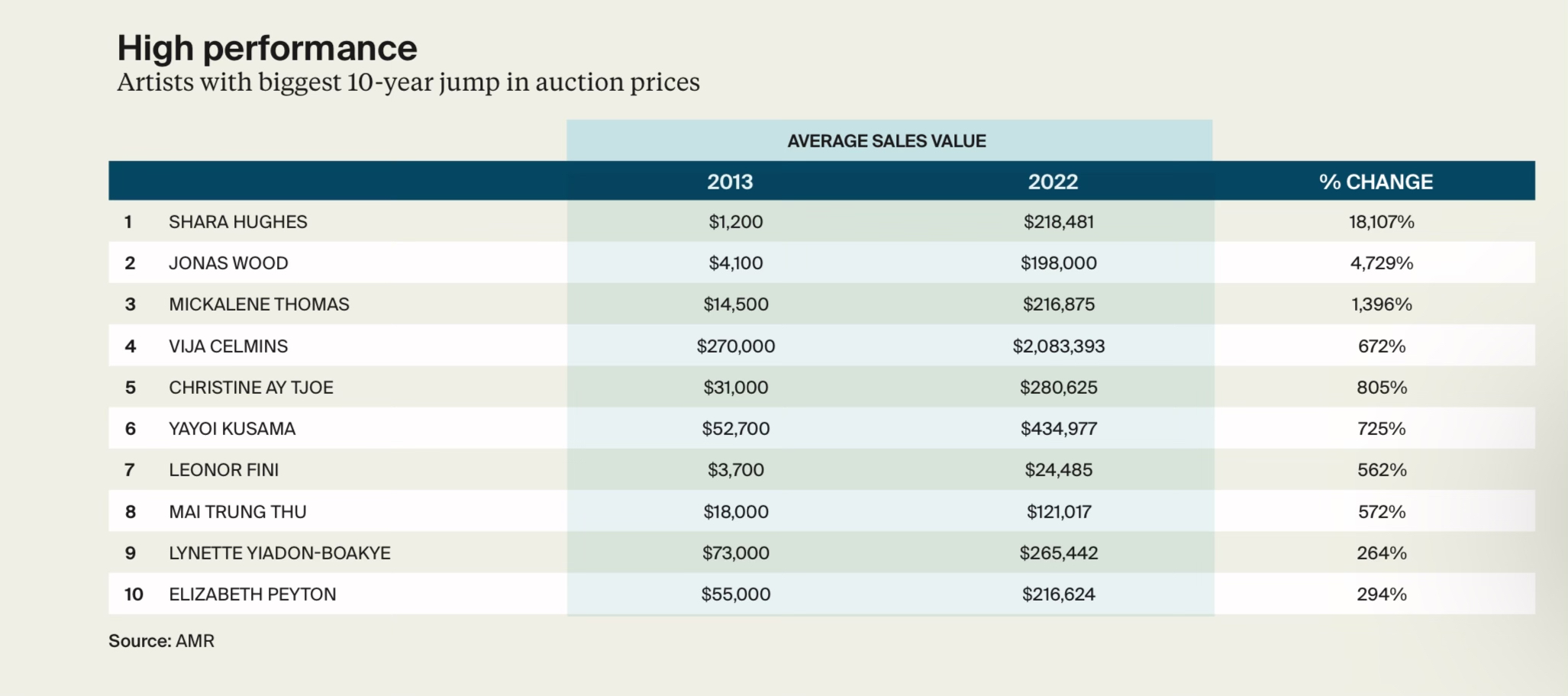

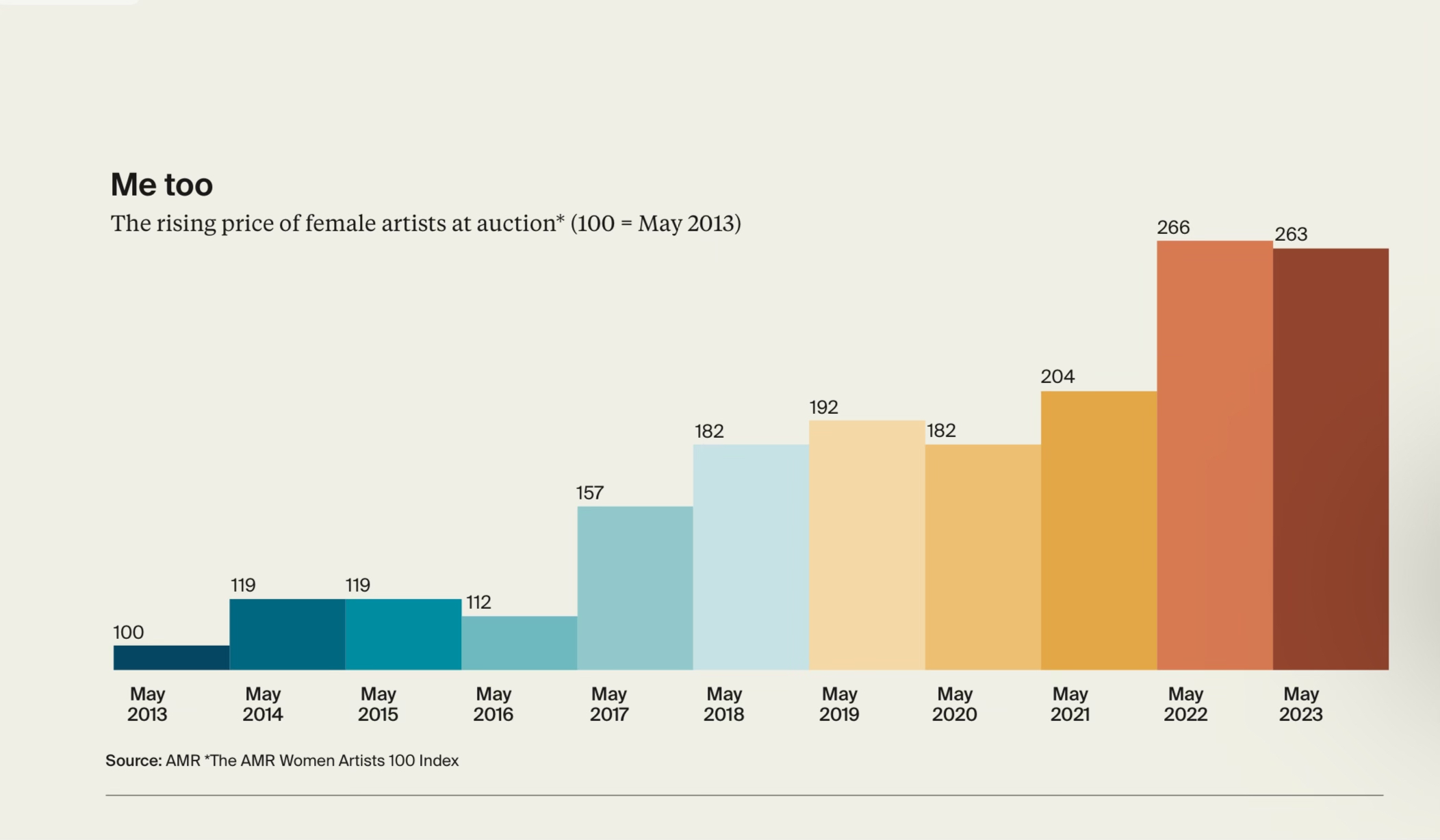

- Female artists have seen some of the strongest price growth in the art market over recent years

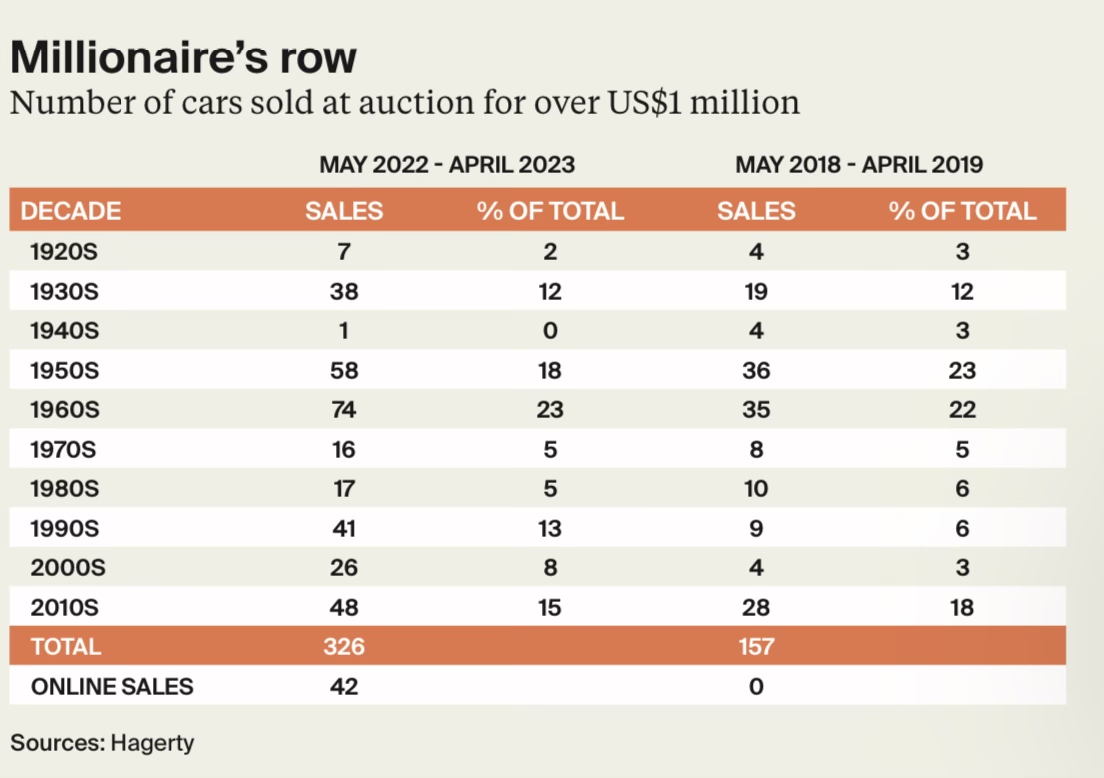

- The demand for electric supercar conversions is also on the rise as a younger generation of wealthy car fanatics eschew petrol power

- NFTS are down but not out (page 12)

- The value of Covid-era high-profile NFTs has slumped, but digital art works considered to have the right provenance are still selling for large amounts